Nerida Conisbee

Ray White Group

Chief Economist

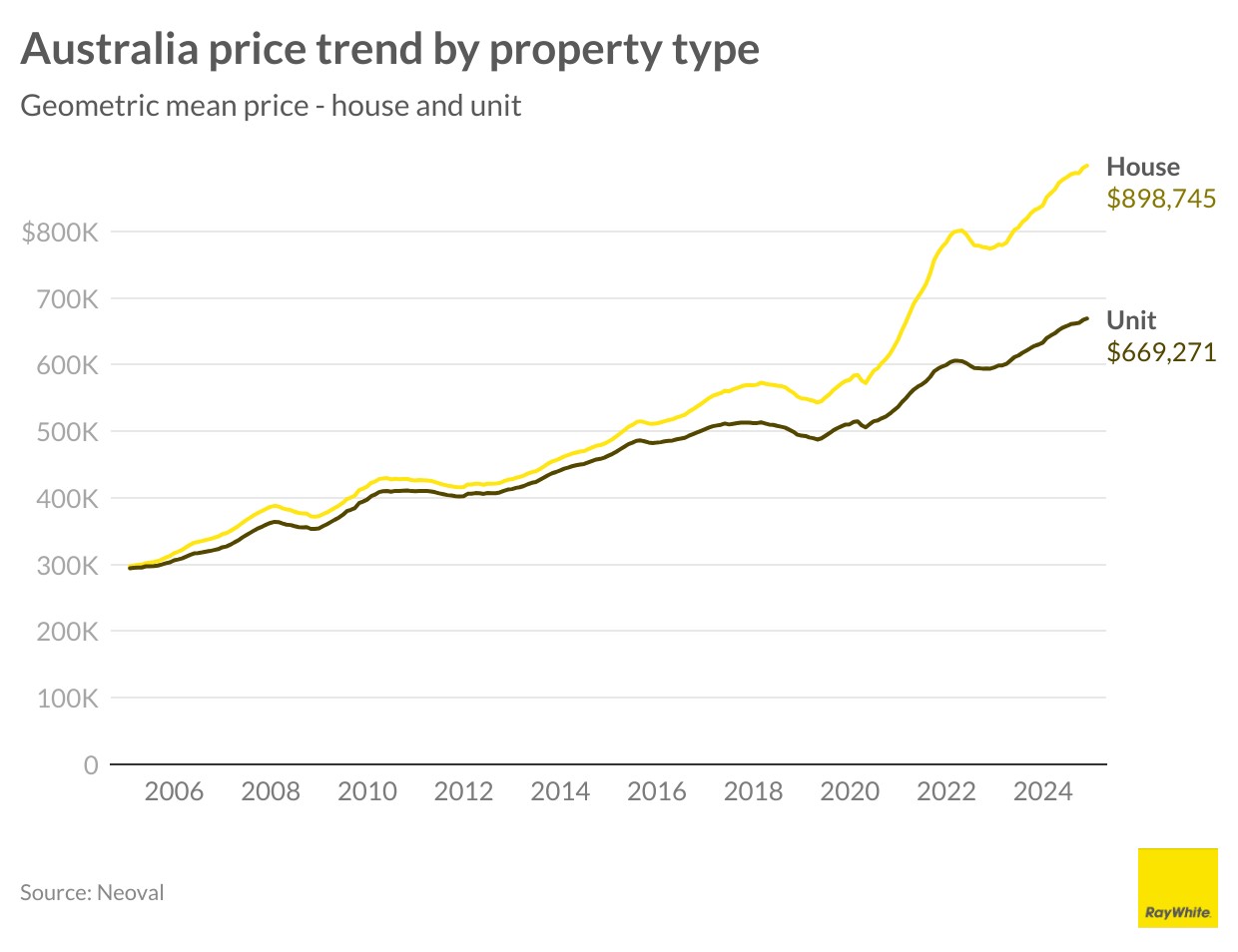

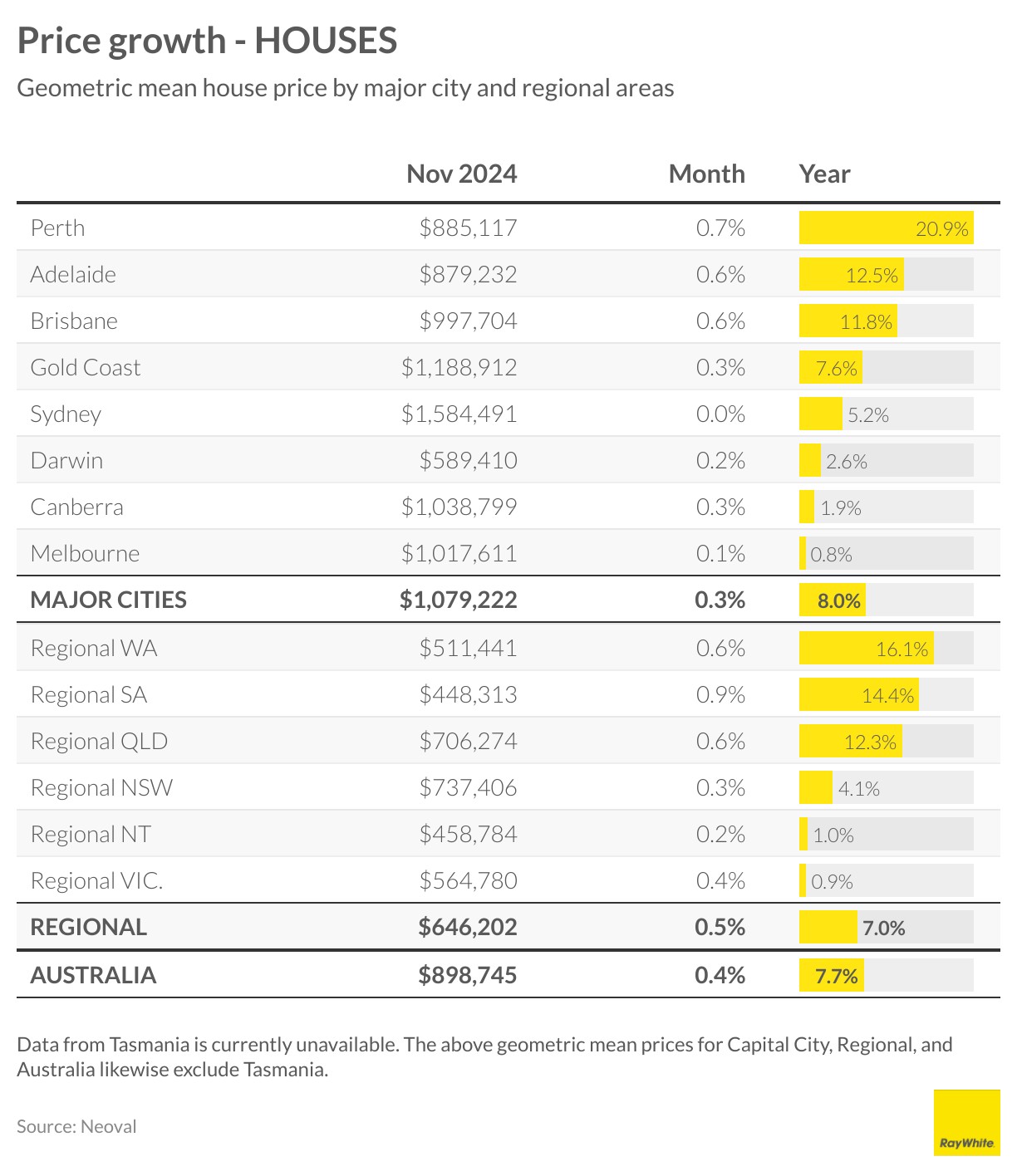

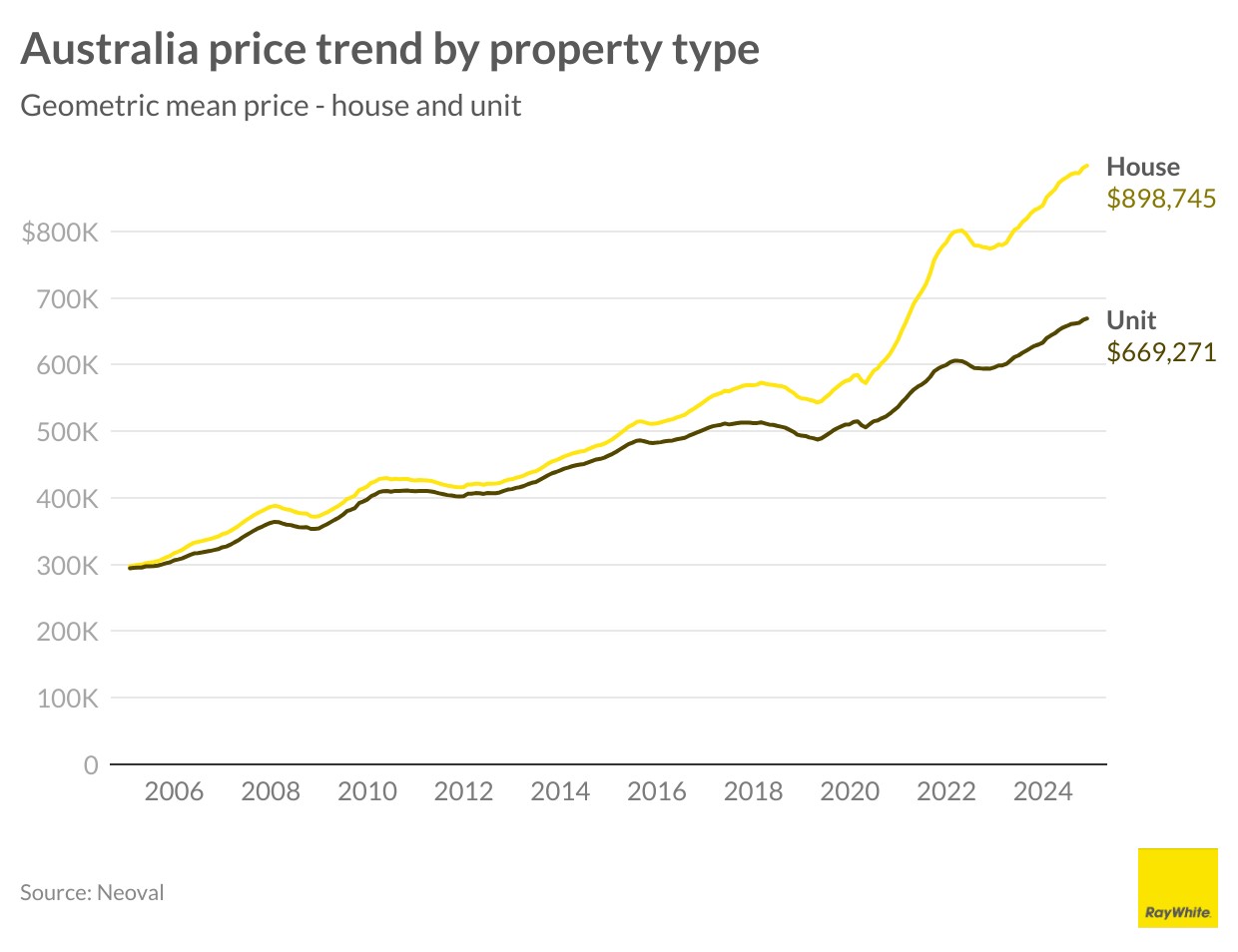

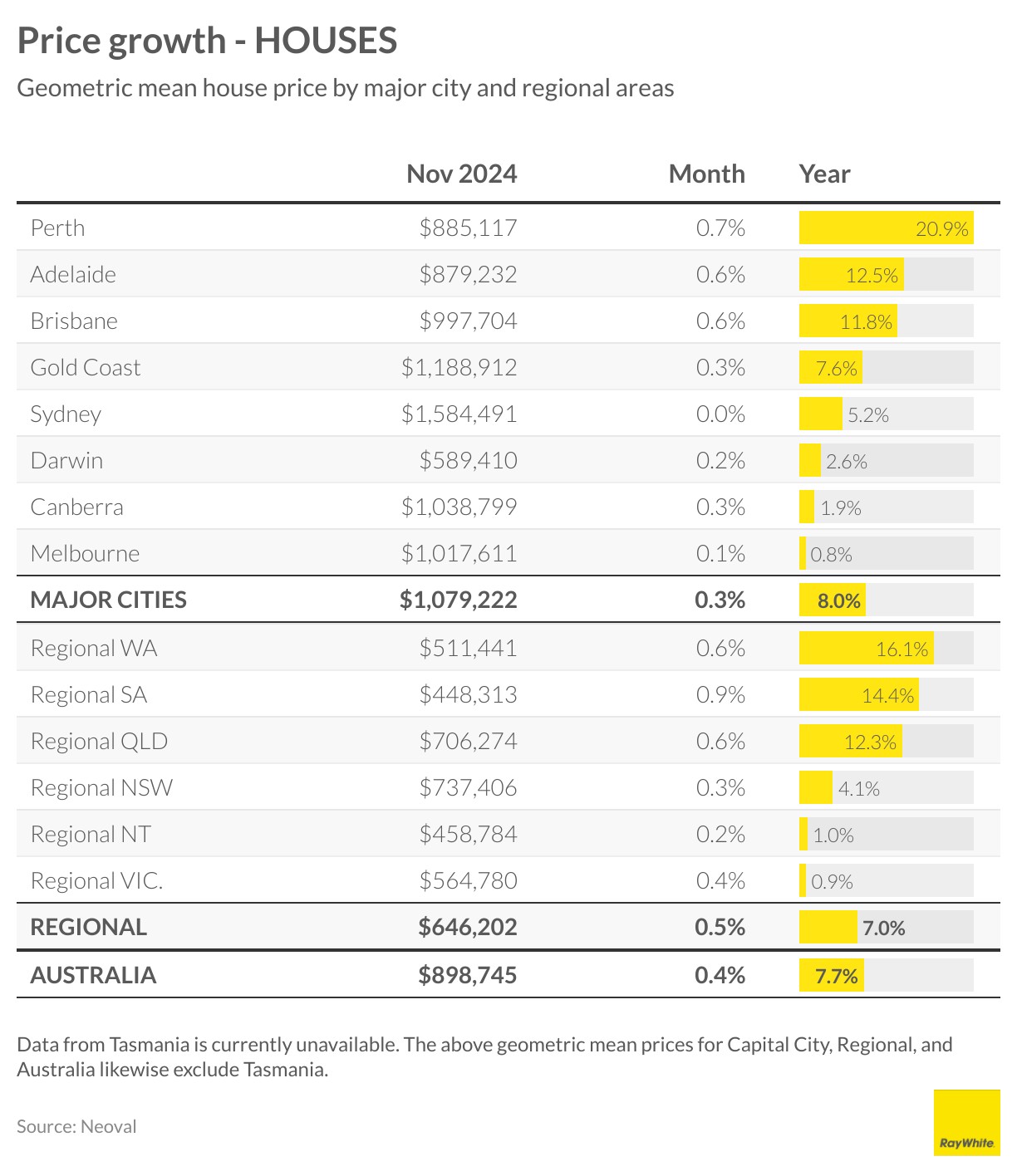

The Australian housing market is showing clear signs of moderation as 2024 draws to a close, with the national house price median reaching $898,745, up 7.7 per cent annually but with monthly gains easing to 0.4 per cent. This deceleration in price growth reflects both seasonal patterns and broader economic headwinds. Will this lead to an actual fall in prices? For some cities perhaps, particularly Melbourne. For others such as Perth, Brisbane and Adelaide, it is likely to slow things down.

Financial markets continue to price in two interest rate cuts for the second half of 2025, though the timing remains contingent on inflation data and global economic conditions. Recent price pressures have moderated, but external factors – particularly U.S. policy shifts and their implications for global trade – may influence the RBA’s monetary policy path.

Capital city performance shows increasing divergence. Perth maintains strong momentum with 20.9 per cent annual growth and a robust 0.7 per cent monthly gain, while Sydney’s growth has moderated to 5.2 per cent with flat monthly performance. Melbourne’s annual growth has slowed notably to 0.8 per cent, indicating shifting market dynamics in Australia’s largest cities.

The regional market narrative remains compelling, particularly in Western Australia where house prices have risen 16.1 per cent annually. Regional South Australia continues to show strength at 14.4 per cent annual growth, while regional Queensland has recorded 12.3 per cent appreciation. This sustained regional performance points to structural changes in buyer preferences beyond cyclical factors.

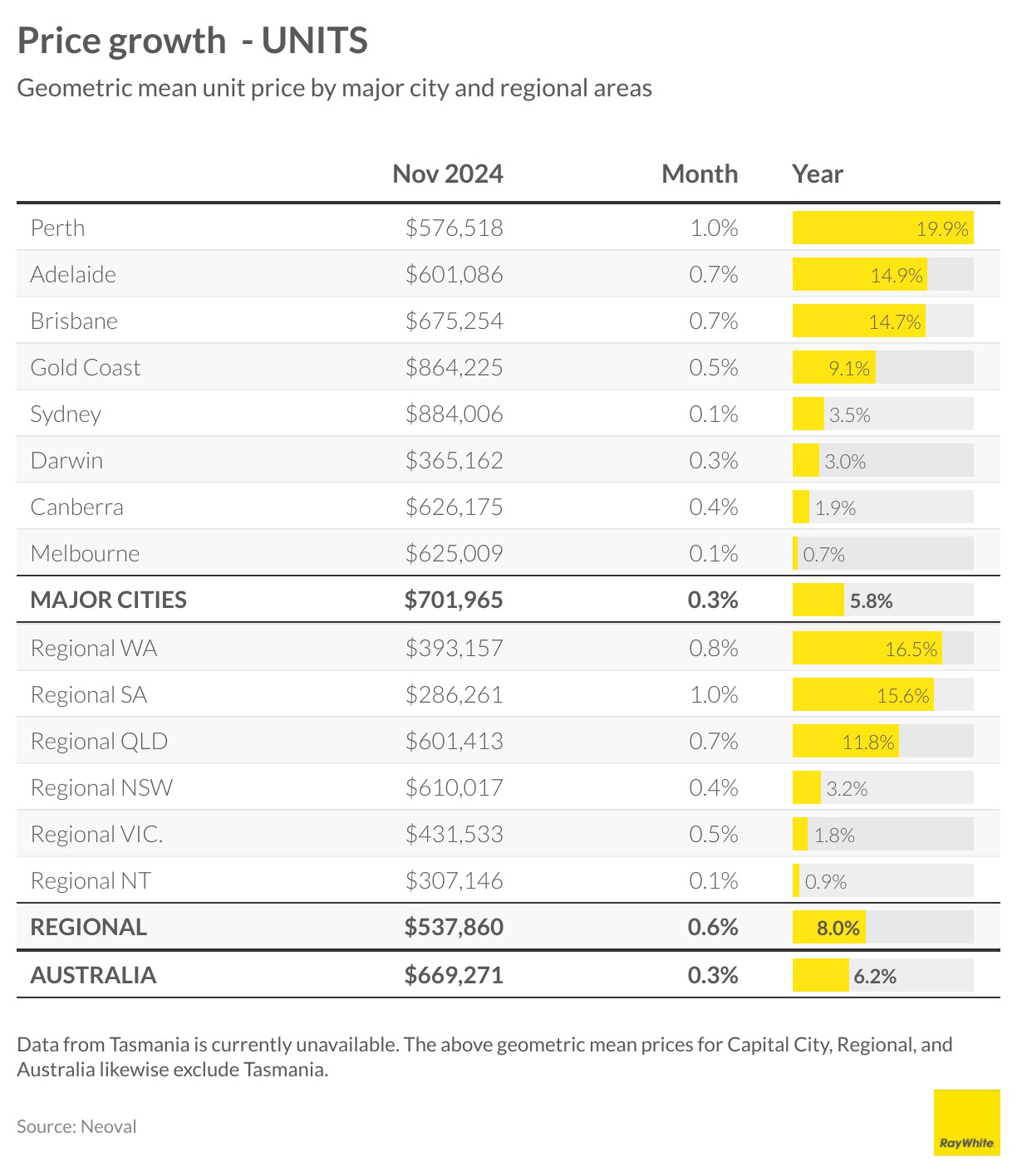

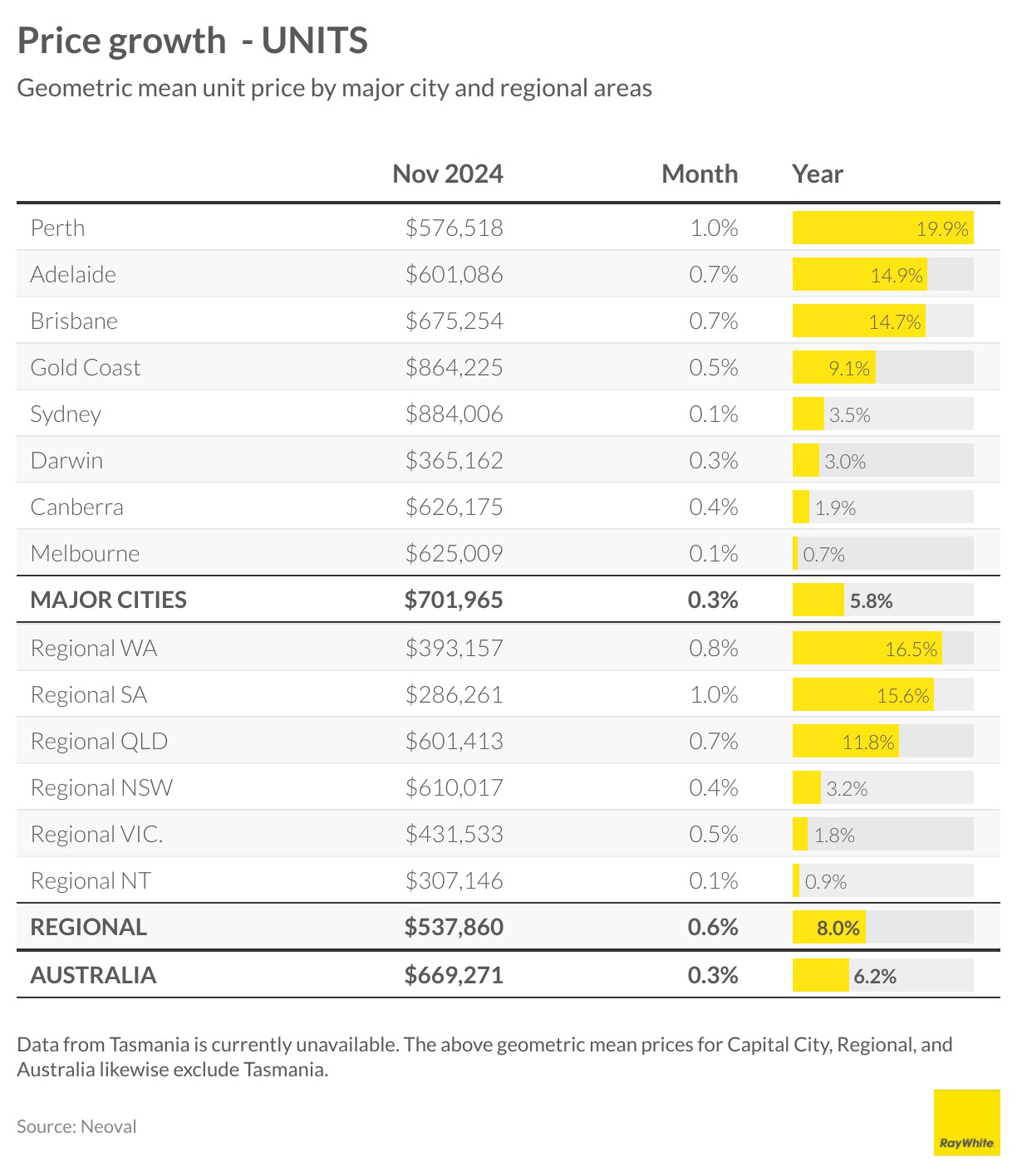

In the unit sector, the national median now sits at $669,271, up 6.2 per cent annually. Regional markets again outperform capital cities, with regional Western Australia and South Australia recording annual growth of 16.5 per cent and 15.6 per cent respectively. Perth leads the capital cities with unit price growth of 19.9 per cent, followed by Adelaide at 14.9 per cent.

Recent data indicates increasing market sensitivity to supply levels, with more properties coming to market tempering price growth in major capitals. This trend is particularly evident in Sydney and Melbourne, where buyer fatigue and affordability constraints are becoming more apparent.

Recent data indicates increasing market sensitivity to supply levels, with more properties coming to market tempering price growth in major capitals. This trend is particularly evident in Sydney and Melbourne, where buyer fatigue and affordability constraints are becoming more apparent.

Looking toward 2025, several factors will shape market conditions. Population growth continues to underpin housing demand, while construction cost pressures restrict new supply. The anticipated easing in monetary policy should improve borrowing capacity, though the impact may vary significantly across markets given the divergence in price points and local economic conditions.

While price growth is expected to continue through 2025, the pace is likely to moderate further as markets adjust to evolving economic conditions and buyer sentiment responds to changing interest rate settings.

Recent data indicates increasing market sensitivity to supply levels, with more properties coming to market tempering price growth in major capitals. This trend is particularly evident in Sydney and Melbourne, where buyer fatigue and affordability constraints are becoming more apparent.

Recent data indicates increasing market sensitivity to supply levels, with more properties coming to market tempering price growth in major capitals. This trend is particularly evident in Sydney and Melbourne, where buyer fatigue and affordability constraints are becoming more apparent.