Nerida Conisbee,

Ray White Chief Economist

Recovery in prices for established homes has taken a lot of people by surprise but highlights that market dynamics aren’t purely driven by interest rates. The problems we are having in the construction sector and with rental growth are going to mean that price growth will continue, driving prices back to where they were at the start of 2022 within the next six months.

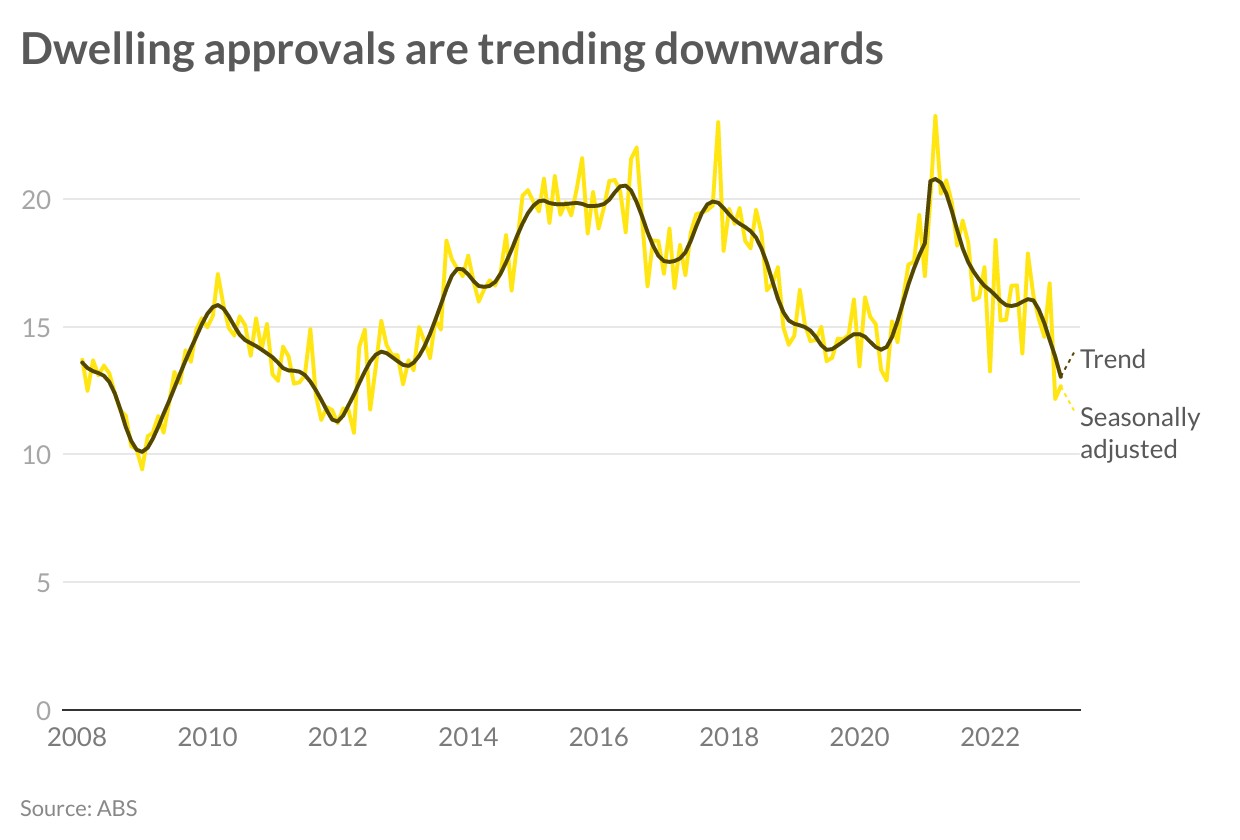

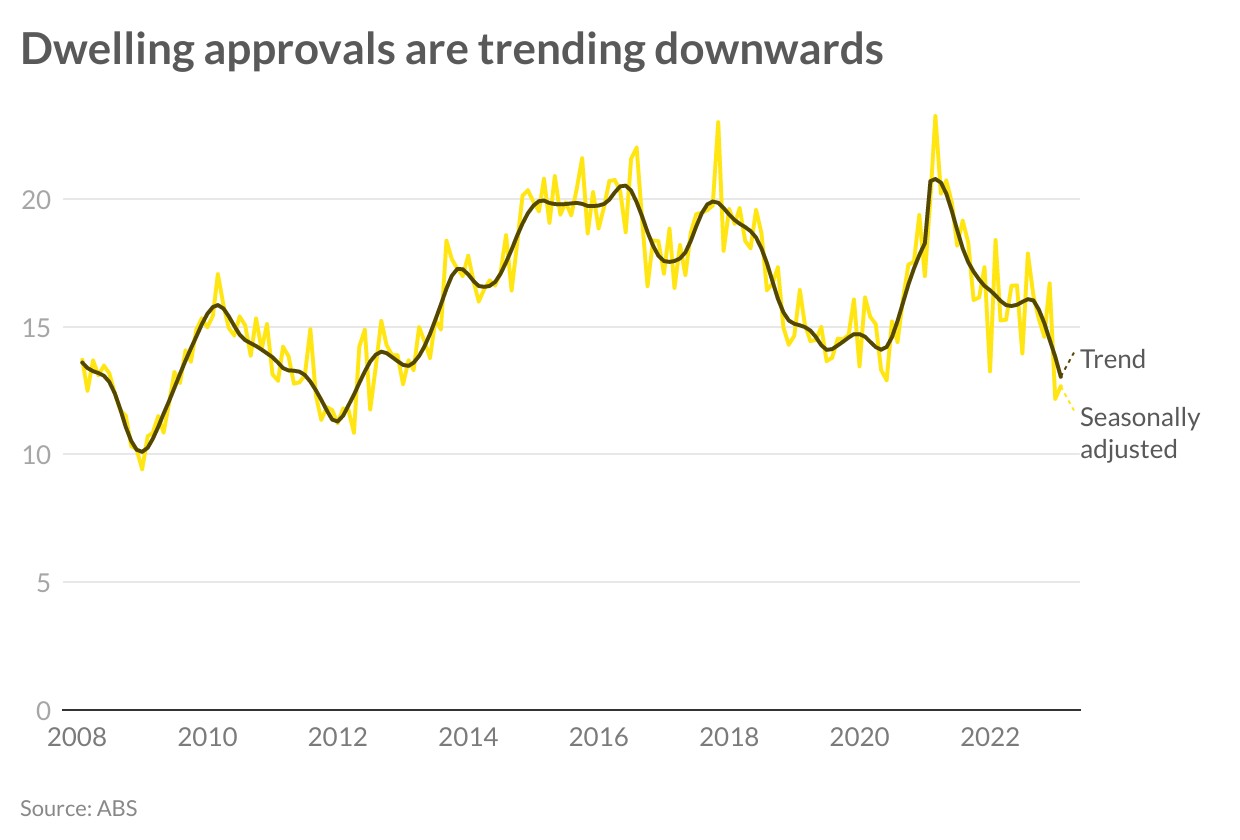

The number of new homes being approved is now trending to its lowest level in over a decade. In February, 12,661 dwellings were approved, a 30 per cent decline from 12 months ago. In historic terms, this is exceedingly low but many of these homes will not be built quickly given construction cost increases. Many people who would otherwise have bought a new home will be pushed to the established market. Either because the cost to build a new home is too high, it is difficult to find a builder or simply there is no availability in the suburb they want to live in.

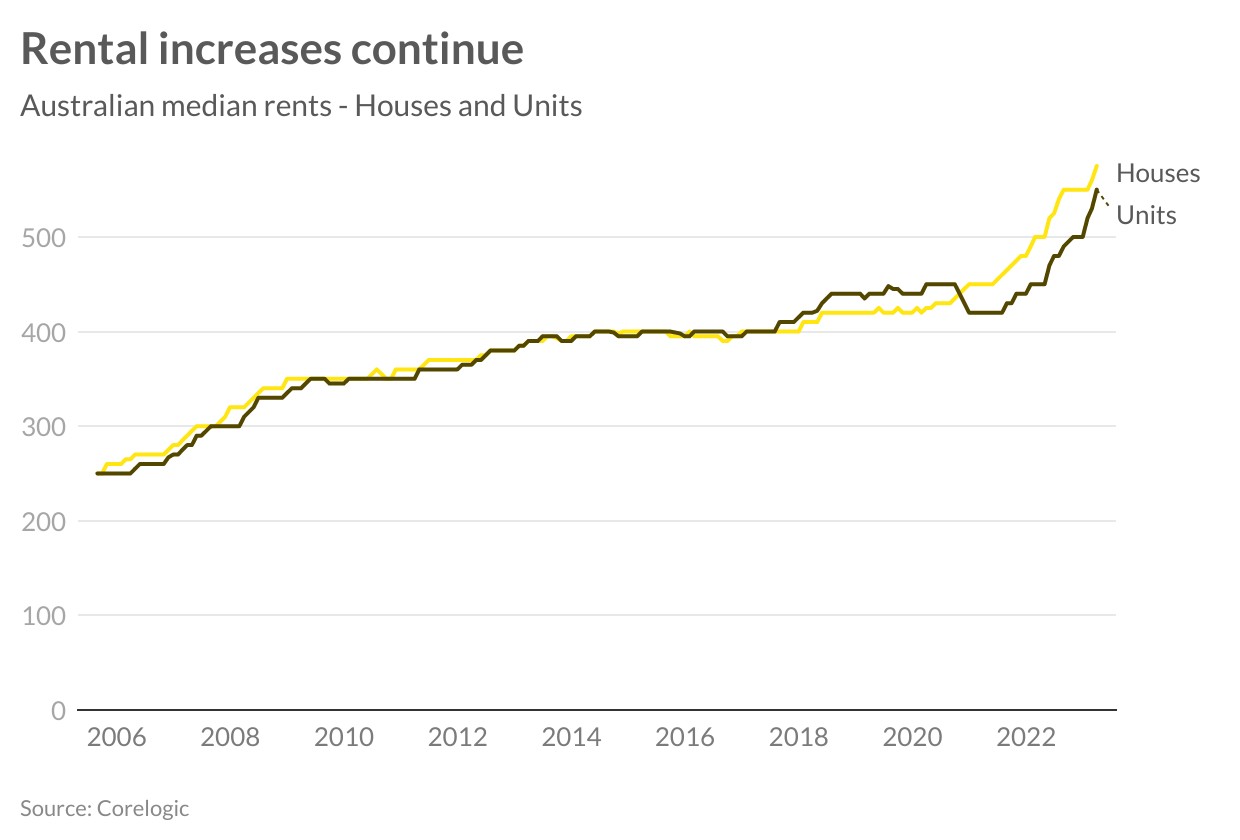

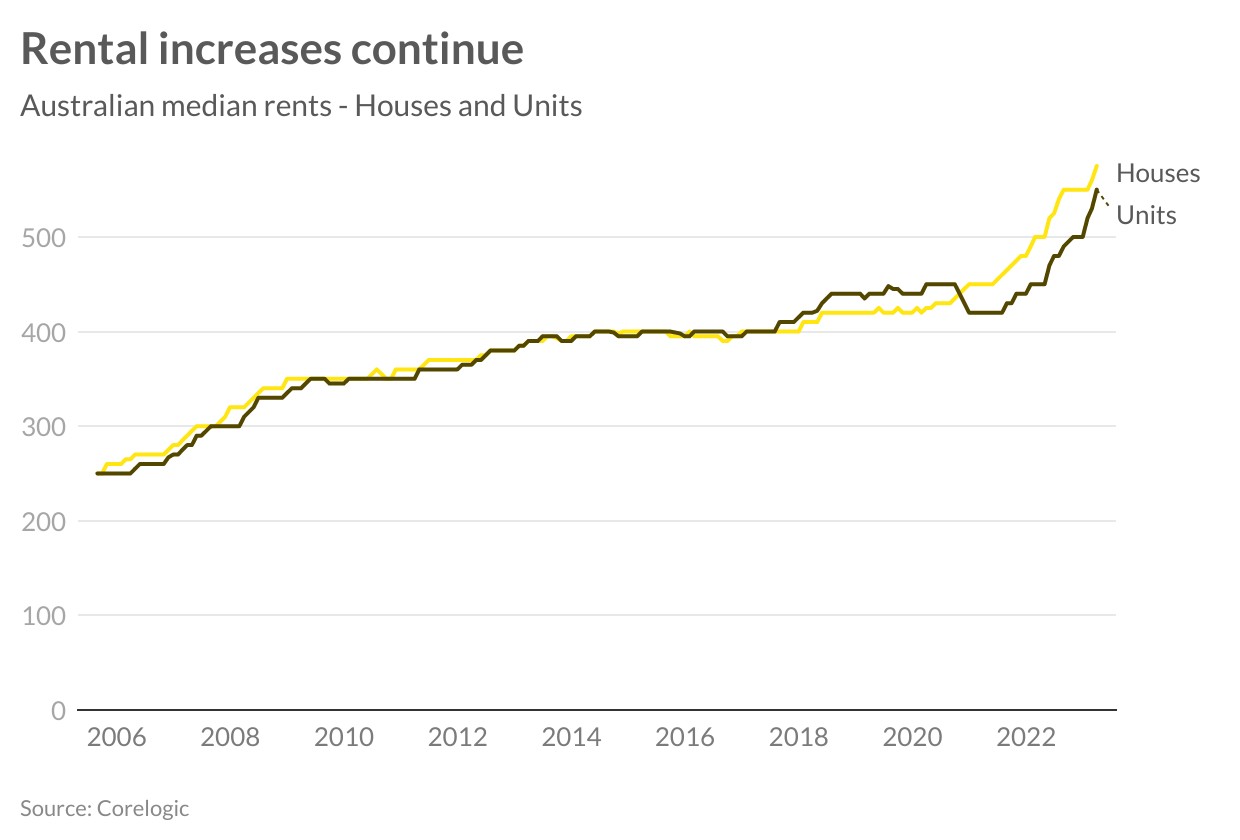

The rapid rise in rents will also drive people to the established home market, particularly those that have recently moved and only planned to rent short term. Although it is not possible to track this, anecdotally it appears to be occurring in regions like south-east Queensland and Perth where there was significant population movement during the pandemic. When moving to a new city, people tend to rent before they buy. Given a lot of this movement happened over 12 months ago, it appears that as 12 month leases expire, rental increases kick in making buying more attractive than it did.

While there has been some signs that construction cost increases are starting to slow, it is unlikely that they will fall back to where they were prior to the pandemic and the pipeline of new homes will take some time to strengthen again. In addition the lack of rental properties will take some time to resolve. Even though the cost of finance has risen rapidly, it looks like this pressure on prices is now being overturned by a shortage of homes.