Nerida Conisbee, Ray White Chief Economist

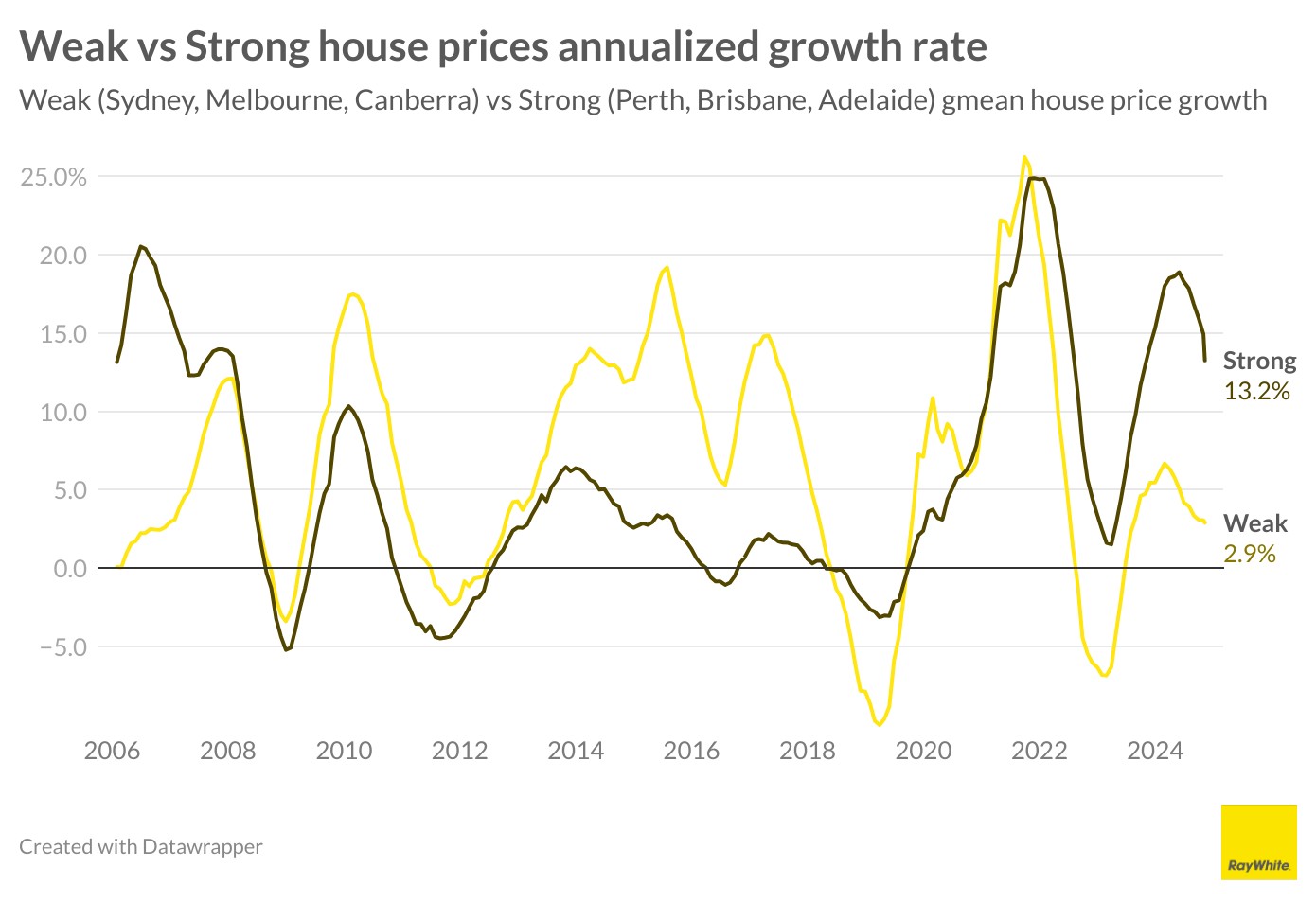

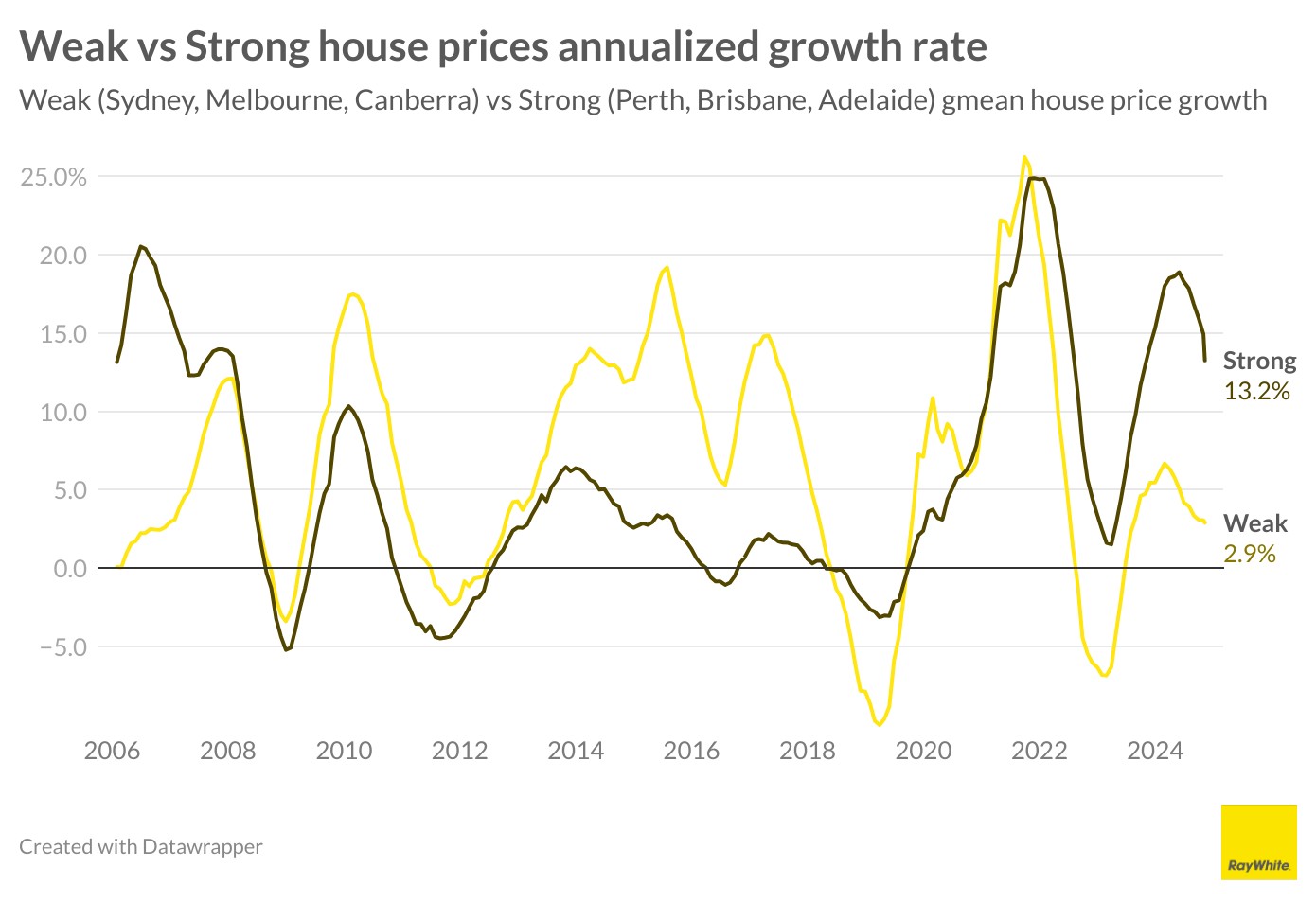

House price growth is definitely slowing. However, conditions in the final quarter of 2024 are continuing to show a two speed housing market. And like any change in market conditions, at a city level, they have very different drivers.

There are two distinct markets at the moment, although both are showing signs of slowdown. The coolest markets are Sydney, Canberra, Melbourne and Hobart with these cities having increased on average by 2.9 per cent over the past 12 months. This is much less than the peak 6.7 per cent experienced in the 12 months to February 2024

.The markets that are continuing to remain much stronger are Perth, Adelaide and Brisbane. Annual growth is currently at 13.2 per cent. While this is much less than the 18.9 per cent experienced in the 12 months to May 2024, the increase is still extremely strong.

The cooling markets

Sydney is feeling the impact of higher interest rates more than most, particularly at the premium end of the market. While more affordable properties are still seeing decent growth, the luxury market has notably softened. Any significant market revival will likely need to wait for interest rate cuts, expected in early 2025.

Canberra is also affected by interest rates, however the capital has another dynamic at play – substantial housing supply. Unlike many Australian cities, Canberra isn’t facing a housing shortage. The ACT Government’s efforts to make Canberra an affordable city through high levels of housing supply appear to be working.

Melbourne faces multiple challenges. Beyond interest rate sensitivity, the Victorian economy shows signs of recession, and property owners are dealing with the country’s highest property taxes. While strong migration continues to provide some support, the market needs broader economic improvement to regain momentum.

Meanwhile in Hobart, the main hurdle is demographic. With population growth at low levels and forecasts suggesting this trend will continue, particularly as a result of plunging interstate migration, the market faces ongoing pressure. While interest rate cuts would help, the fundamental population challenge remains significant.

Growth slowing but still strong

South-east Queensland continues its impressive run. The golden arc from northern New South Wales through the Gold Coast, Brisbane, and up to the Sunshine Coast keeps attracting both interstate and international migrants. With housing supply falling short of demand and strong market confidence, prices continue to rise across all segments.

Perth’s market also remains remarkably robust, with both prices and rents continuing to climb. While some of this represents catch-up growth, the combination of population increases and rising construction costs continues to limit supply. Interestingly, recent softening in iron ore and lithium prices may be starting to impact momentum slightly with the rate of change starting to come back marginally

Adelaide shares Perth’s positive outlook, benefiting from mining sector strength while enjoying additional advantages. Strong state government leadership has boosted confidence, driving investment and tourism growth. Perhaps most significantly, Adelaide’s median house price – at half of Sydney’s – makes it increasingly attractive for interstate migrants seeking value, as well as investors.

Looking toward 2025, this two-speed market looks set to continue. Local economic conditions, population trends, and housing supply are playing crucial roles in determining each city’s path. As we head into a lower interest rate environment, it’s becoming increasingly clear that understanding these regional differences is key.