William Clark

Ray White Economics / Data Analyst

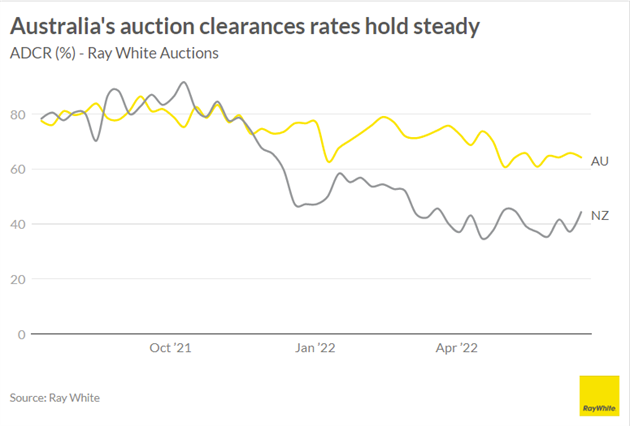

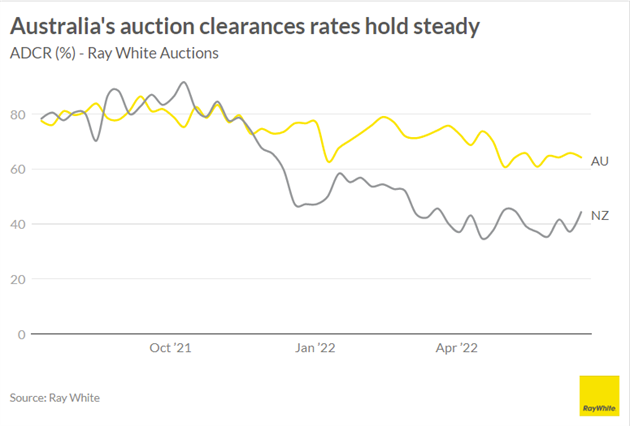

In the wake of the Reserve Bank of Australia’s cash rate decision today, we examined the state Australia is in, and qualify it against New Zealand’s efforts to curb inflation. With house prices taking a dip this month in some markets, what do further rate rises have in store for home buyers and sellers?

Australia

Australia has now seen three interestrate hikes from it’s all-time low cash rate of 0.1 per cent. RBA Governor Philip Lowe has offered a likely scenario of inflation peaking at 7 per cent in the December quarter, but is far less willing to offer guidance on when and where the cash rate will peak. While these moves are dramatic in the context of the last five years, it is worth observing the relative success seen in the RBA’s implementation. Our auctions data show demand is only moderately diminished against the fever of 2021, with the daily clearance rate at 64 per cent compared to 74 per cent this time last year.

New Zealand

New Zealand has had to react rather more dramatically to increasing global inflation concerns, moving both earlier and harder to curb what was at the time nascent inflation. This has led to a slashing of house prices by over nine per cent, and the pain appears to only be beginning. The cash rate, from a low of 0.25 per cent, is now at two per cent, and forecasts from the central bank itself state that the interestrate is likely to peak at four per cent, and continue at that rate for as late as to 2024. Auctions broadly show a dramatically lower demand and a growing stock of property on the market, with daily clearance rate of 44 per cent from 78 per cent this time last year.

.png)

The upshot of these figures is that Australia’s cash rate is lifting later, is forecast to peak lower, and start to ease off earlier, and not impact demand as seriously. This is no criticism of the management of New Zealand’s inflation, but rather the relative degree of early skill, and good fortune in Australia in a very global rise in inflation and cash rates. Inflation controls like the cash rate are designed to curb rising prices, not slash prices altogether, so households may yet be in a robust position in the climate of increased interestrates.

.png)