Nerida Conisbee,

Ray White Chief Economist

Mortgage stress has risen dramatically since last year but so far we are yet to see an increase in people selling as a result. As Ray White data analyst William Clark outlined in his most recent listings report, the number of properties coming to market continues to fall. Mortgage holders are stressed but they are not yet so stressed that they are being forced to market.

As the cost of living continues to rise, many households would be reviewing their budgets carefully for cost savings. Some costs are easier to cut than others. For pretty much everyone, selling the family home would be one of the last resorts. Selling an investment property or a holiday home however would be a possibility. Particularly if that investment property is not making enough to cover a mortgage, or that holiday home is not being used as much as expected.

Working out how a property was used when it’s sold is difficult. It’s not information that is provided to the valuer general so tracking it on a large scale is not possible using this means. One measure however is using data collected each week on Ray White auctions. Not all properties are sold by auction, or sold by Ray White, however it is a decent sample of the market.

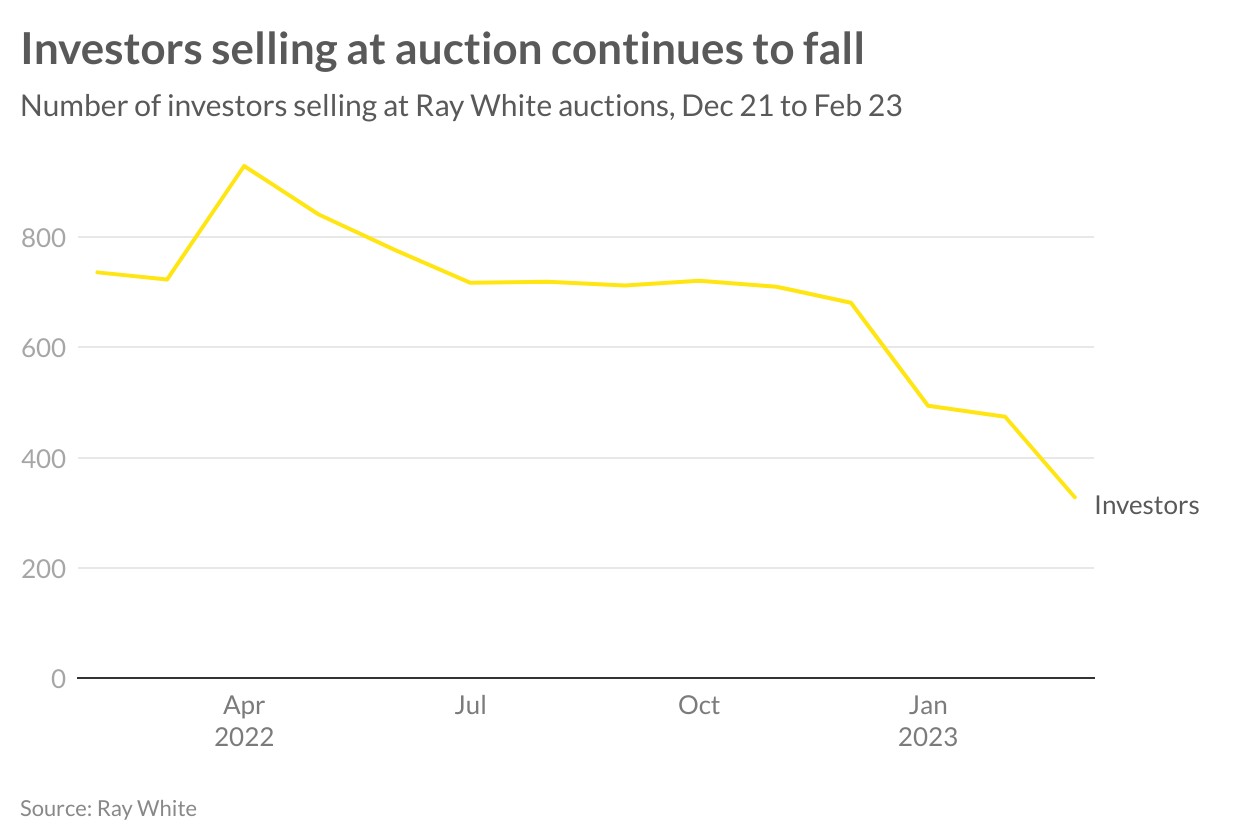

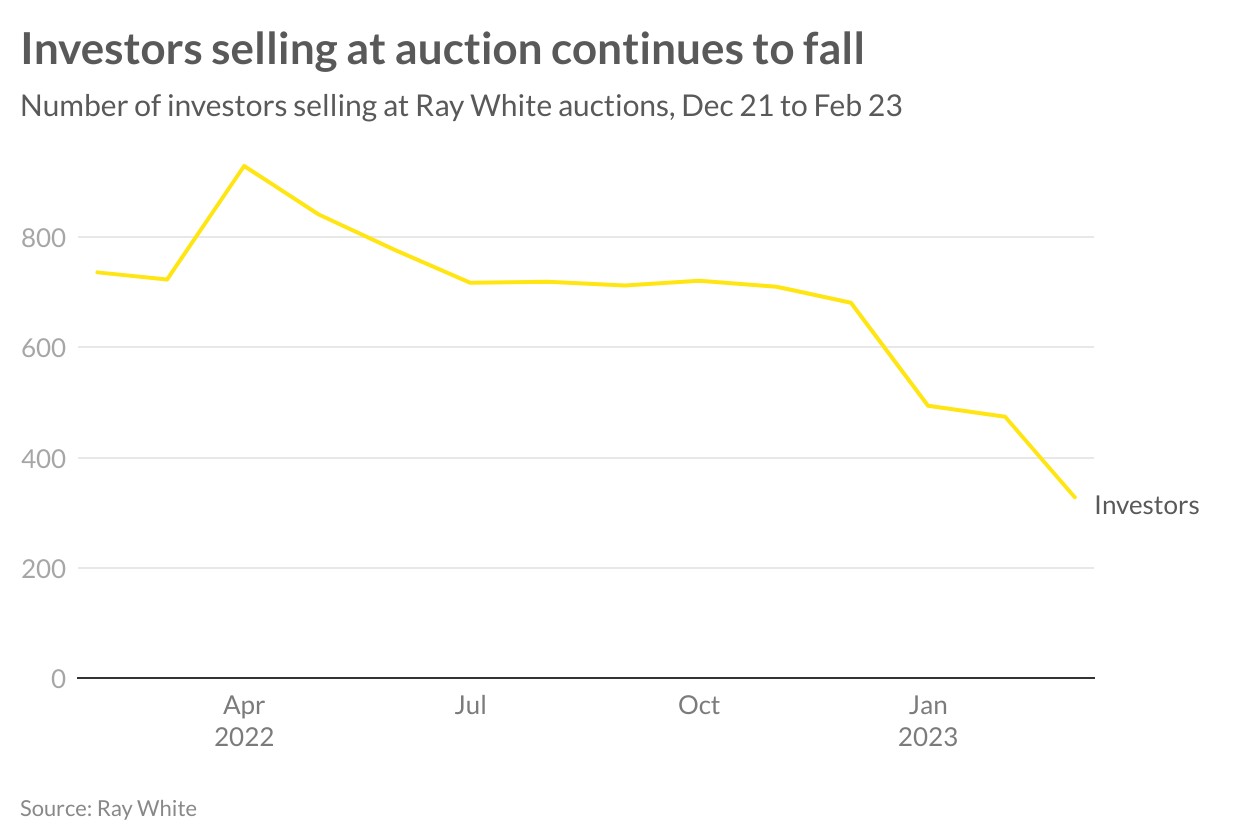

Since the end of 2021, we have been gathering information from agents on who buys at auction, as well as who is selling. Consistent with listings overall, the number of auctions has been falling over time. However, of these auction, we have also seen a falling proportion of investors selling.

This proportion of investors selling at auction peaked in August at 28 per cent. In Feb it was 21 per cent. Furthermore, the number of investors selling at auction was far higher in the months prior to when the downturn began and in the months following than it has been in the past six months. Investors that went to market appear to have taken the opportunity to sell close to peak, in anticipation of the downturn. Fewer are selling now given that prices have come back, but also because rents have risen so much, thereby providing a buffer for higher mortgage costs.

With the property market staging a surprise recovery in recent months, but interest rates still rising, we may start to see more investors selling properties that are no longer providing enough of a return. If so, given that fewer investors are buying, it will result in even more pressure on rents.