Nerida Conisbee

Ray White Group

Chief Economist

There have been a lot of people, events and policies blamed for Australia’s low levels of housing affordability. Ranging from negative gearing, high interest rates, investors, developers, migrants, students, planners, government and the list goes on. And while the reasons are complex, there is one simple reality, if you build enough homes where people want to live, then housing becomes more affordable.

However, the challenge is that to build enough homes where people want to live, we need to increase density. Many people don’t like higher densities around them and most of us aren’t used to living in much smaller homes.

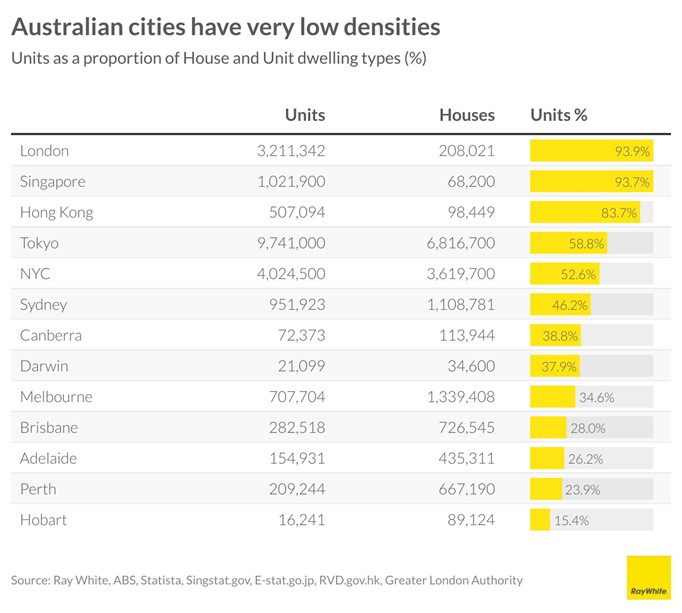

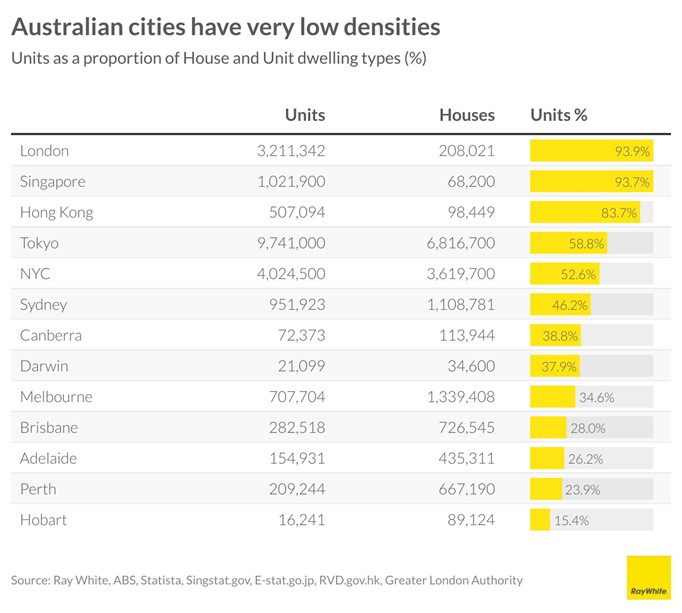

Australia has very low levels of housing density. Whereas in London, Singapore and Hong Kong, more than 80 per cent of homes are either apartments or townhouses, Sydney has just 46 per cent. Hobart has extremely low levels with just 15 per cent of all homes being units. And while comparing London to Hobart may seem unfair, even comparing to smaller cities around the world, our densities are extraordinarily low. In the US, the least dense small city in the country is Norman, Oklahoma and even there, close to 35 per cent of homes are units.

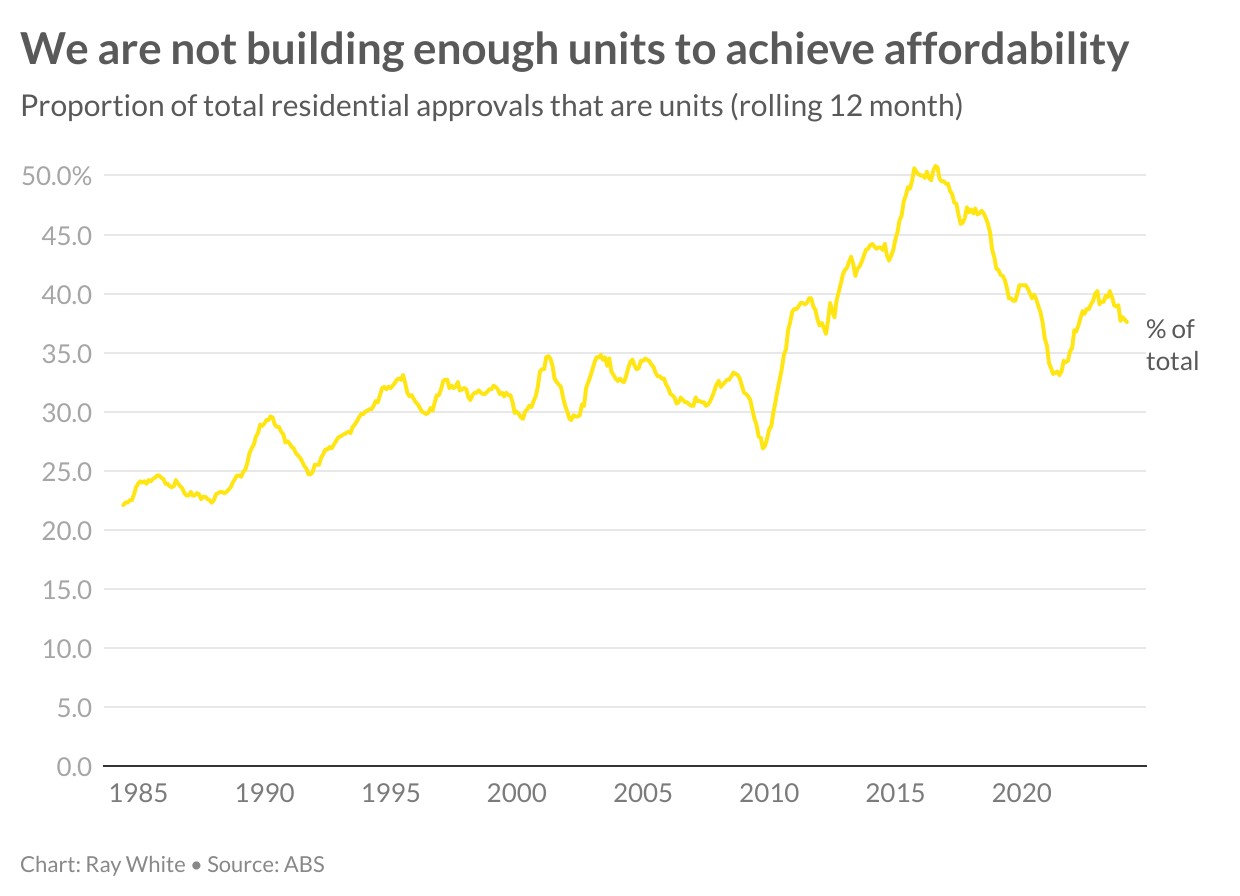

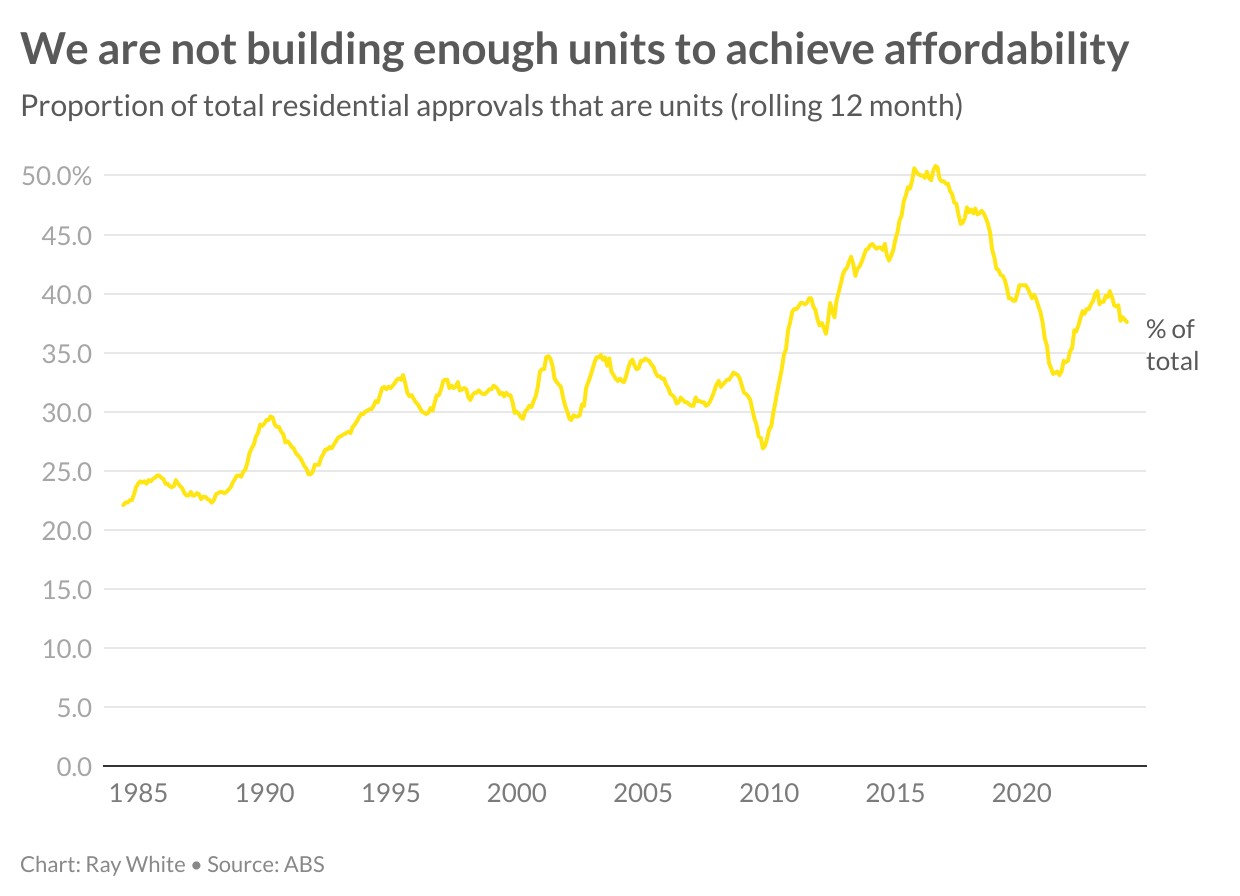

Last decade we got a lot better at building density. So much so, that in the 12 months to August 2016, more than half of residential building approvals were high density. A loss of foreign investment led to that plummeting towards the end of last decade, picking up slightly in the pandemic but we are now seeing a downward trend once again. Over the past year, only 37 per cent of homes approved have been units. We are not on track to getting more homes built where people want to live.

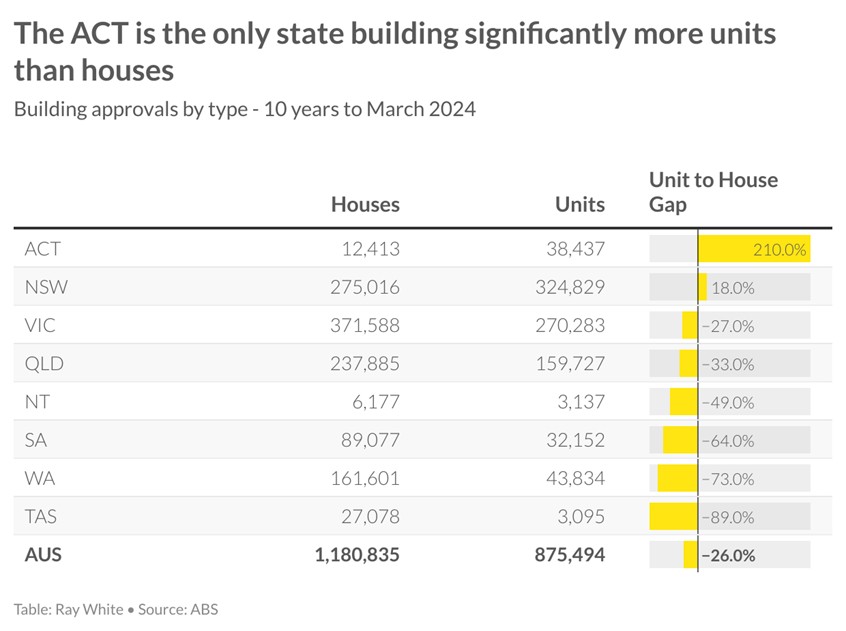

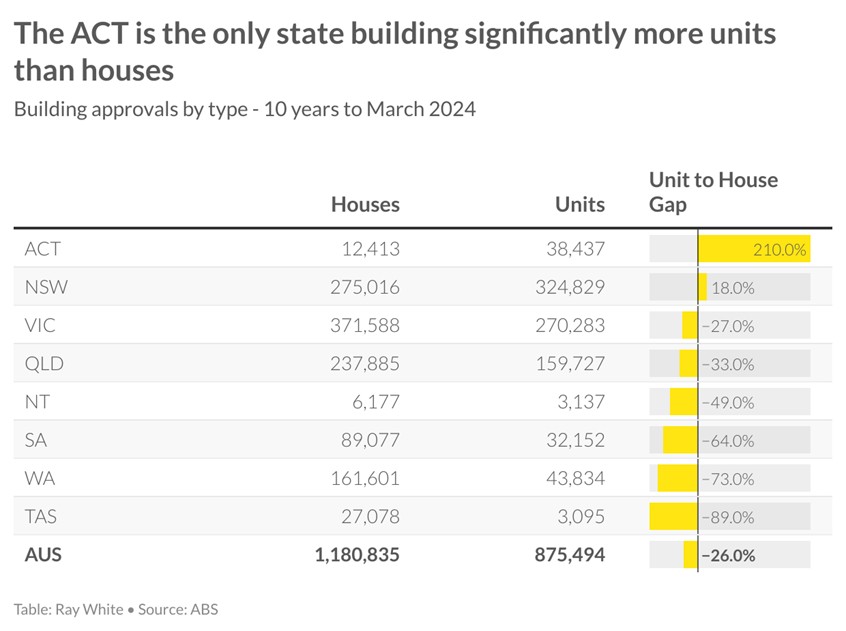

By city, the only place that is now consistently building more units than houses is Canberra. Over the past decade, more than three times more units have been approved than houses. New South Wales is now building more units than houses, however, the gap is comparatively small. In Hobart, only 10 per cent of all homes approved have been units. In areas where a lot of units are built, there is affordability for both buyers and renters.

The uncomfortable reality for many is that we are going to have to get used to living in much smaller homes to achieve affordability. Even now with relatively low densities, most cities have affordable units, but not affordable houses. A first home buyer in Melbourne could afford a unit in Collingwood at $650,000 but would struggle to buy a house where the median is close to $1.2 million. In Brisbane, a median priced apartment in Paddington is $620,000 compared to a house at $1.75 million. With the exception of inner Sydney, the majority of suburbs with apartments across Australia have affordable homes available, as long as those homes aren’t a house.

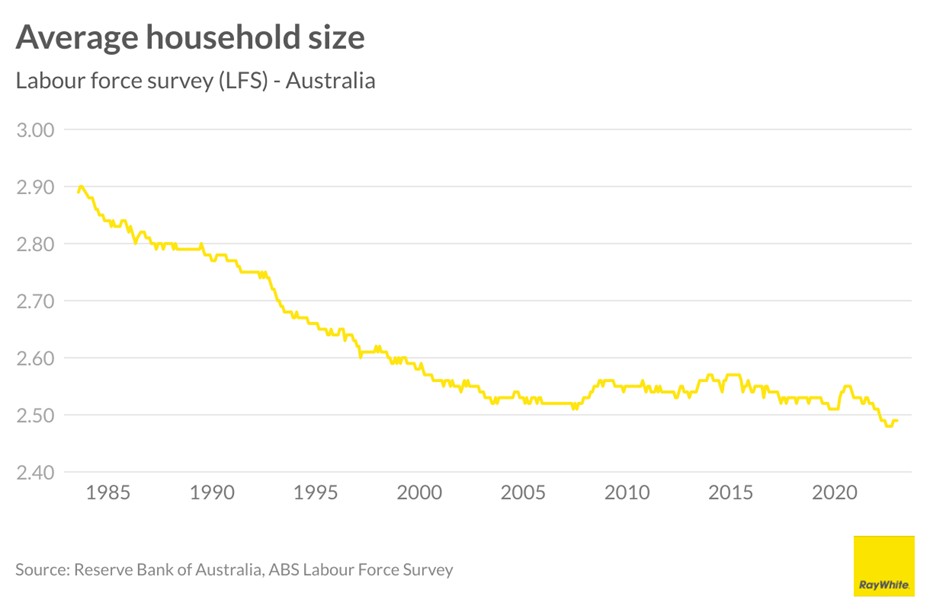

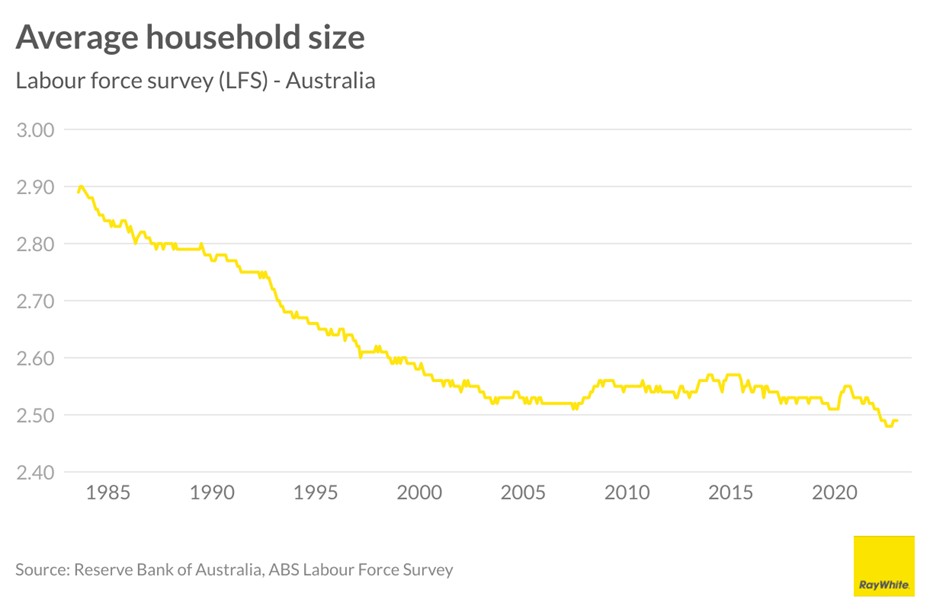

We won’t achieve 1.2 million homes over the next five years if the majority of them are single detached dwellings. Larger homes are more expensive to build and urban sprawl is expensive to adequately service. You can’t create more land in desirable suburbs but you can build more homes there if you build upwards or build homes closer together. We also don’t need to keep building bigger homes as household types are changing. As a proportion of total households, single-person households are the biggest growth area over the next decade. Average household sizes are shrinking.