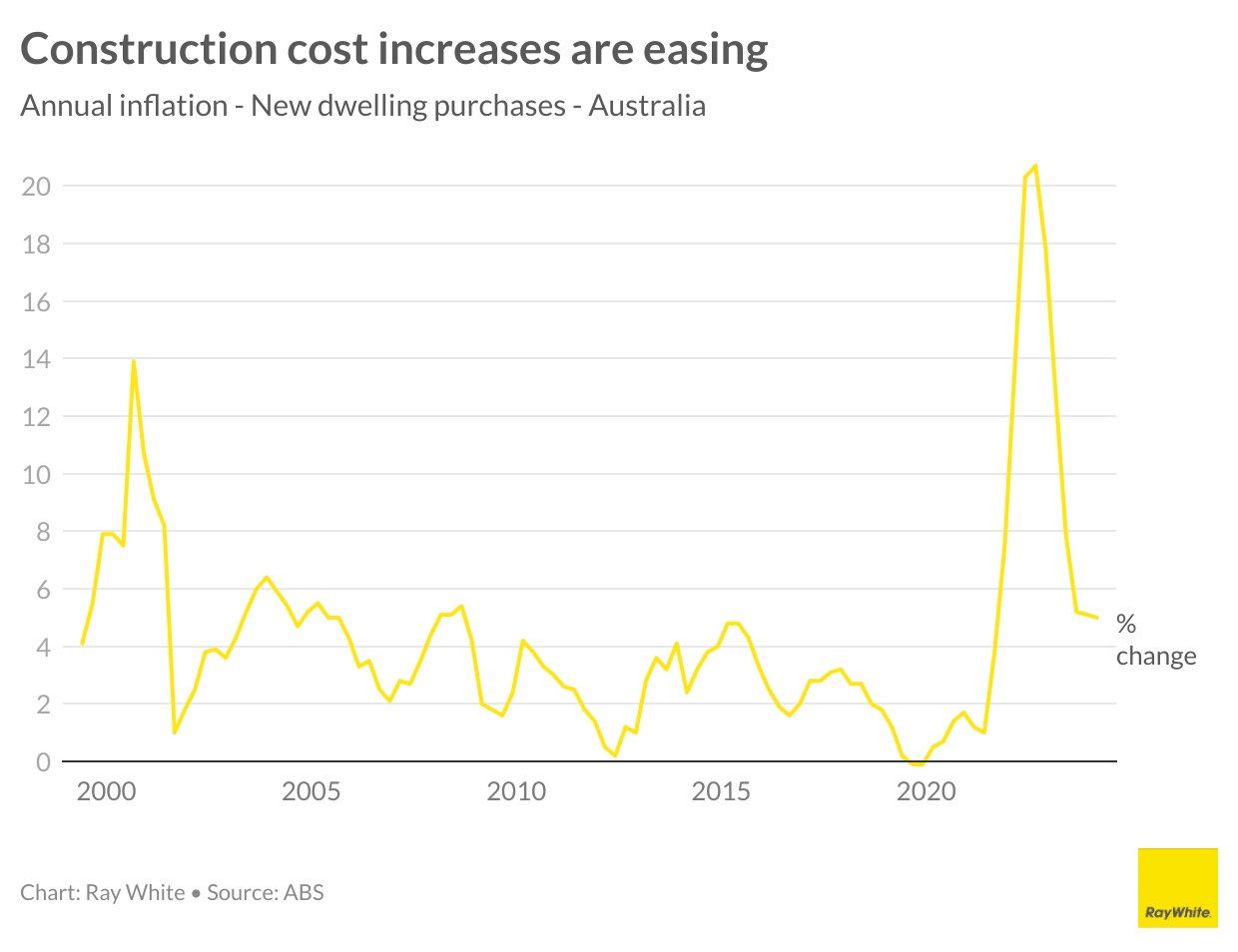

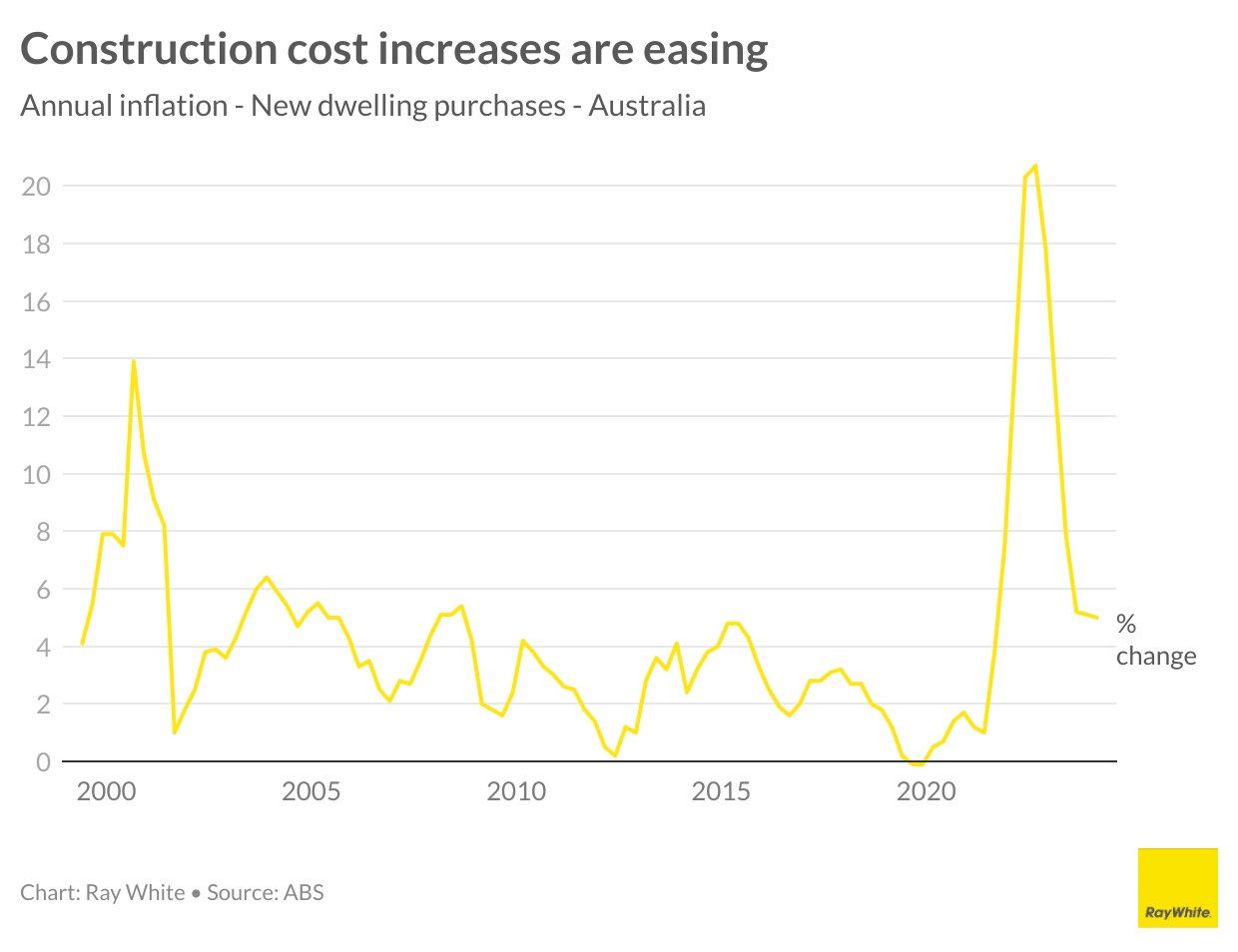

Construction problems started during the pandemic. Blocked supply chains and high levels of global demand meant that the price of materials increased. The slow down in materials coming into the country impacted productivity with projects taking longer to finish as a result. At the same time, a labour shortage became particularly apparent by 2022. Material costs started to flatten but the cost of labour started to climb. By the end of 2023, construction cost increases had started to moderate but not fall. However, there are bigger problems in the industry now.

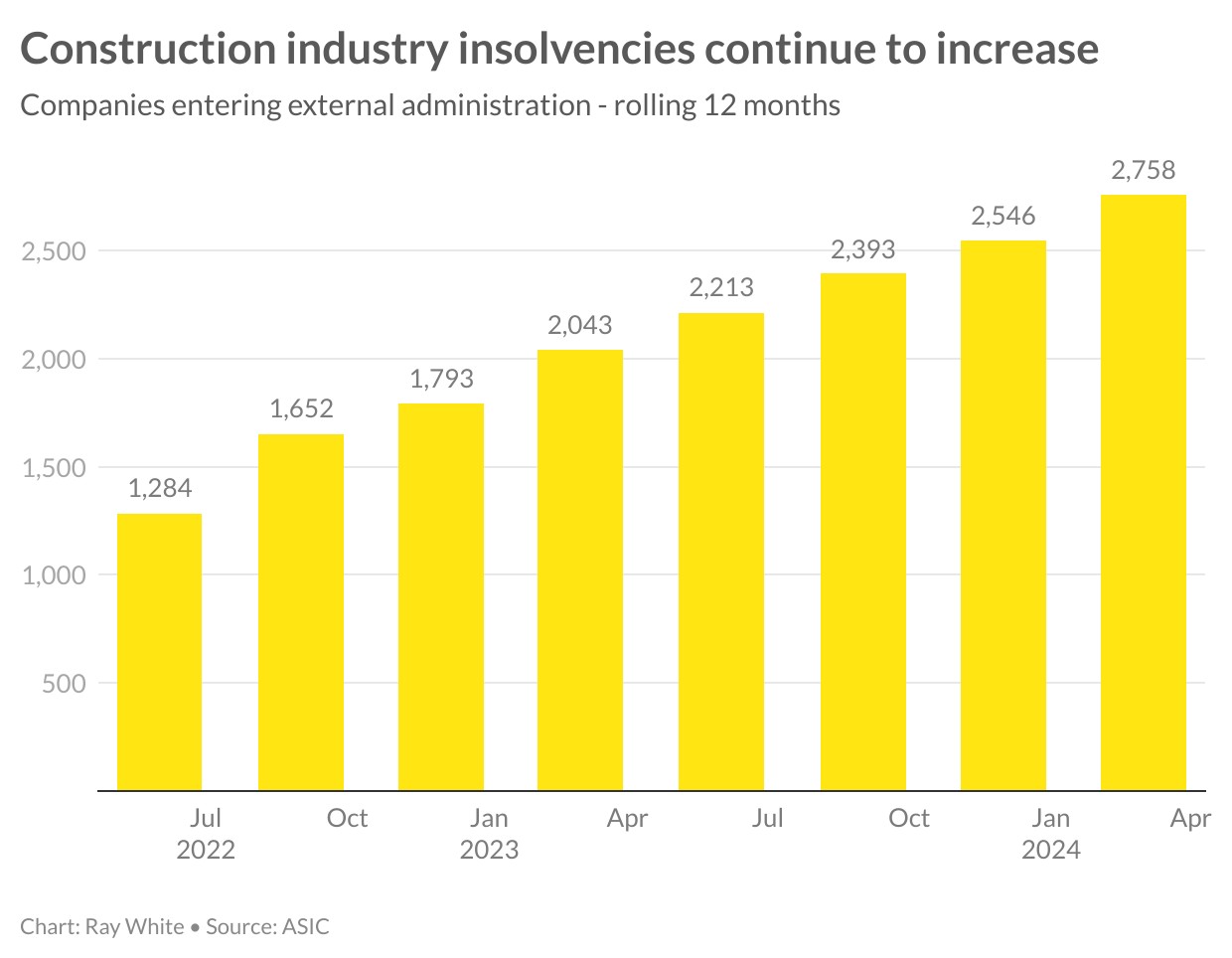

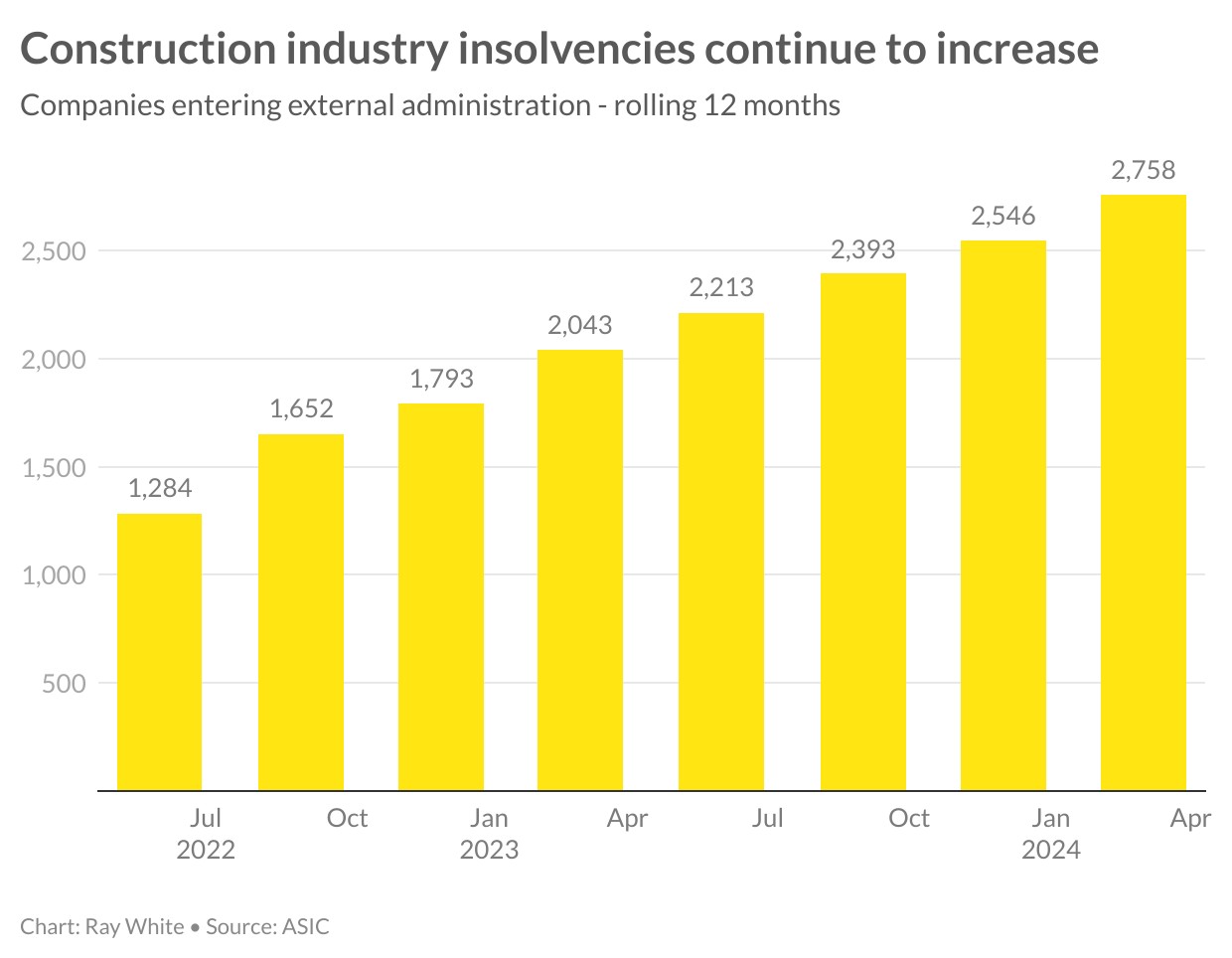

Building industry insolvencies are now at record highs and there appears to be no slowdown in the rate of increase. Costs may no longer be rising at such a fast pace but it is getting very hard to find someone to build anything. In the 12 months to March 2024, 2,632 construction firms have entered external administration or had a controller appointed. New South Wales is bearing the brunt of the problem with close to half of them in this state.

It will take at least 18 months for this to resolve and it is one of the biggest challenges in meeting housing targets – even if there was the money to build 1.2 million homes over the next five years, there isn’t the construction industry capacity to get them out of the ground.

The ability to get more homes built is particularly bleak at the moment. This cycle, it isn’t planning that is so much the challenge. In addition to the big problems in the construction industry, there isn’t the capital to fund new developments – there is no giant pot of money waiting around to build all the new homes required.

Foreign investment is very low and we won’t be able to rely on this in the same way we were last decade. Build-to-rent is still in its infancy and is only being built by a small number of developers, Governments at both a state and federal level are sitting on record levels of debt with a lot of construction funding being channelled into infrastructure projects. For owner-occupiers and investors, it is generally cheaper to buy an established home, rather than build a new one and this will force up pricing until it matches construction costs.

Nerida Conisbee

Ray White Group

Chief Economist