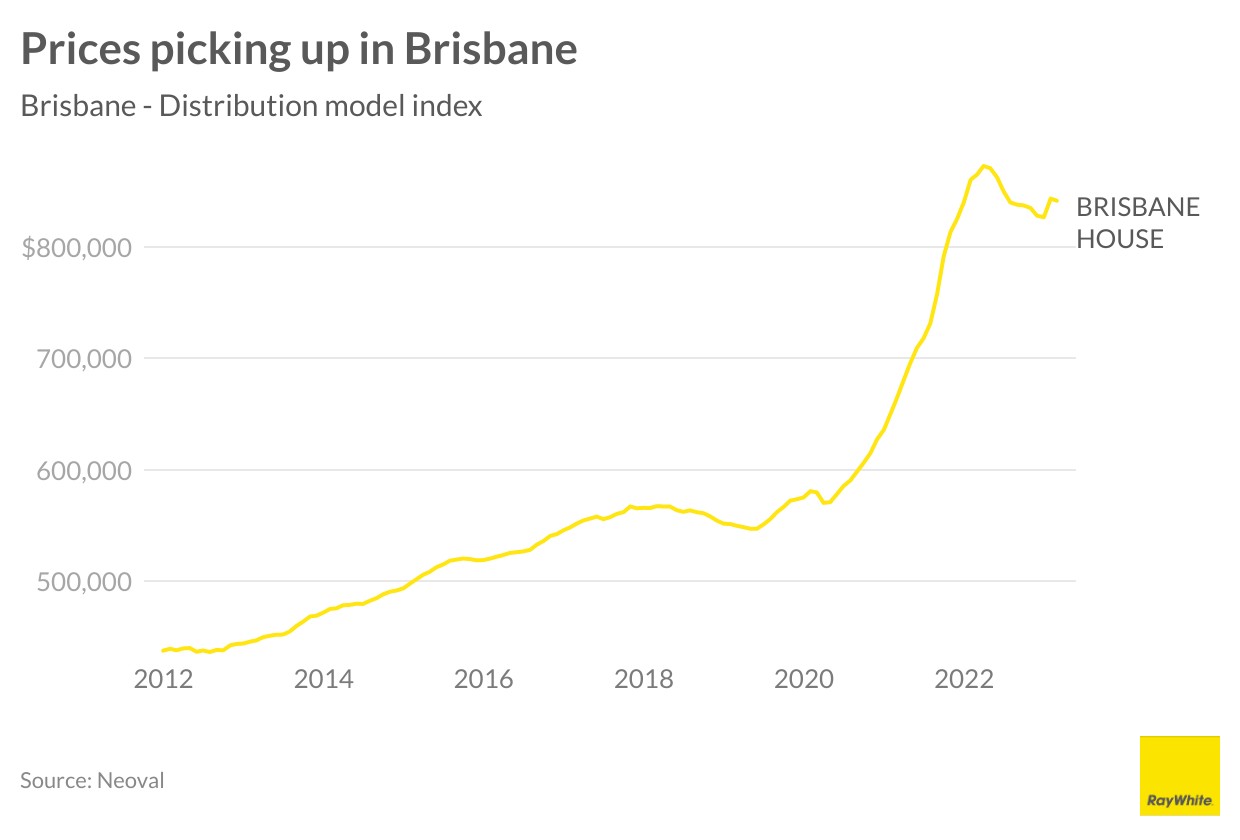

A shortage of homes is biting hard in Brisbane. Population growth in Queensland is the strongest in Australia and at the same time, the value of homes being constructed has fallen by six per cent. At the same time, an infrastructure and non-residential building boom is taking trades away from new homes being built. This is most immediately showing up in rental growth. Advertised rents have risen by 32 per cent over the past two years. However, it’s also keeping house prices far more elevated than what you would expect in such a rapidly rising interest rate environment. House prices hit a low in December and are now back to where they were mid-last year.

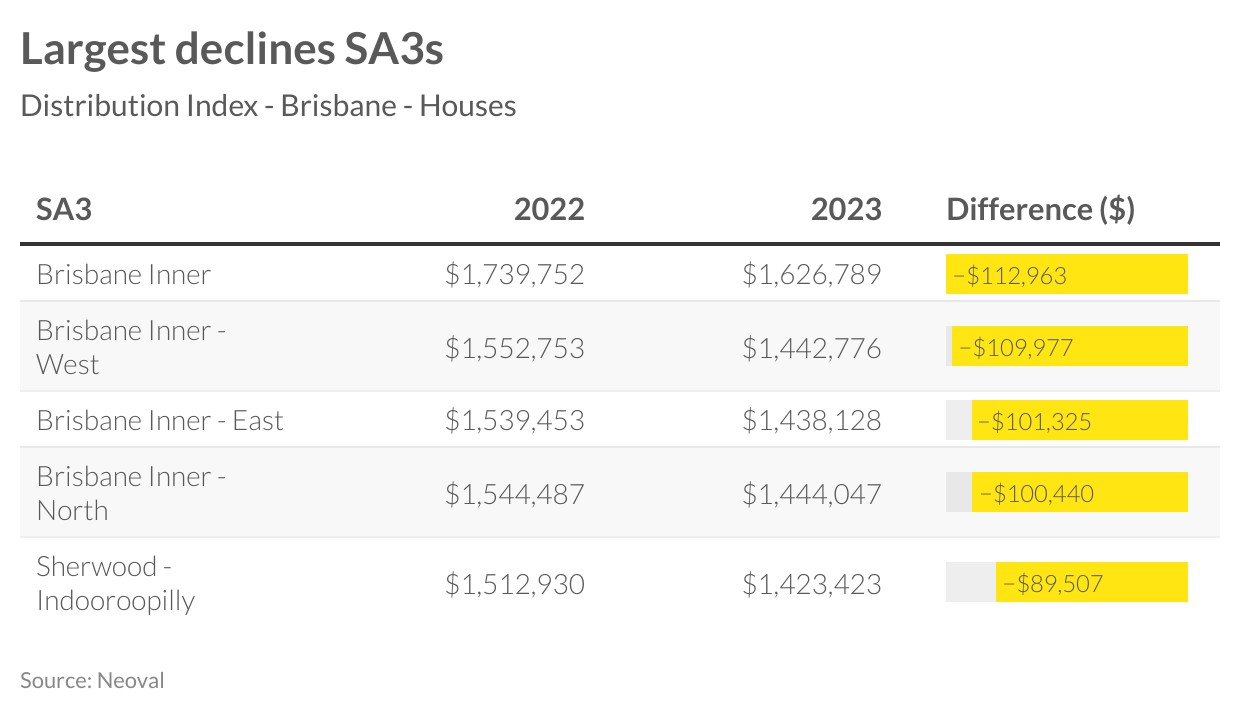

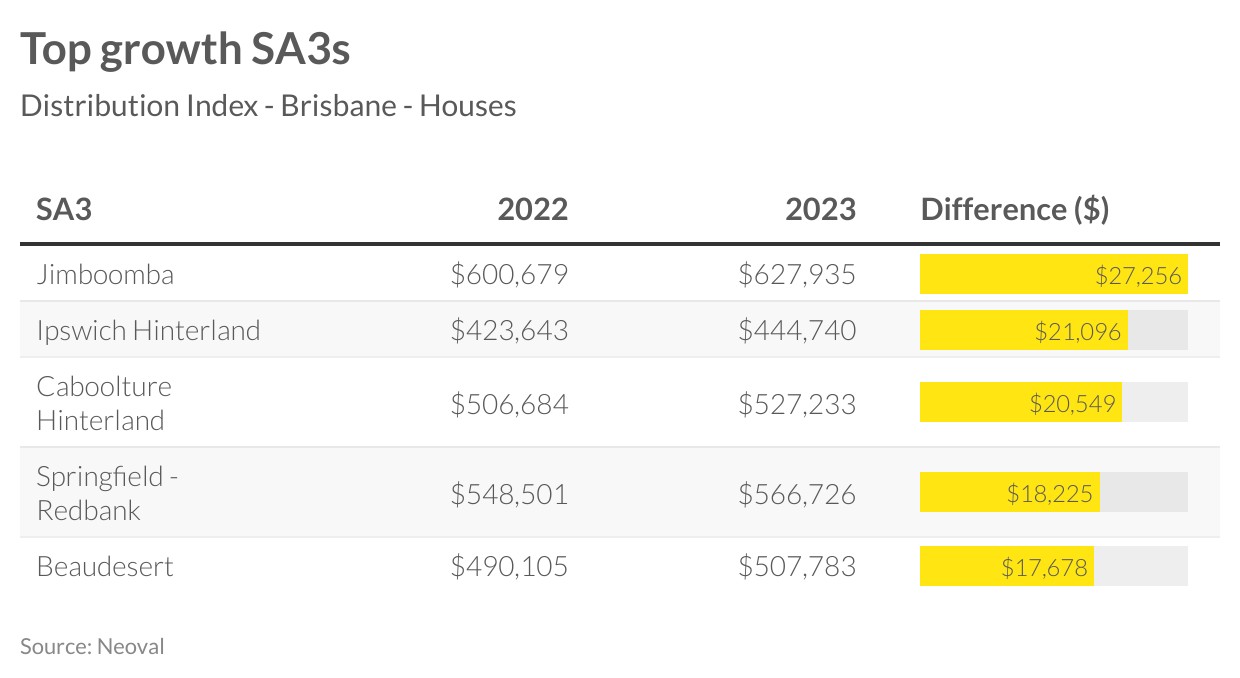

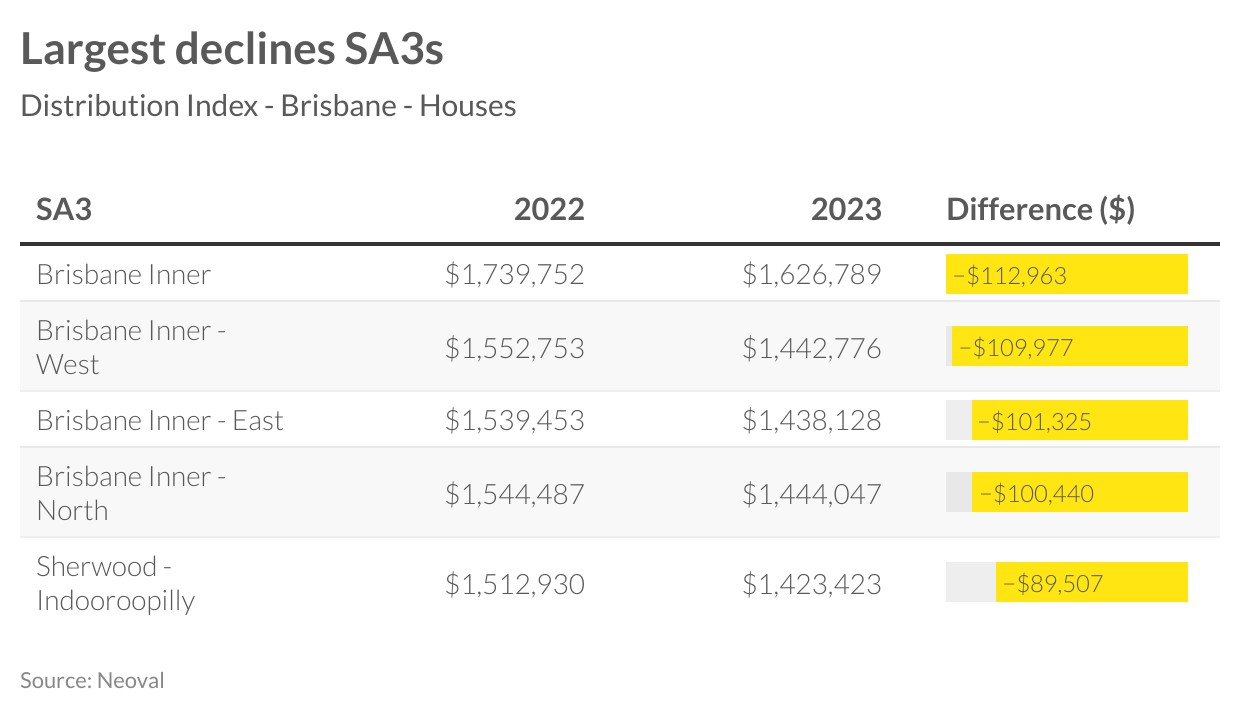

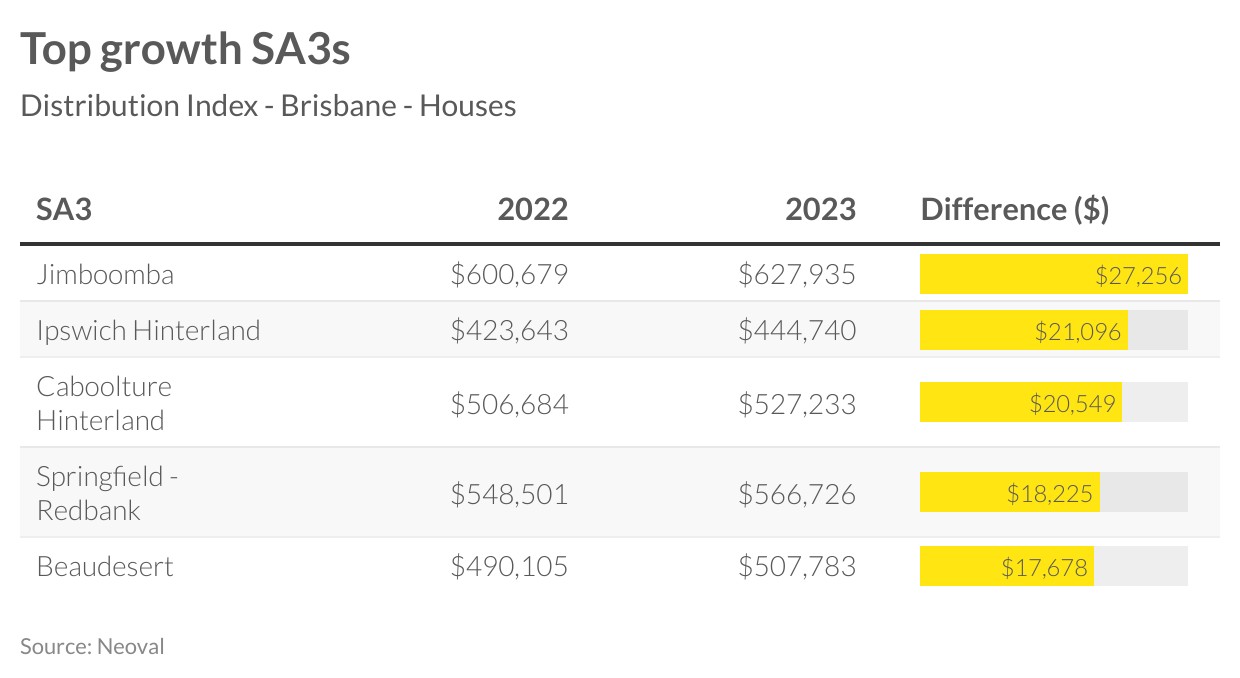

The comparative strength in Brisbane is showing up at a local area level. Unlike in Melbourne and Sydney, not all suburbs are recording price drops. More similarly though is that the areas that are the top performers over the past 20 years, and through COVID, have seen the biggest declines. Inner Brisbane is the most expensive region and has also seen the biggest declines. In contrast, lower priced areas are still increasing, perhaps driven by investor interest in these areas, as well as lower mortgages. Jimboomba has seen prices rising by almost $30,000 since last February.

The outlook for Brisbane is for continued shortages of homes. Brisbane saw very high levels of interstate migration during the pandemic and most of these migrants would have rented. Anecdotally, many of these renters are looking to become buyers. While interstate migration has slowed, international migration has started up again. Rental growth is continuing and it looks like price growth that’s following will also continue.