Nerida Conisbee,

Ray White Group

Chief Economist

Prices accelerated in November despite a rate rise as population growth hits its highest level on record.

Latest population numbers show that Australia saw an additional 563,000 people in 12 months. This many people require around 225,000 additional homes. With us now consistently building fewer than 180,000 homes per year, construction is nowhere near keeping up. Interest rates may have increased at the fastest rate recorded but it is no match for the need for housing and this is fundamentally what is driving up house prices.

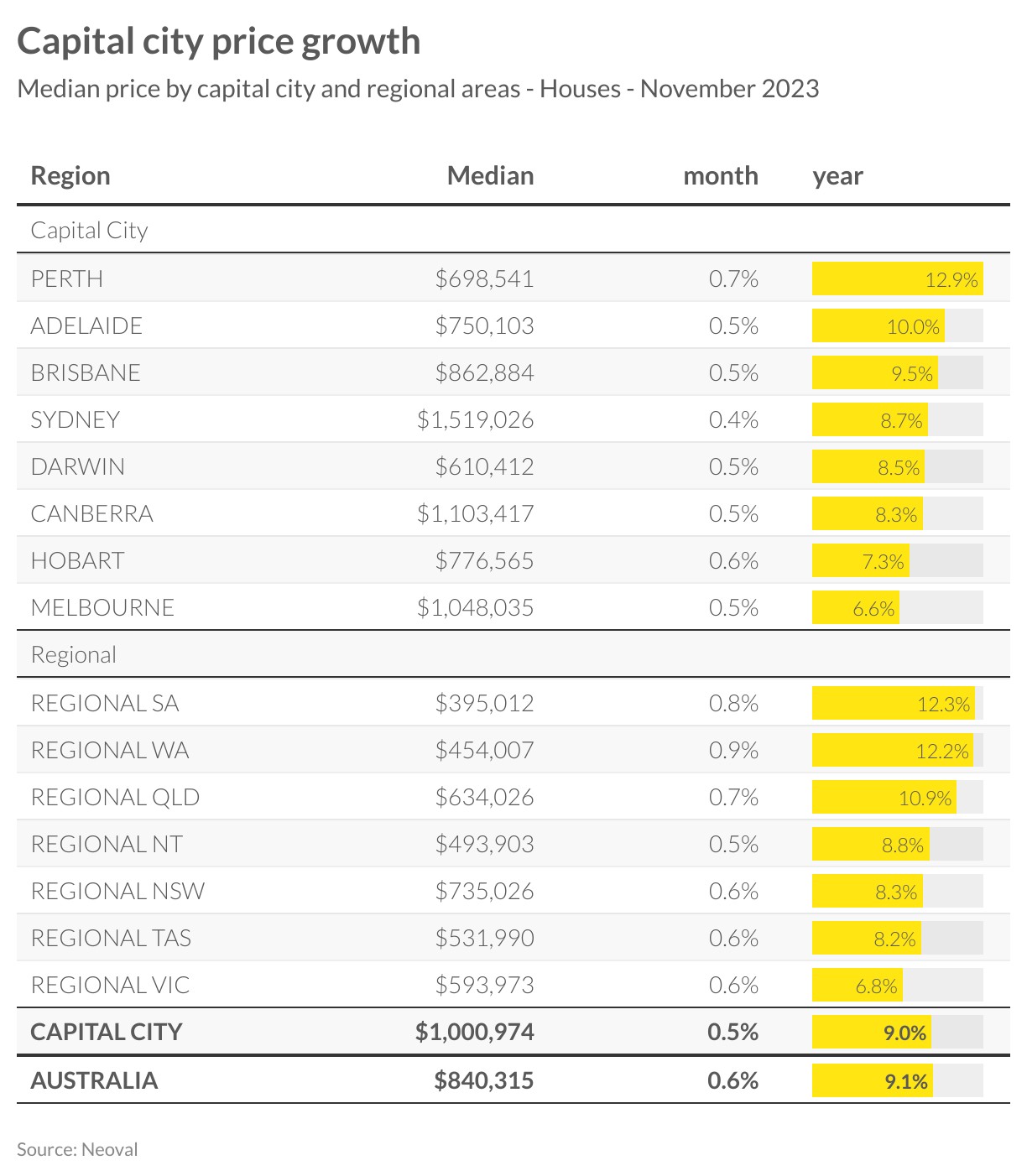

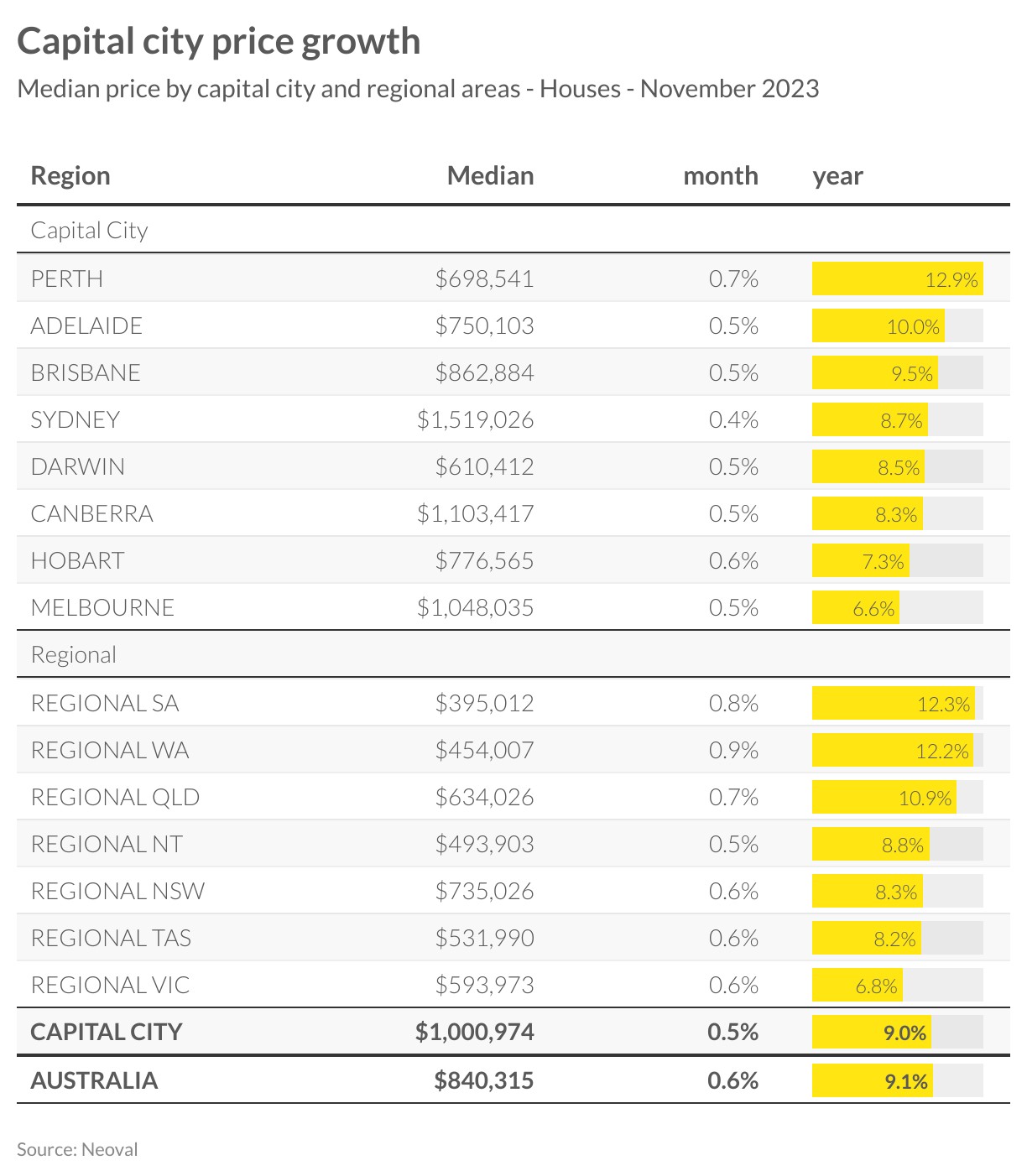

In November, price growth accelerated. Perth still leads the way, pushed along by rising wealth off the back of iron ore and green energy mineral mining. However, Adelaide is also moving quicker than the rest of Australia. Mining is also playing a role here with copper playing a major role in economic growth for the state. This mining strength in both states is also driving up prices in regional Western Australia and regional South Australia – these are the strongest performers in regional Australia at the moment.

The capital city median has now hit $1 million and this price growth will continue. There are some areas of weakness. In beachside holiday destinations, the number of homes for sale has jumped considerably. Anecdotally, many investors are starting to feel the squeeze and choosing to sell and pay down debt. This is great news for first home buyers but will make it challenging for renters hoping to secure affordable housing, with a likely drop in rental stock being the end result.

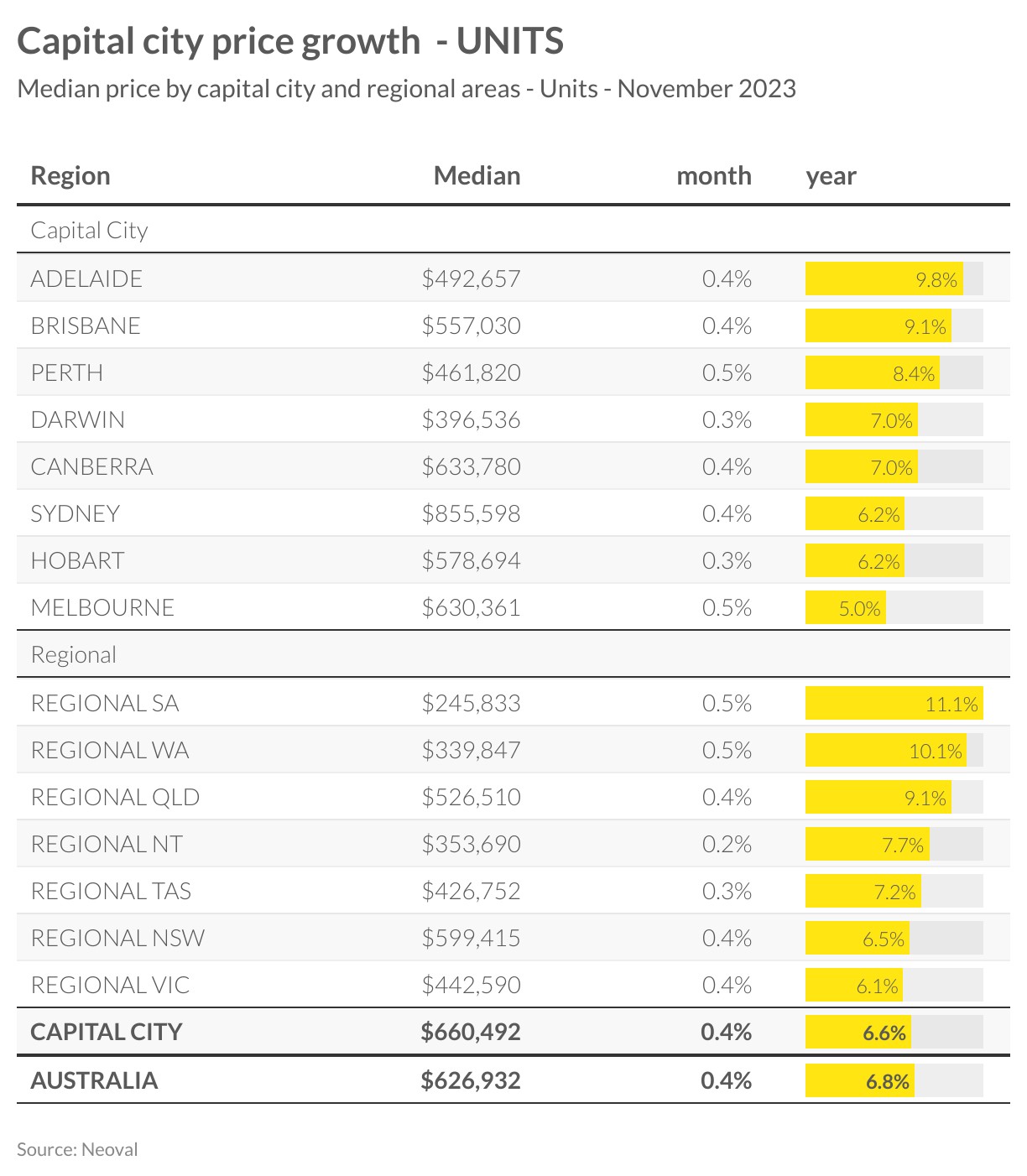

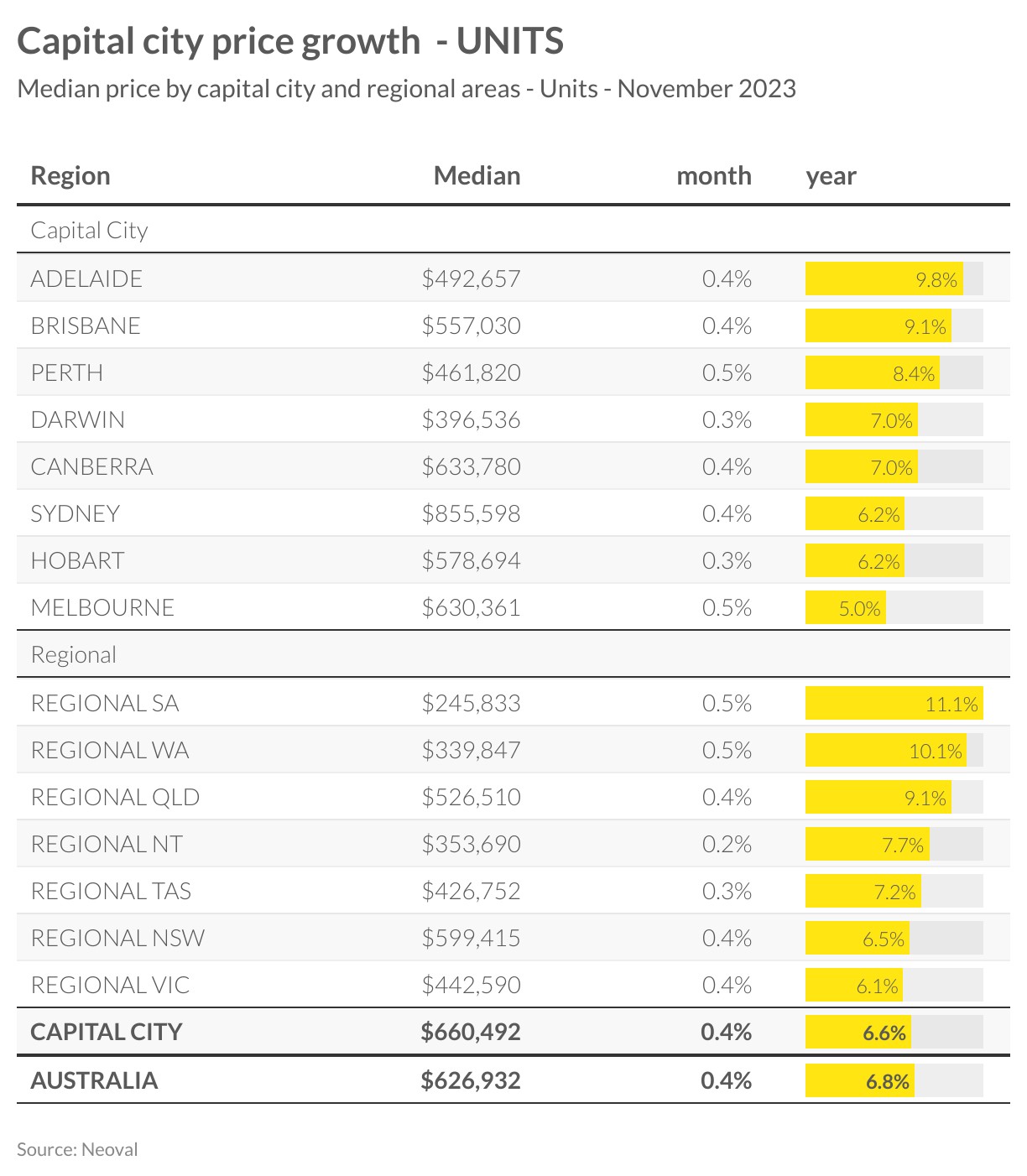

Units also saw considerable growth over the month. While challenging for affordability, it will allow more new developments to become viable. The large jump in construction costs has made many projects unviable unless prices lift considerably.

How much more can prices move? If we use Sydney as a benchmark relative to incomes, it is likely that the market will support much higher prices in other capital cities. Although not great news, it reflects the challenging situation with housing supply right now.