Nerida Conisbee,

Ray White Group

Chief Economist

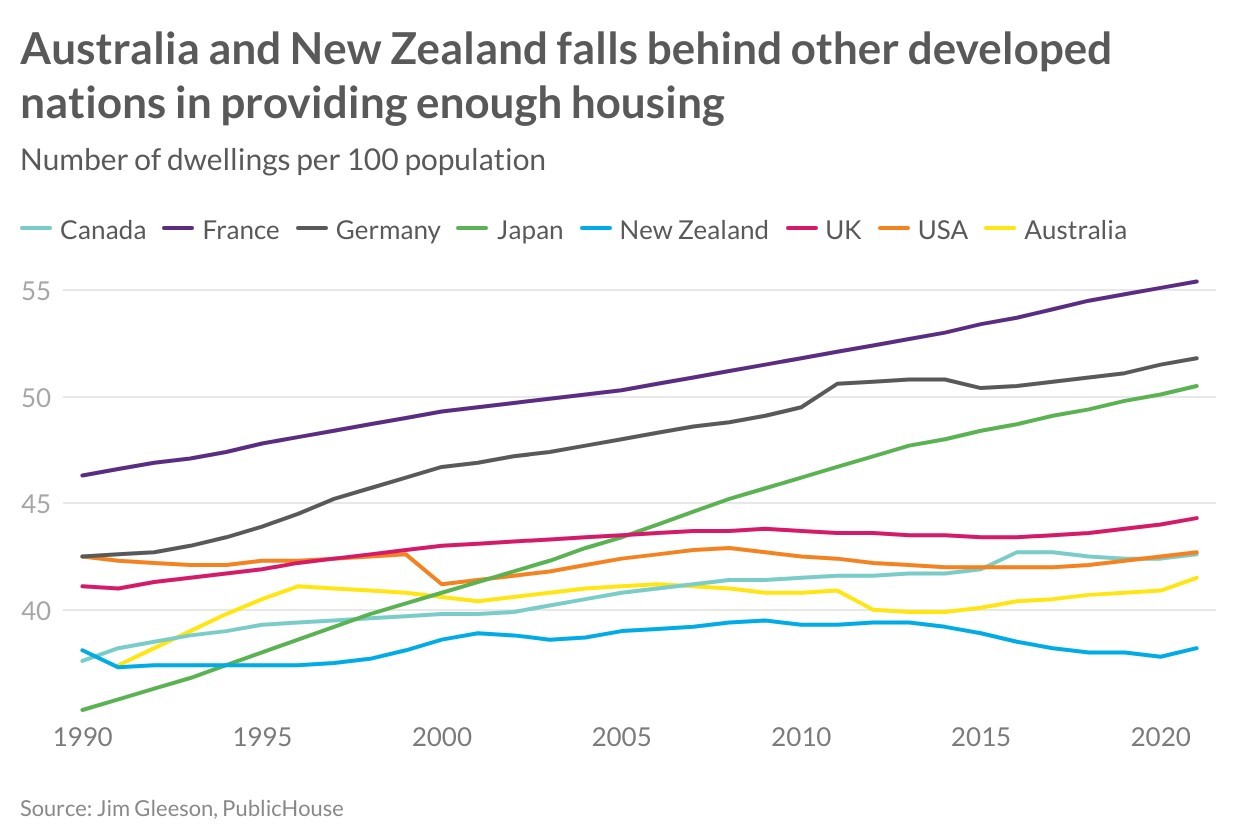

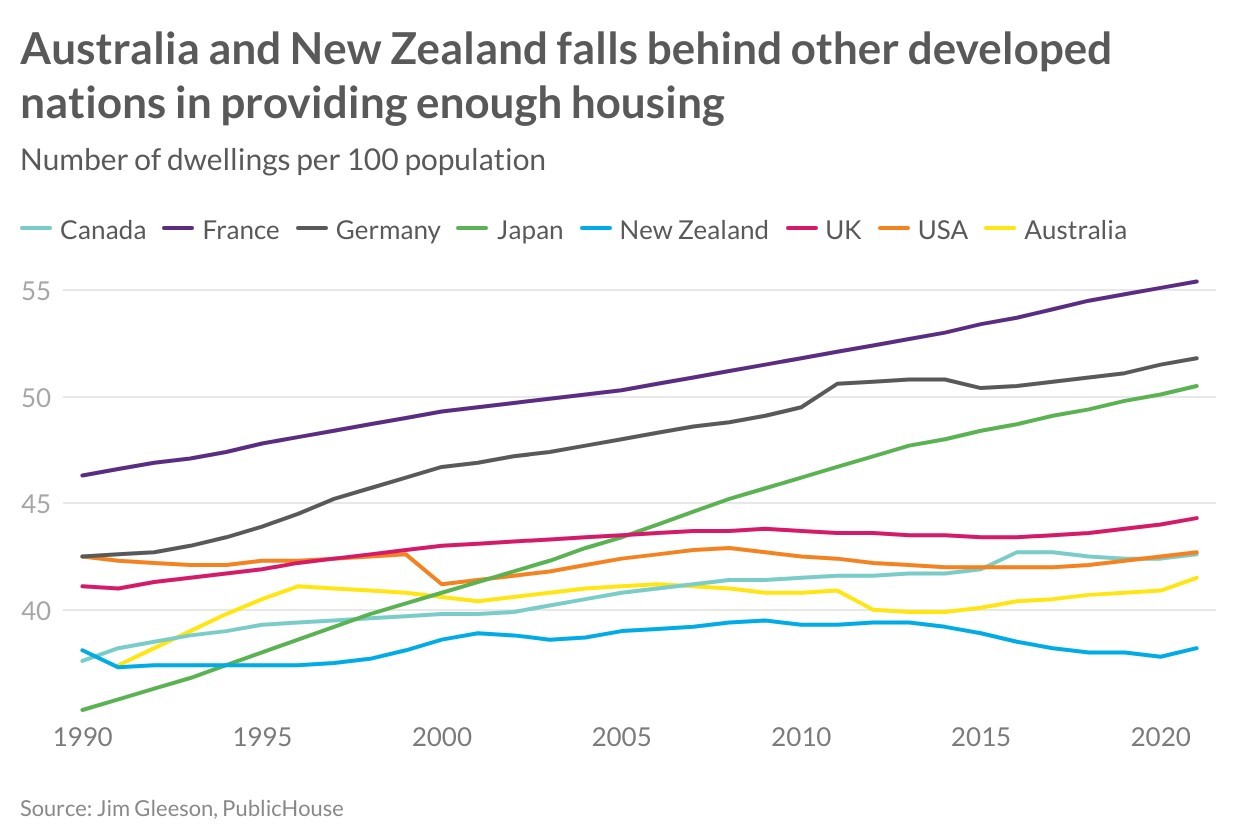

We aren’t quite the worst country in the world for not building enough homes. New Zealand takes that honour, but we come close.

Since the mid 1990s, the number of homes per 100 people has remained stable. At the same time, average household size has declined. In most other countries around the world, the number of dwellings per 100 people has increased significantly. This has been the key to keeping them far more affordable for both renters and buyers.

Australia’s demographics are changing. Half of all households are now couples or singles without children. Fewer children, an ageing population and more people living alone is driving up the number of homes we need, further accelerated by population growth. While the rest of the world has been building more homes per person as this demographic change has taken place, Australia has lagged behind.

In 2021 (the latest at which global data has been available), Australia had 41 homes per 100 people. Compare this to France with 55.4 homes and Germany with 51.8 homes. Interestingly, as both France and Germany’s populations have aged and demographics have changed, this number has increased. Japan has also shown a rapid increase, however this is also being driven by a declining population.

How does this impact affordability and policy? Germany and France with their abundant housing have remained far more affordable for renters. New Zealand, which lags behind the most, is the least affordable. Affordability for buyers is also apparent. The ratio of house prices to incomes is highest in New Zealand and Australia. For housing policy, it simply means that we won’t fix affordability until we fix housing supply. Pretty much every other measure fixes affordability at the margins, or in many cases, makes it worse. We need to build enough homes where people want to live.