Nerida Conisbee

Ray White Group

Chief Economist

The perennial debate between choosing a house or an apartment continues to challenge home buyers, each option presenting its own set of trade-offs.

Houses typically offer more space and privacy, but often at the cost of a less central location. Apartments, while generally smaller, frequently boast prime urban positions and lower maintenance responsibilities. But beyond immediate lifestyle considerations lies a crucial financial question: which choice would have yielded a better return on investment over the past decade? The answer, not surprisingly, depends on where you bought.

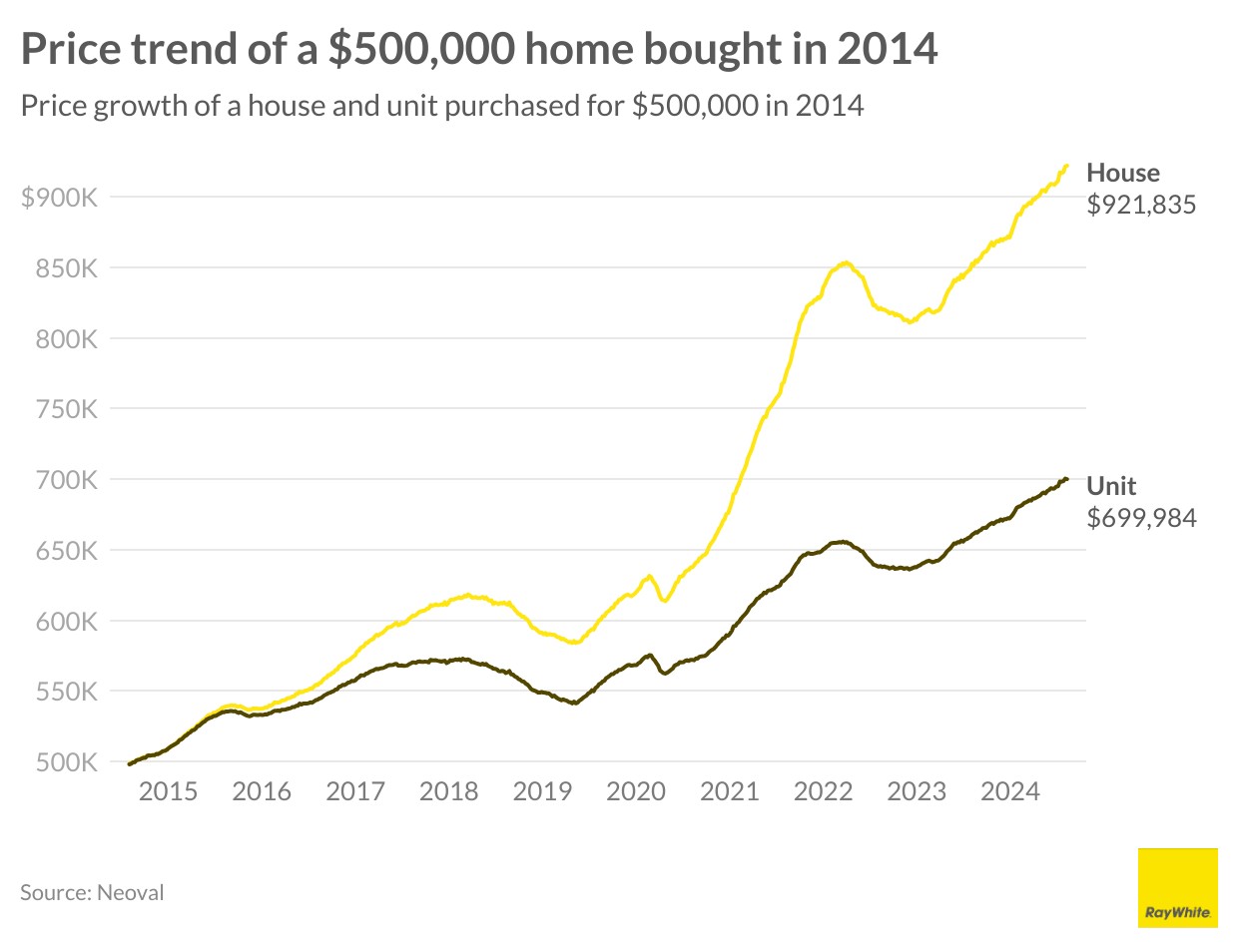

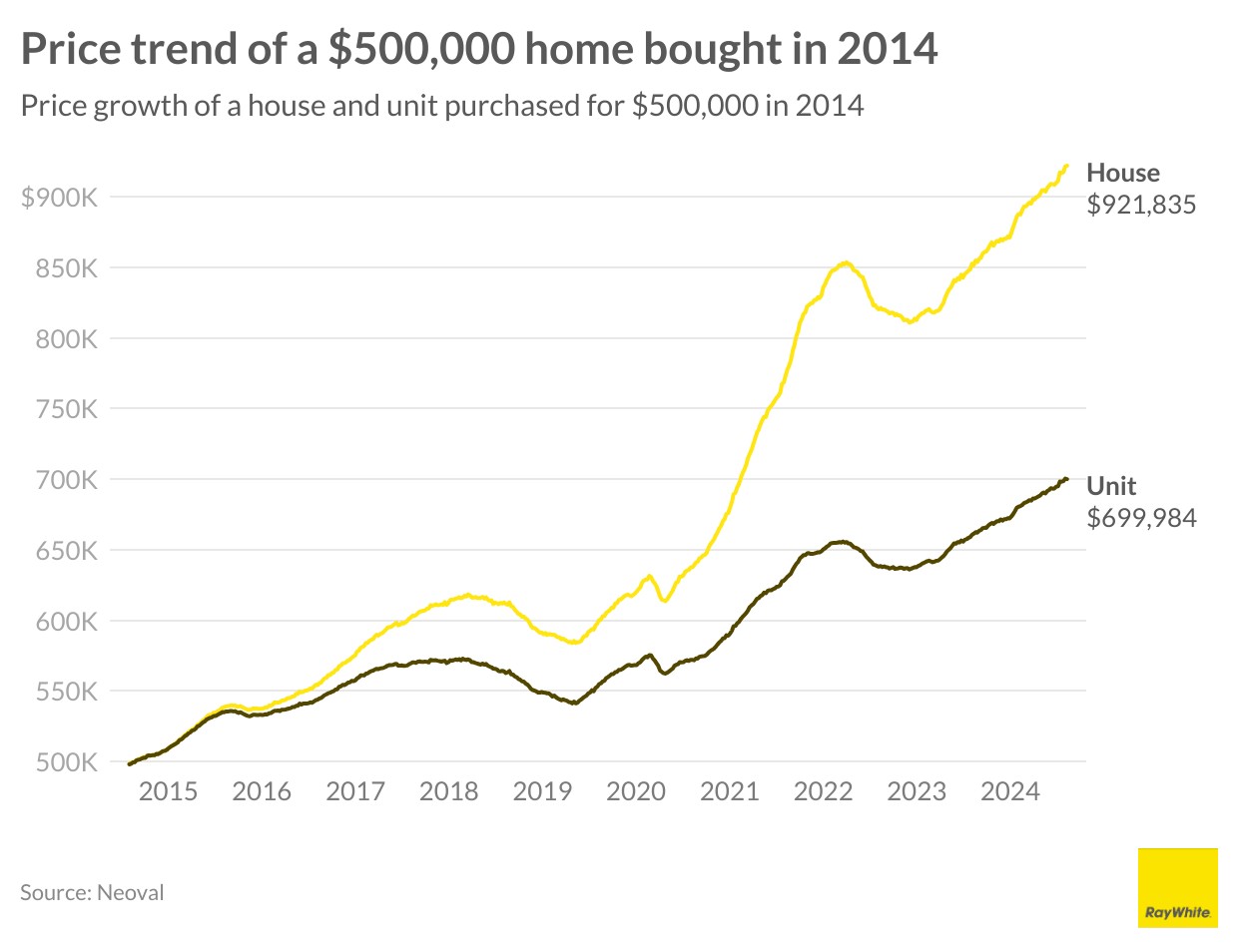

To answer this question, we used Neoval data to see what a house priced at $500,000 in 2014 would be worth now compared to a unit purchased at the same price. While nationally, a house purchased at this price has performed better, at a capital city level, the results are more nuanced.

On average, a house purchased in Australia at $500,000 in 2014 would have increased by 84 per cent to $921,200, while an apartment purchased at the same price would have increased by 40 per cent to $700,400. However, the gap is greatest in Sydney where the house would have almost doubled while the unit would have increased by 37 per cent. A similar situation occurs in Brisbane where the gap is also wide – a house more than doubling compared to a unit increasing by 53 per cent.

In direct comparison to Melbourne and Brisbane, buying a unit or a house for $500,000 in Hobart almost yields the same results now. The house would be worth on average $1 million now, the unit $996,000. The gap in Darwin is also similar, although both would have fallen with the $500,000 unit now worth 14 per cent less compared to one per cent less for the house.

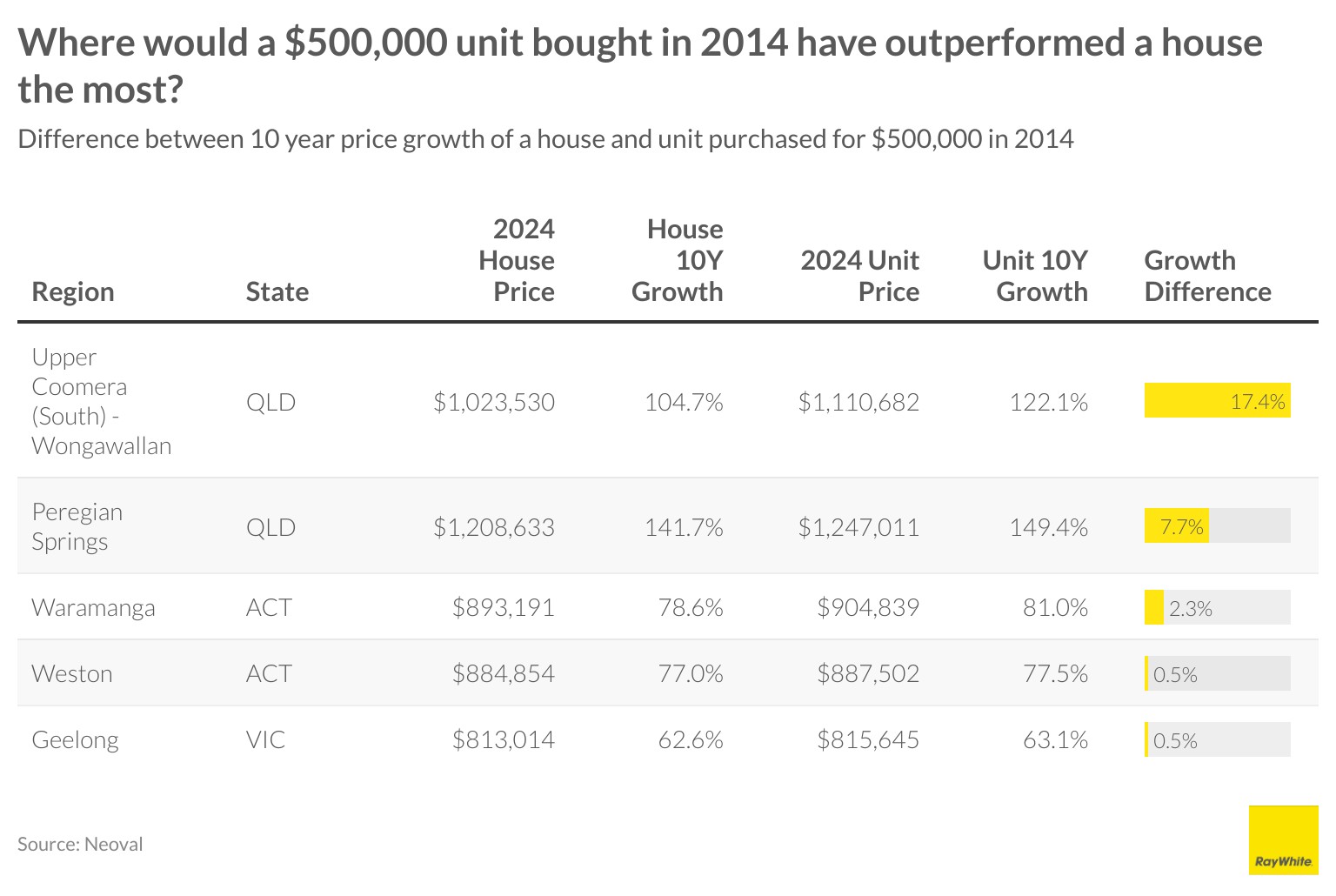

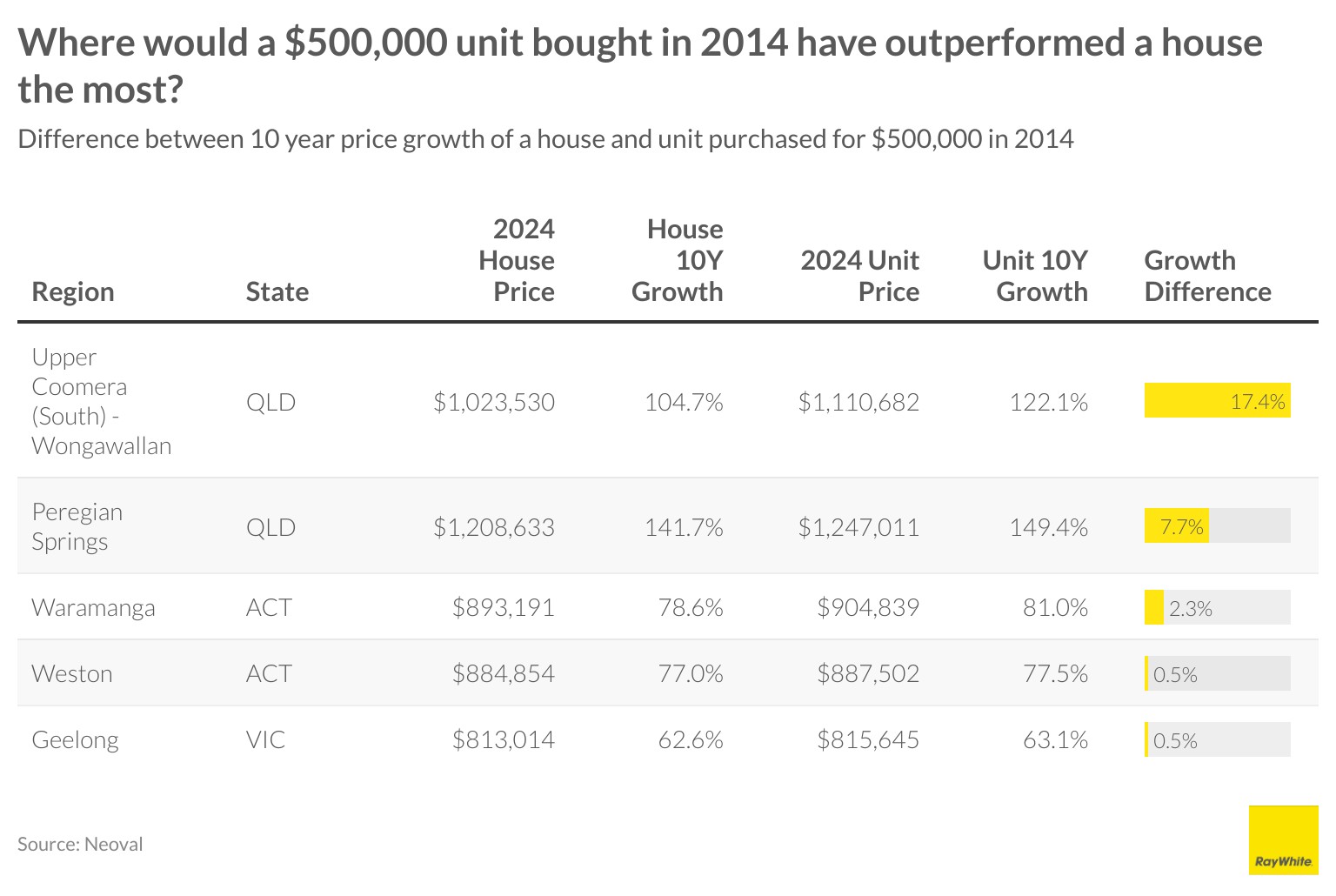

At a suburb level, there are a lot of areas where a $500,000 apartment 10 years ago was a much better investment. Topping the list is Upper Coomera on the Gold Coast where a house purchased at this price would be worth $1.02 million while an apartment would be worth $1.11 million. Canberra also features heavily with Weston and Waramanga all being places an apartment would have been a better purchase.

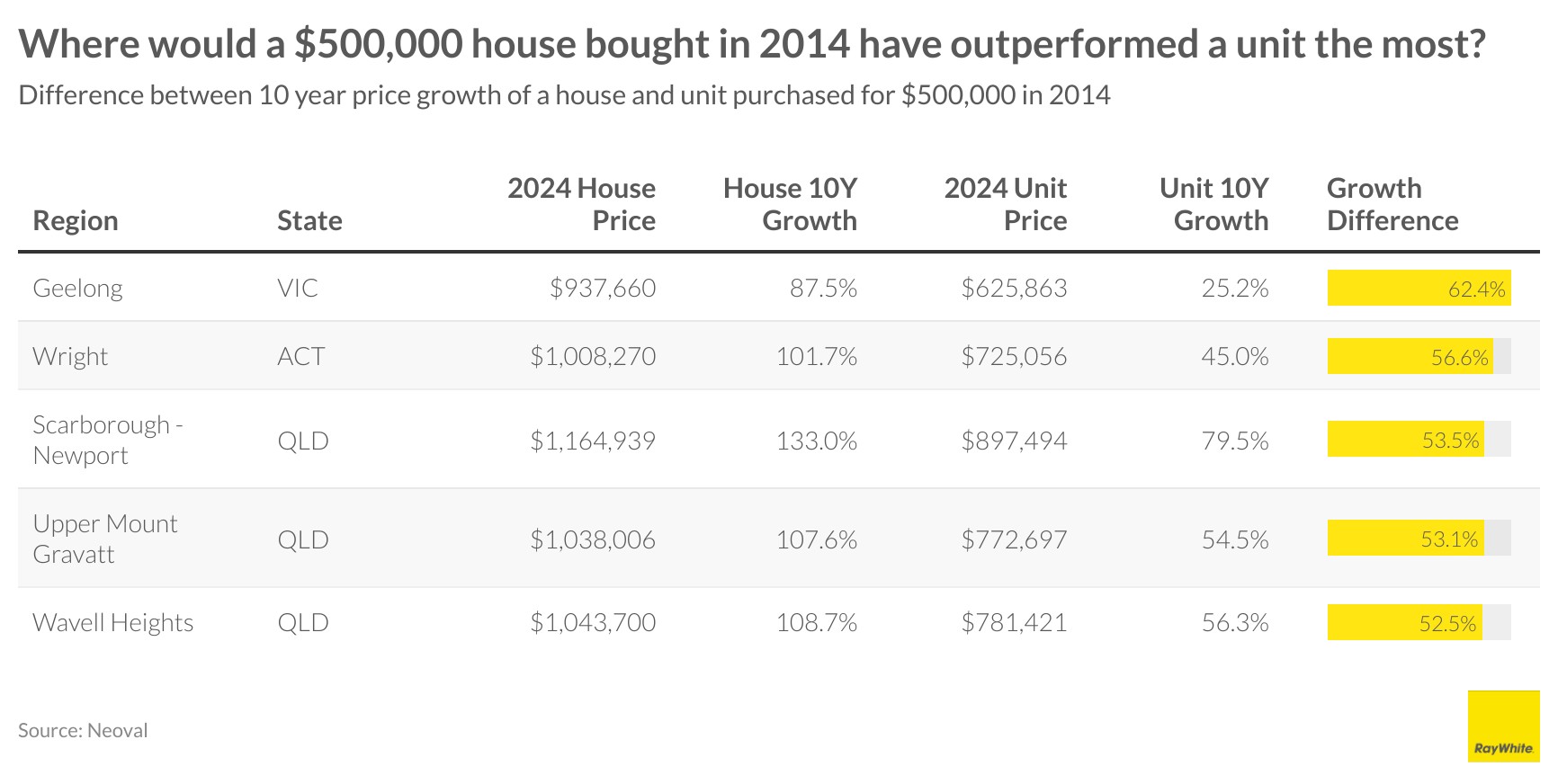

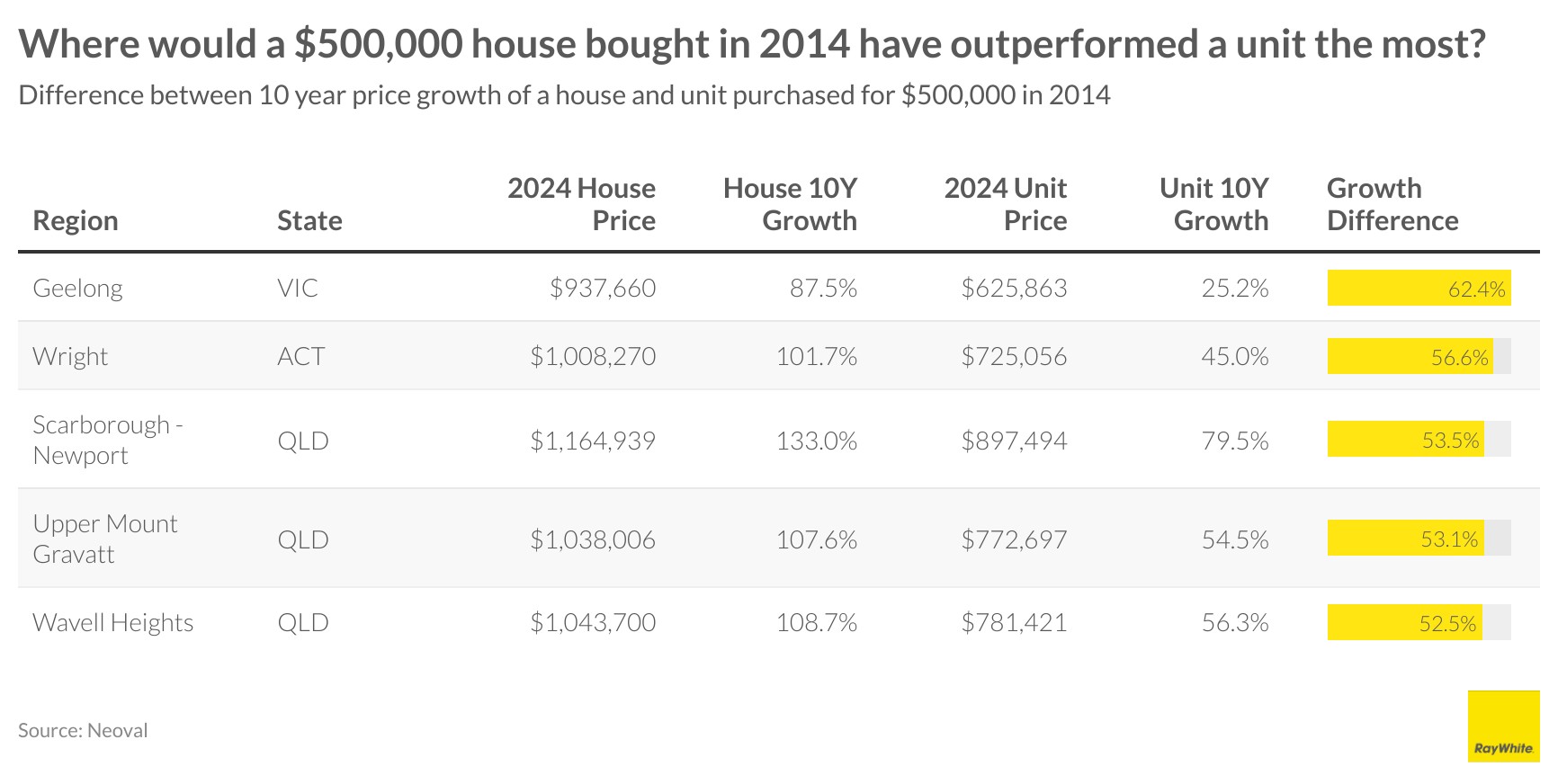

At the other end of the scale, buying a house in Geelong and many South-East Queensland suburbs would have been a better option than an apartment. In Geelong, a $500,000 house purchased in 2014 would now be worth on average $937,700 compared to an apartment at $626,000

What we can take from this is is that firstly, it is not necessarily the case that houses do better than apartments. At a fundamental level, it holds that land holds value and therefore owning it should yield better returns. However, it depends on where that land is located – well serviced land in highly livable areas being worth far more than areas that are less so.

Secondly, housing supply creates greater levels of affordability. Very high levels of property development in Melbourne and Sydney has created affordability for apartments relative to houses. In Hobart where fewer apartments have been built has led to a greater increase in apartment prices, almost on par with houses.

Nerida Conisbee

Ray White Group

Chief Economist