Nerida Conisbee,

Ray White Group

Chief Economist

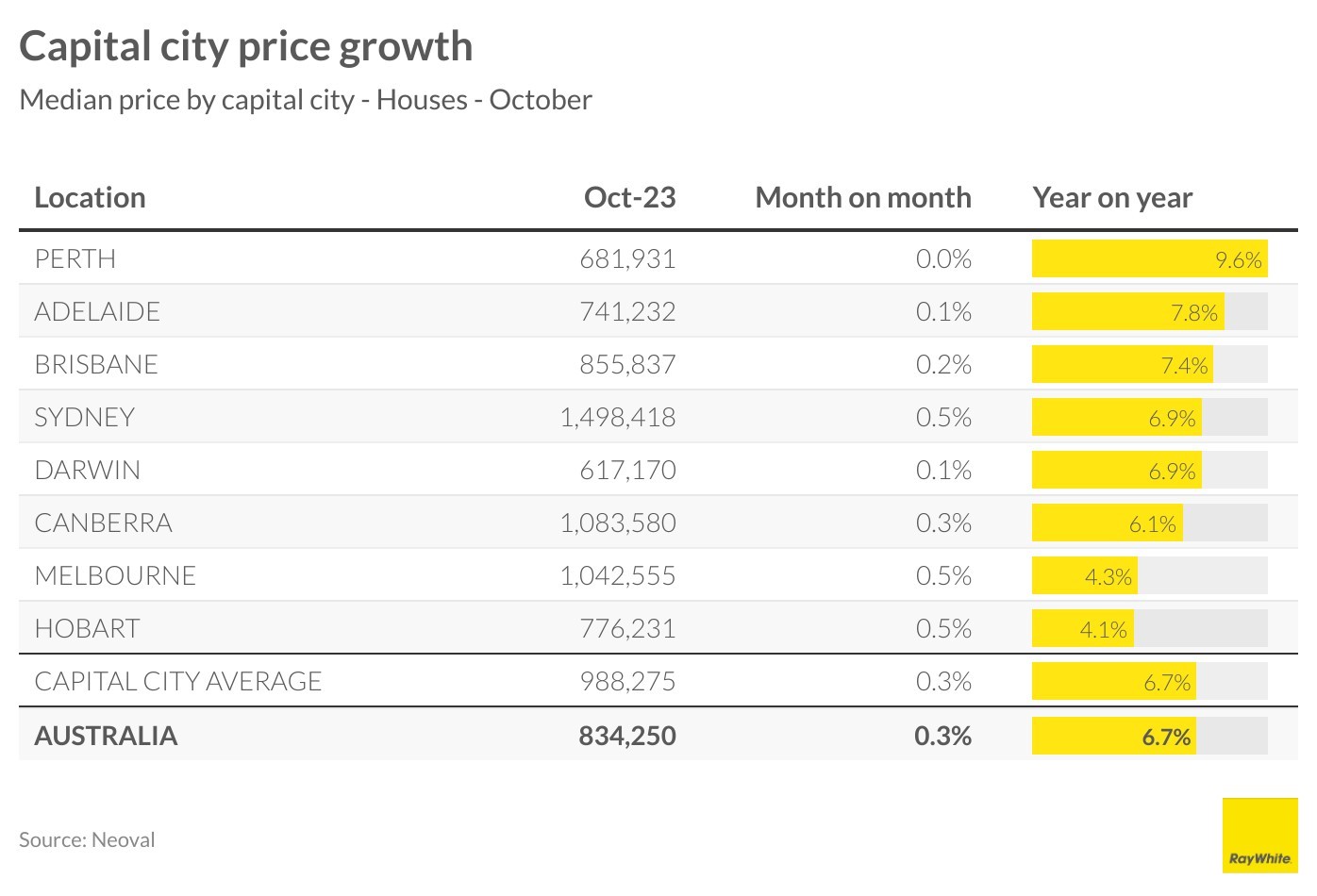

Despite a lot more homes on the market compared to last year and interest rates a lot higher, house price growth is continuing across our capital cities. The capital city median is now getting closer to $1 million and is now significantly above the previous peak reached last year.

The strongest growth market continues to be Perth. Prices are now up almost 10 per cent compared to last year although they did stabilise over the month. The slower markets of Melbourne and Hobart meanwhile are strengthening. Although growth is less than half that of Perth, both cities saw strong increases in October of 0.5 per cent

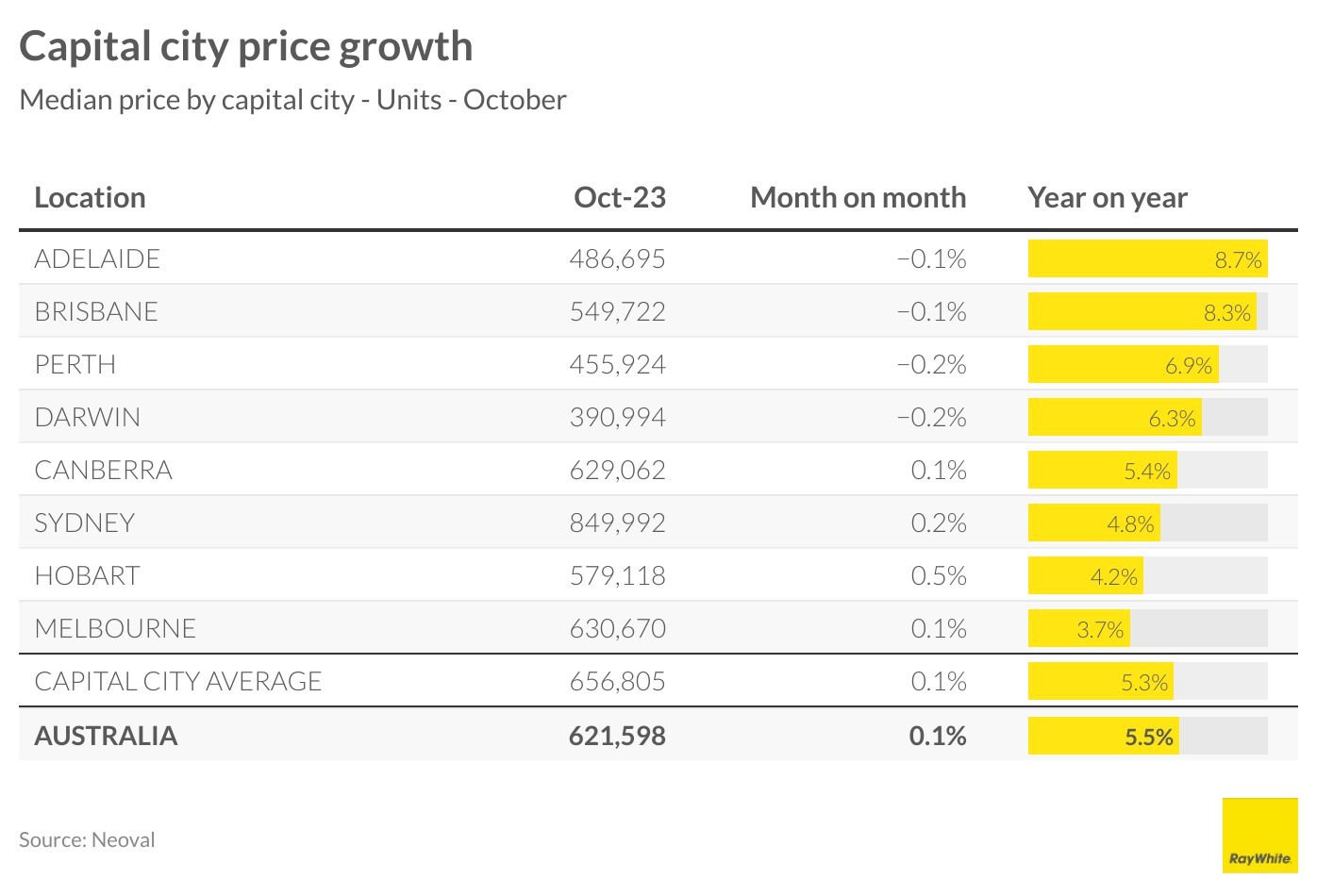

Meanwhile, the unit market is moving a bit slower, perhaps driven by greater ownership by investors. The median is well in excess of the 2022 peak and prices are overall up over the month, however we did see a slightly decline in the strongest markets of Adelaide, Perth, Brisbane and Darwin. However, Adelaide remains the strongest market for units on a year-on-year basis, while Hobart, a city that has too few units, saw the biggest jump over the month.

Price growth is expected to continue for the remainder of the year. Although we may see a Melbourne Cup rate rise, a lack of properties continues to be a challenge for buyers. We saw a jump in listings in late winter however this has failed to continue and spring has been far slower than expected for properties coming to market. In addition, potential new home buyers are being pushed into the established home market and strong rental increases are making renting far less attractive.