There is the media and then there are the facts. I think what is interesting is that the media coverage has started to move away from home price predictions, to the cost of living and rental market news.

There is no doubt that the 10th interest rate increase in a row is having an effect on borrowers, both those with home loans and those looking to purchase; however, the market is doing some amazing things.

In February Ray White Qld conducted 465 auctions, with an average number of bidders of 5.4 per auction. With 6 in every 10 auctions selling in 3 weeks or less, with no finance, no inspection clause, and no cooling off period.

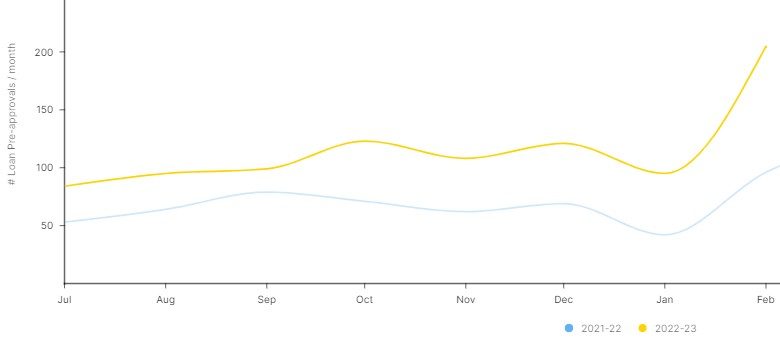

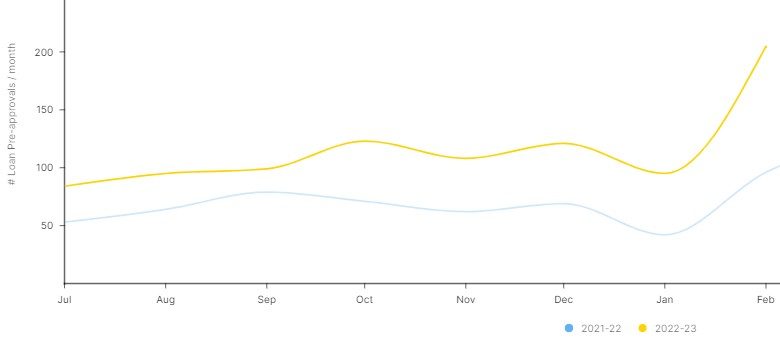

In February Loan pre-approvals were up 103% year on year, which includes re-financing and new home loan applications. Buyer open home attendance was up 20.21% year on year and new listings coming to market are down 10.31%

The above data is fact and provides confirmation of what we are seeing on the ground, in our office, in that buyers are active, pre-approved, and buying. With fewer new listings available to buyers, despite the increased interest rates and doom & gloom in the media properties are selling and the downward trend in pricing has for the moment eased.

Why Sell Now? No one has a crystal ball and no one knows how long this interest rate cycle will remain, what we do know is the facts. Loan approvals are up, buyer inspection numbers are up and new listings are down. This data should give Sellers the confidence to act

Data Provided by Ray White Pulse 7th March 2023

Loan Approval Data:

Buyer Inspection Numbers:

New Listing Data: