Nerida Conisbee,

Ray White Chief Economist

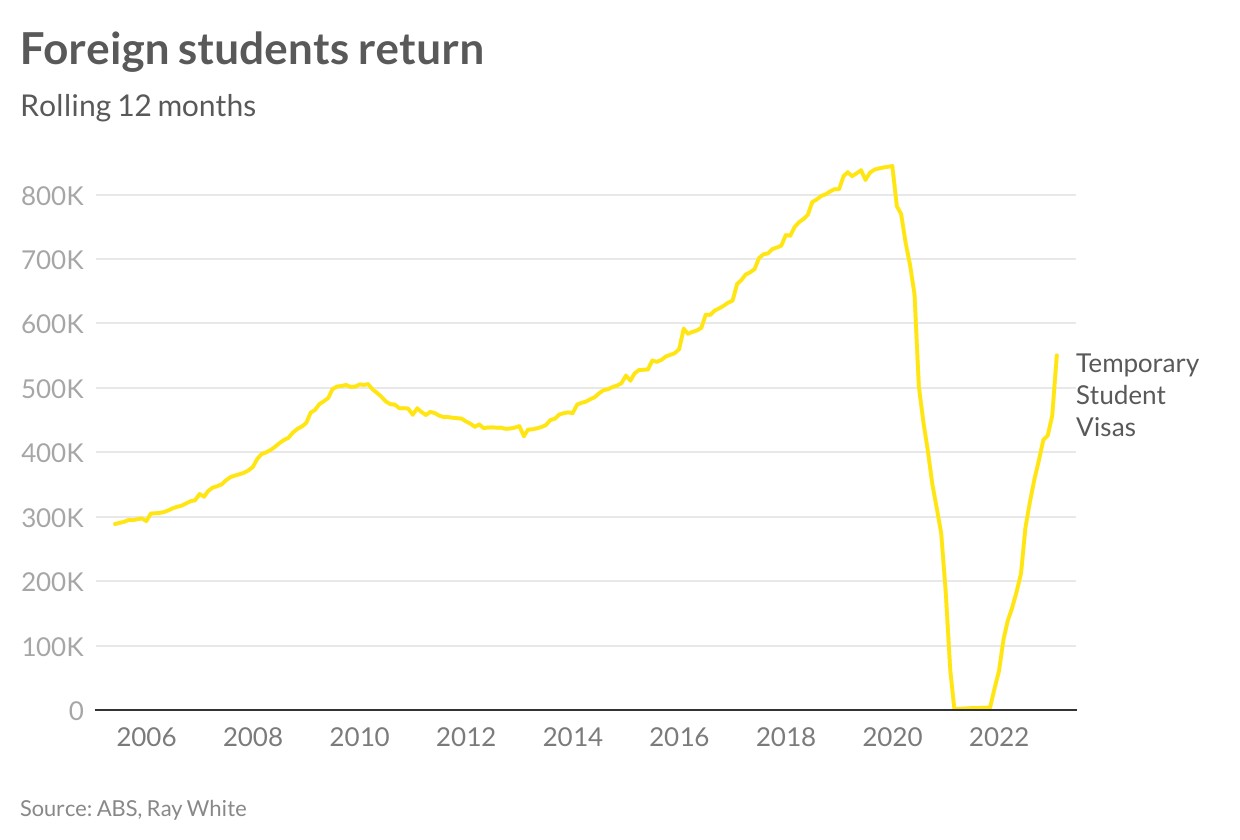

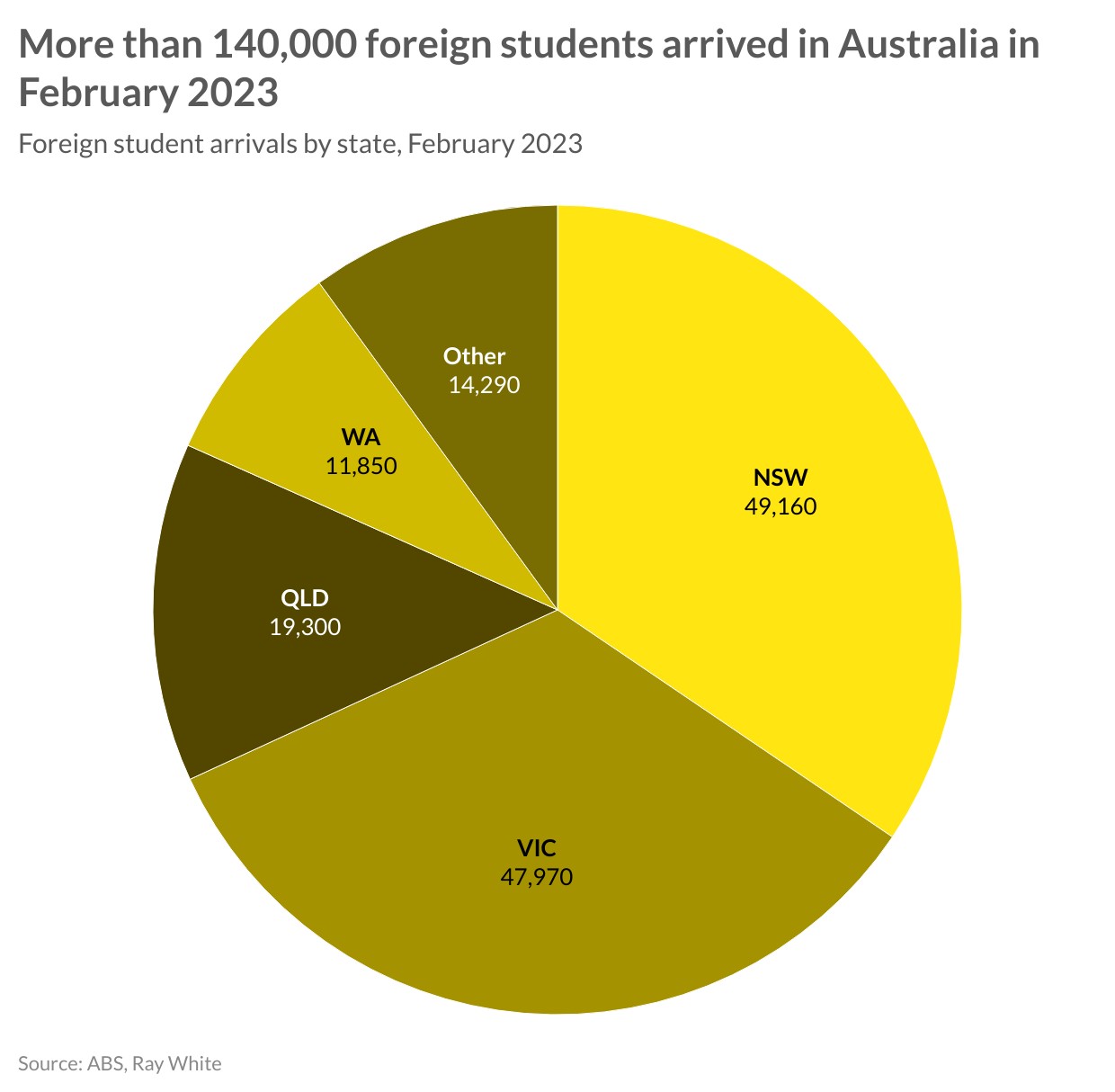

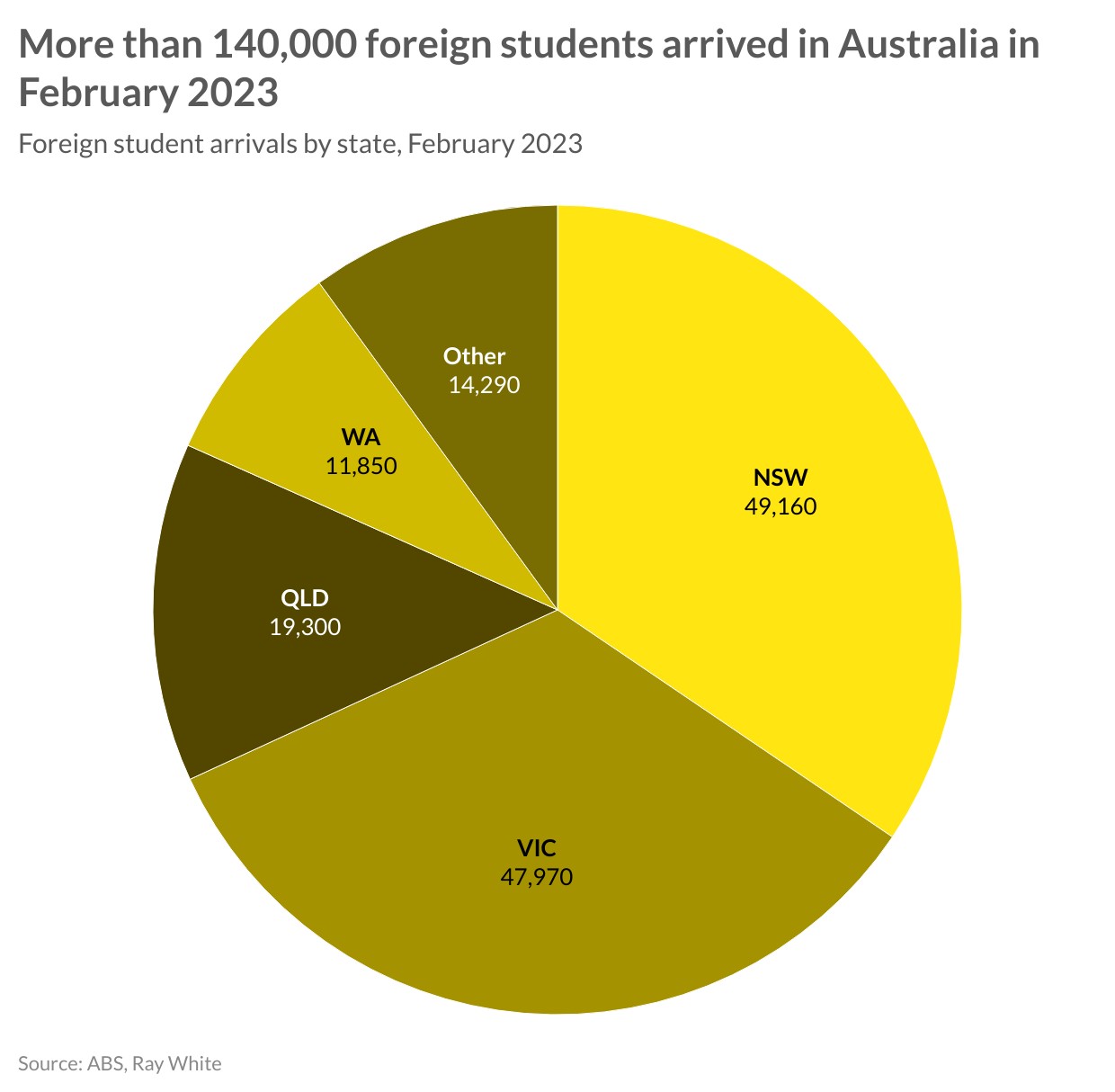

In February, over 140,000 foreign students returned to Australia and the number of students arriving on temporary student visas is slowly returning to pre-pandemic levels. While this is good news for universities, as well as employers that rely on students such as hospitality, it is also good news for many apartment markets.

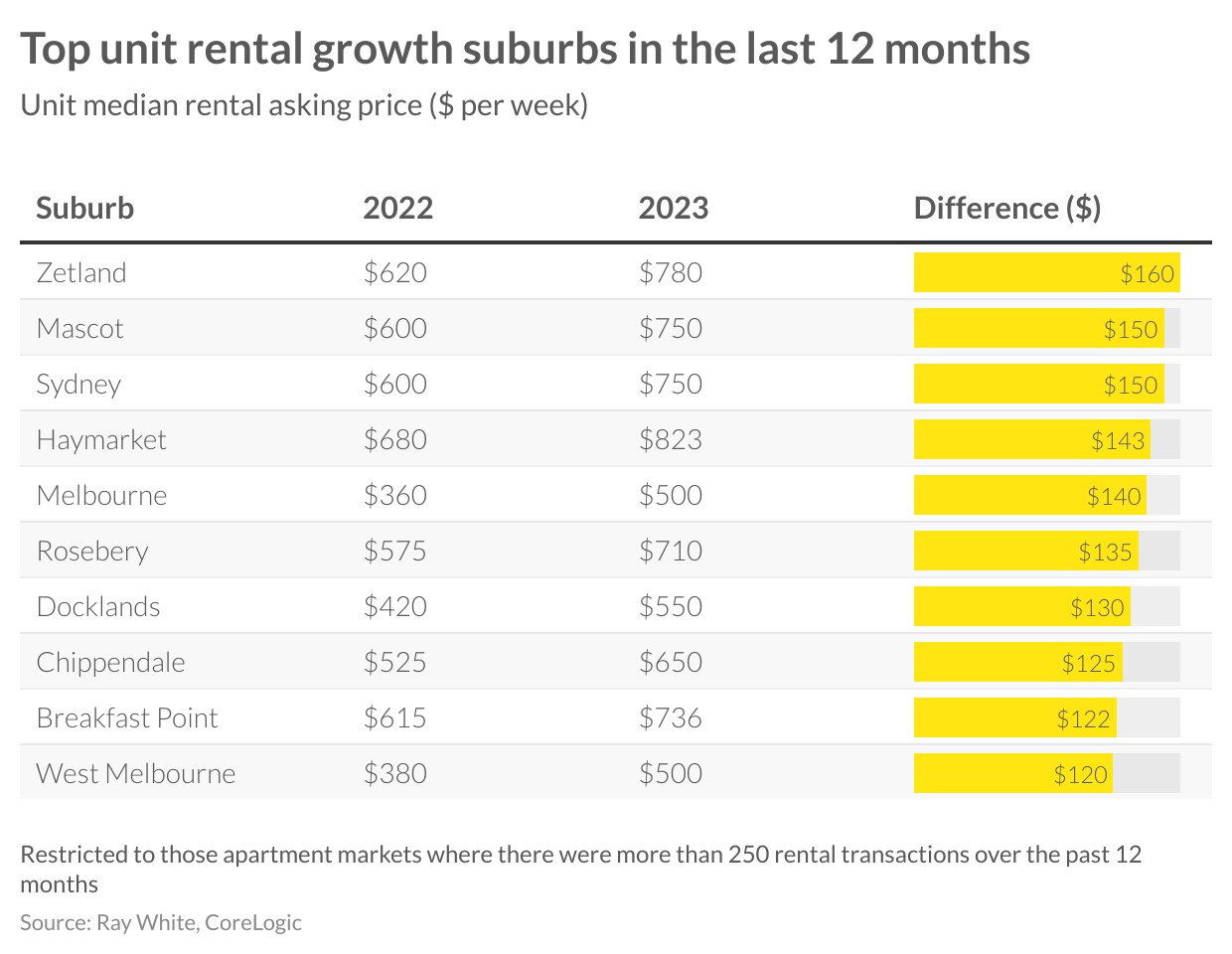

Suburbs with a high proportion of student accommodation saw large losses in both rental levels and values during the pandemic. Melbourne CBD saw the biggest impact. In 2021, rental levels dropped by 23 per cent, while prices declined by 7 per cent. While rents and prices grew rapidly throughout 2021 in almost all property markets, this was not the case for apartment markets that housed a lot of students. This also had a flow to commercial property, particularly retail that relied on a large number of people living nearby.

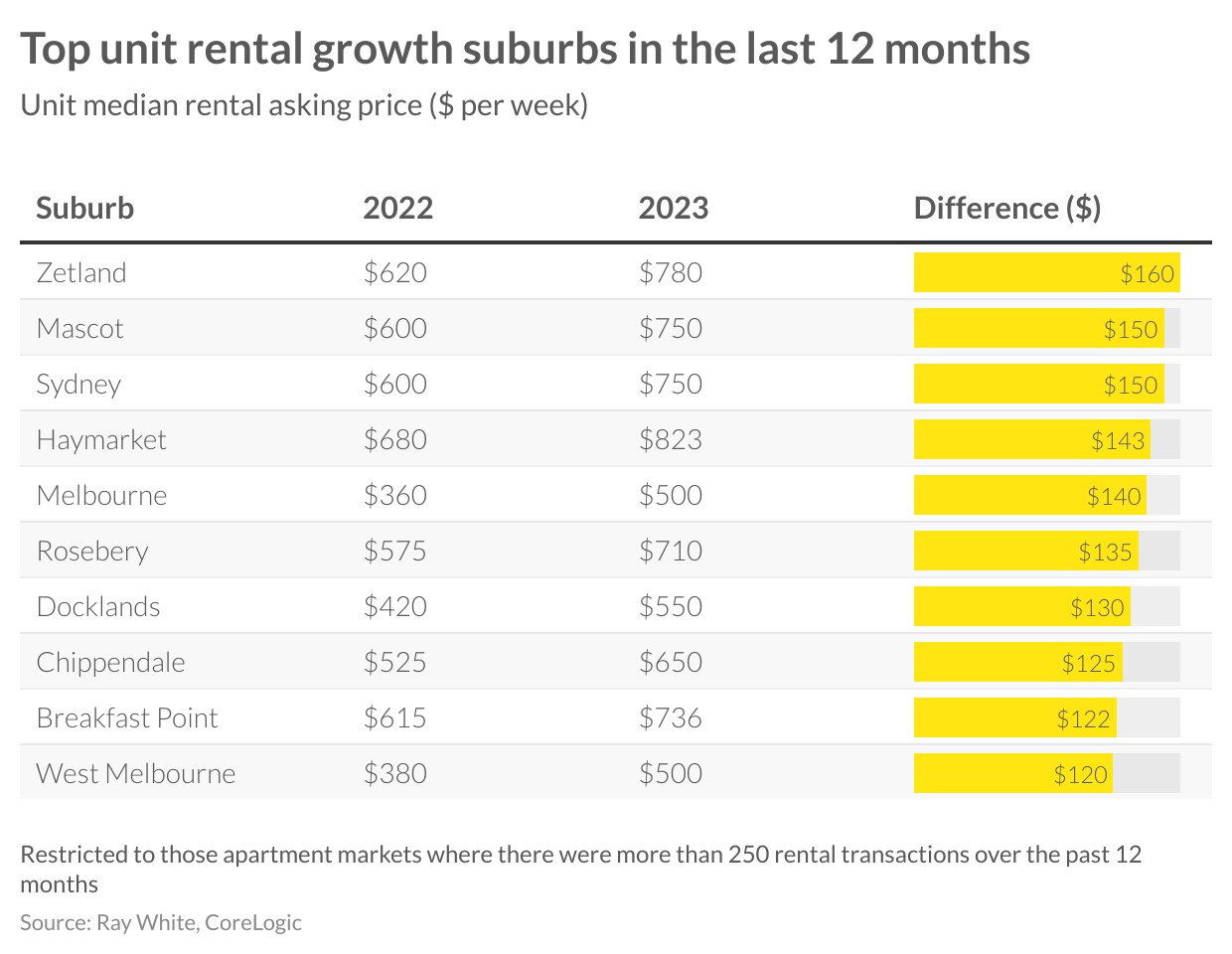

With students returning, rents are increasing quickly. In Melbourne CBD, they have increased by almost 40 per cent over the past 12 months and are back to pre-pandemic levels. While in Zetland and Mascot they have increased by over 25 per cent.

While rents are rising rapidly as a result of increased demand, we are yet to see a similar increase in values. With property prices back on the move nationally, it is likely that this will hit apartment markets sometime later this year. Ideally once this happens, we will start to see a new construction cycle kick off for affordable student apartments, improving rental affordability and ensuring enough accommodation for students that want to study in Australia.