Federal Labor introduced legislation last week that, if passed, would give older Australians a two-year exemption from the assets test for downsizing, allowing them more time to sort out their finances and move properties before their pensions are reduced. This incentive is in addition to the downsizer superannuation benefit which allows older people to put up to $300,000 into their super using the money from the sale of their main residence, regardless of caps and restrictions that otherwise apply.

The incentives have been put in place to try to free up big family homes for those that need them and encourage older people to move into more suitable homes. While it is difficult for families to find big enough homes, particularly in desirable suburbs, the capacity in existing homes is high. It is estimated that there were around 13 million spare bedrooms in Australia with many older people living in homes with several spare bedrooms.

Unfortunately, financial hurdles aren’t the only obstacles keeping older people in big homes, there are also challenges for many to find more suitable smaller homes and of course, there is the emotional attachment so many have to where they live. Nevertheless, reducing the financial burden of downsizing should go some way to encourage people to move. It may not lead to a flood of properties entering the market but we should see an uptick. So where may we see this increase?

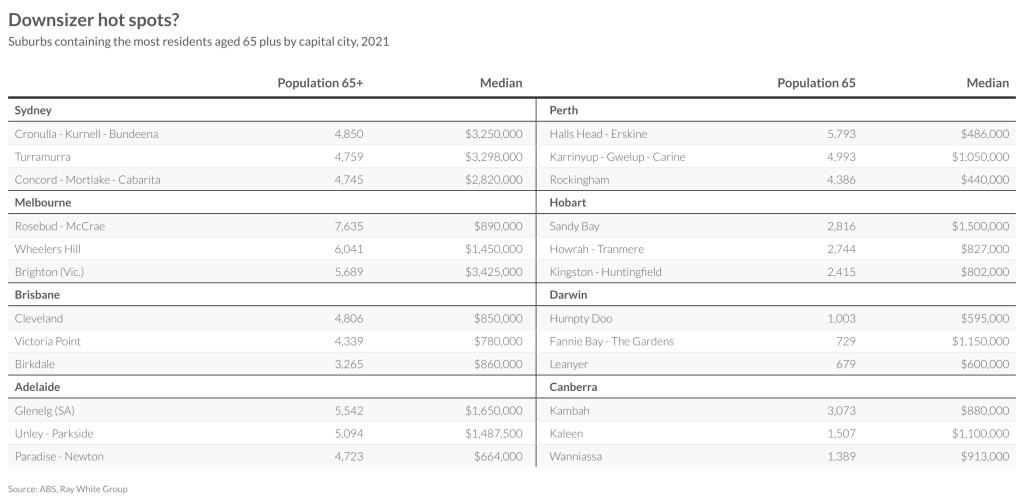

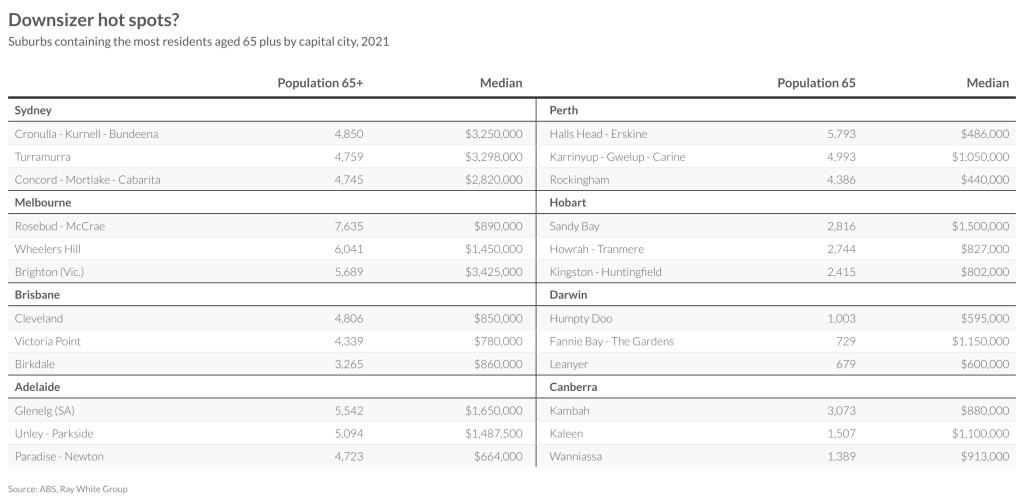

Last week, data on population by age group by suburb was released by the Australian Bureau of Statistics. It provided a snapshot into where there are a lot of babies (Mickleham in Melbourne’s north) and the most middle aged people (Bentleigh in Melbourne and the Noosa Hinterland). It also provided details on where the most people aged 65 plus live which perhaps gives us an idea where any downsizer incentives will provide the biggest uplift in availability of family homes.

While some suburbs may contain a lot of older Australians because there is a retirement community or aged care facility, the mix of where the most 65 plus years residents are is an interesting mix. It includes some very desirable suburbs such as Glenelg in Adelaide, Sandy Bay in Hobart and Brighton in Melbourne where there are likely lots of families keen to settle into big family homes.

Original Article: https://www.raywhite.com/ray-white-now