Nerida Conisbee

Chief Economist

The main housing related announcement was a new $11.3 billion “Homes for Australia” plan. This includes $9.3 billion over five years to combat homelessness, provide crisis support and build and repair social housing, $1 billion to build infrastructure such as roads, sewers and community infrastructure and $1 billion for crisis and transitional accommodation for women and children fleeing domestic violence.

The government has also stated that it will work with the higher education sector to ensure there is enough student accommodation and $90.6 million to boost the construction workforce through TAFE funding and skilled migrant visas.

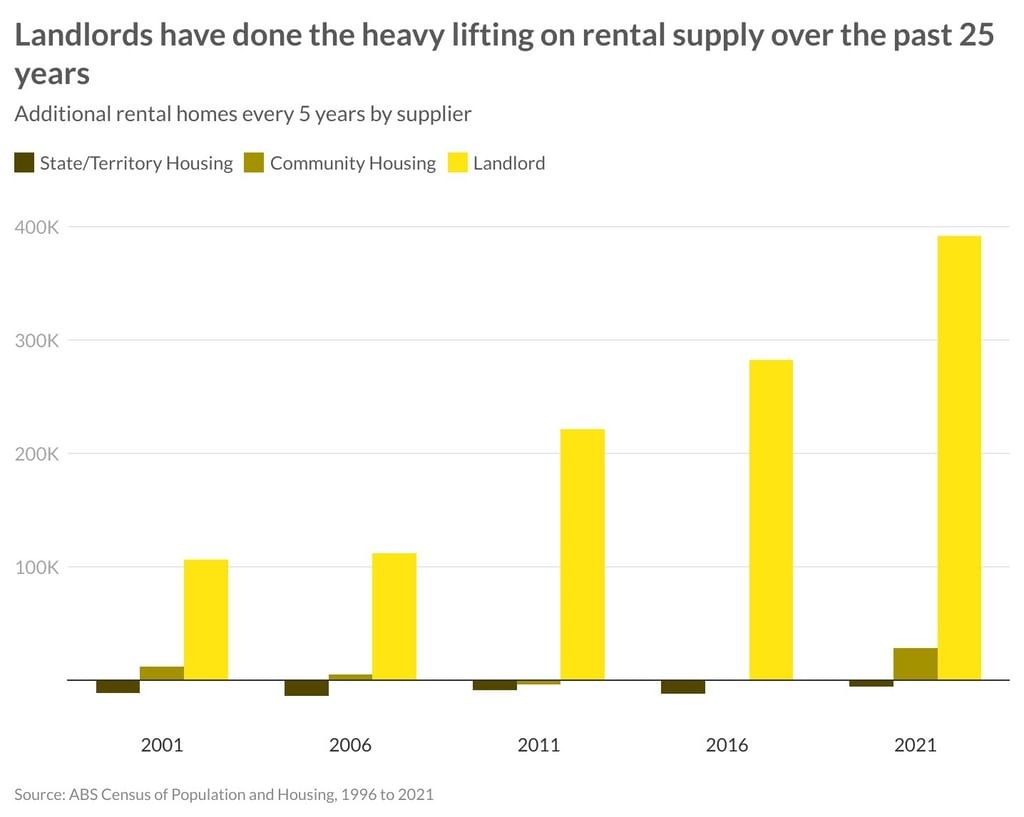

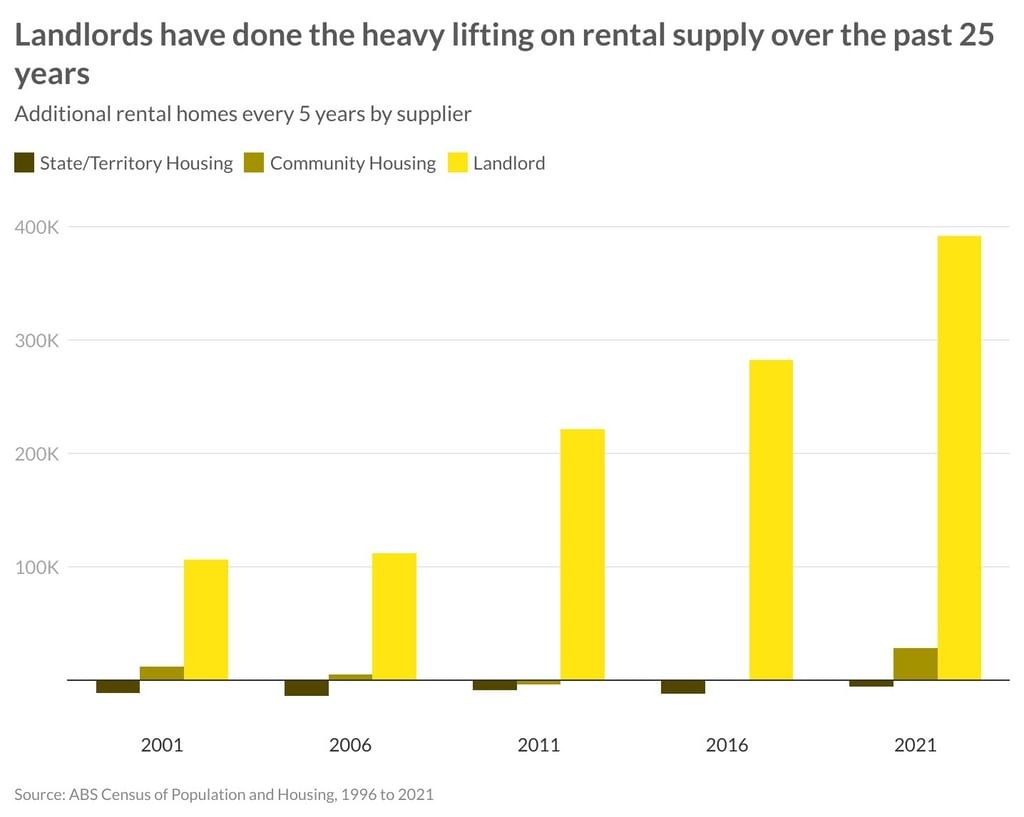

Given that the total stock of government owned rental stock has been declining for decades and more assistance needs to be given to community housing providers, this is a welcome announcement.

An immediate positive to many renters is an increase in rent assistance with nearly one million people currently receiving the full Commonwealth rent assistance getting an extra 10 per cent in their payment. While this won’t immediately help with housing supply, it will likely reduce rental increases which feed into inflation. Given that rents have been such a major component of high inflation, it may even result in interest rates being cut a little sooner than currently forecast.

Student housing is also a challenge and the budget will assist in addressing this, particularly given how important education is to the Australian economy. However, it won’t do enough for our biggest challenge at the moment, which is housing supply and the goal set out in the Housing Accord for 1.2 million homes over five years.

There are a number of challenges in achieving the goal of 1.2 million housing. The first is ensuring planning systems make it possible, the second is to find the money to build them and the third is to ensure the construction industry is available to build. The first is being addressed already by the government, the third has been addressed in the budget. The challenge now is the second – the money for new housing has to come from somewhere.

Planning changes are in place

There has been significant focus by all levels of government to ensure that planning systems are in place to ensure sufficient housing. This has been a welcome step forward, particularly in highly desirable areas with good public transport where higher densities can provide a lot more housing.

Where will the money come from?

Government debt is at record levels so there are limits to how much money can be provided for homes. Federal Government debt repayments alone are the fastest growing expense, increasing by 11.7 per cent per annum over the next decade.

There are also inefficiencies with government supplied housing. We have most recently seen this in New Zealand where a program to build 100,000 affordable homes was launched in 2018 with the eventual aim of recreating a new social housing department. The program created barely any new homes with the New Zealand Government coming up against the same challenges that private sector developers face – rising construction costs, difficulty in finding sites, staffing problems and push back from local residents.

Build-to-rent, or institutional ownership of rental properties, is an opportunity and has been a focus for the current government but will remain a miniscule proportion of total rental stock for a long time. Right now it provides less than one per cent of total stock and the number of developers producing these homes remains small.

Foreign investors are also an opportunity, and ways to encourage this investment back in is critical. At a minimum, many of the additional taxes and fees that were implemented last decade should be reviewed. Regardless, it is unlikely that we will see this form of capital flood back in in the same way as when it funded the highest level of development we ever saw in the five years to 2018.

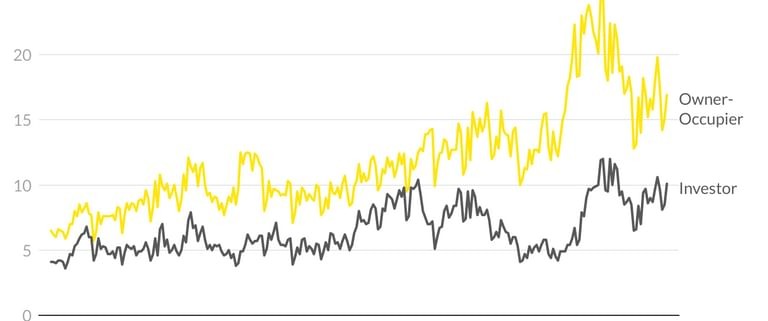

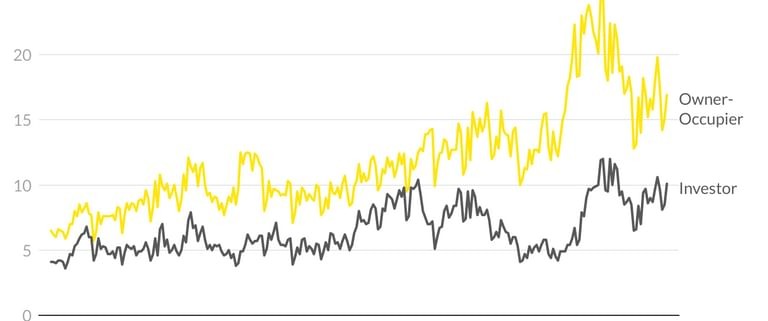

A program similar to Homebuilder but for investors would get more homes built for renters, quickly mobilising funding from the investors that hold around 90 per cent of rental properties already. Investor lending has recovered somewhat and it’s likely that once rates are cut, we will see more money flowing in. “Mum and dad” investors remain our only real opportunity to get the funds required to substantially increase rental housing availability and increase housing supply. This is a missed opportunity in the budget.

Construction industry needs help

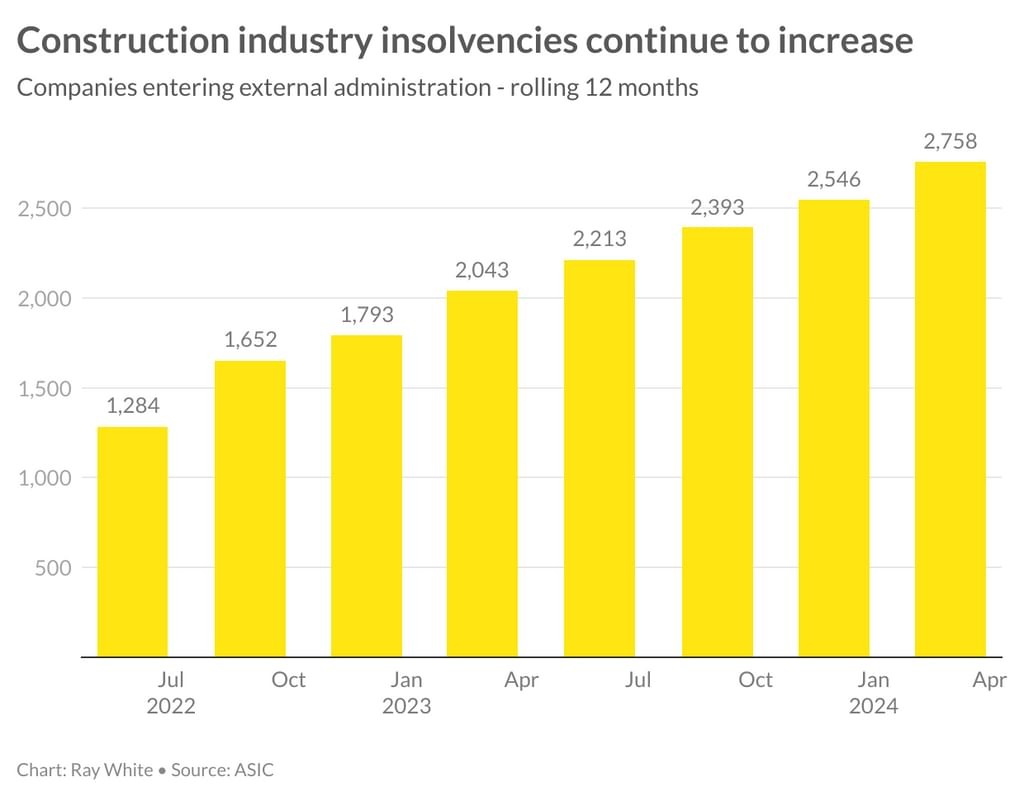

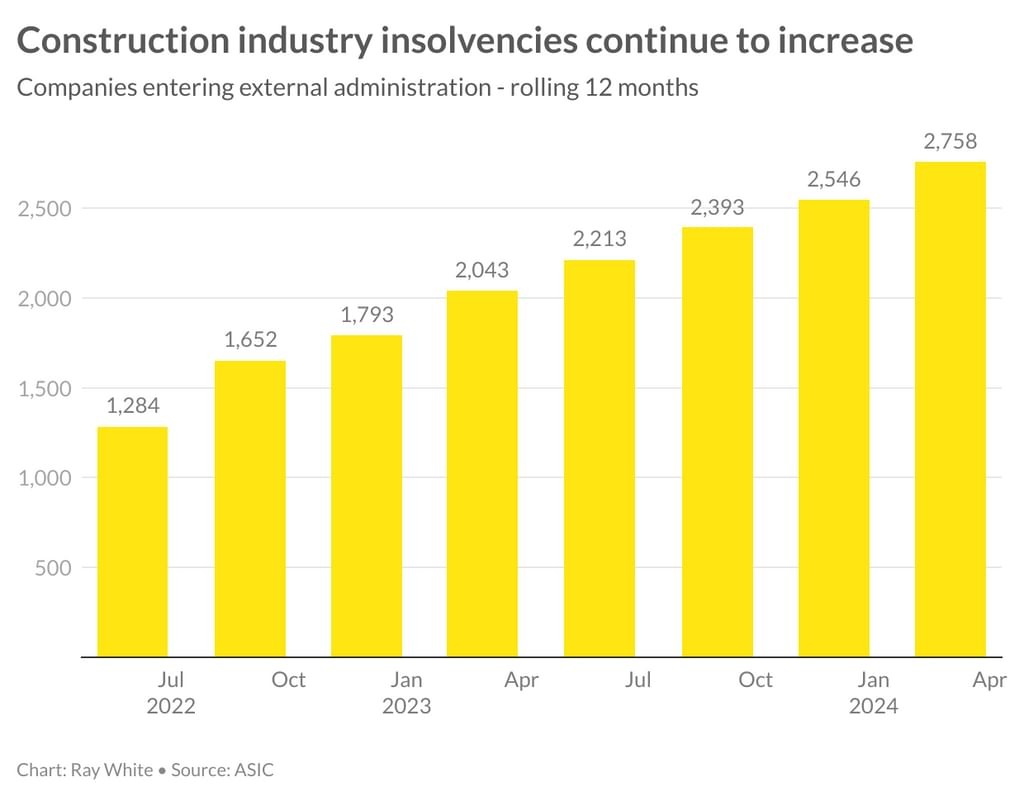

Right now, it’s cheaper to buy an established home than build a new one as a result of strong increases in construction costs over the last three years and a current rise in the number of builders going into receivership.

While construction problems began when we saw a surge in materials prices, this is no longer such a challenge. The budget does address the major challenge we have right now which is labour shortages. While the TAFE funding will be positive for the longer term, the skilled visa program changes are a welcome step forward which will help the industry immediately. However, there is still a long way to go for the construction industry to get back to full capacity.

Nerida Conisbee

Chief Economist