Nerida Conisbee

Ray White Group

Chief Economist

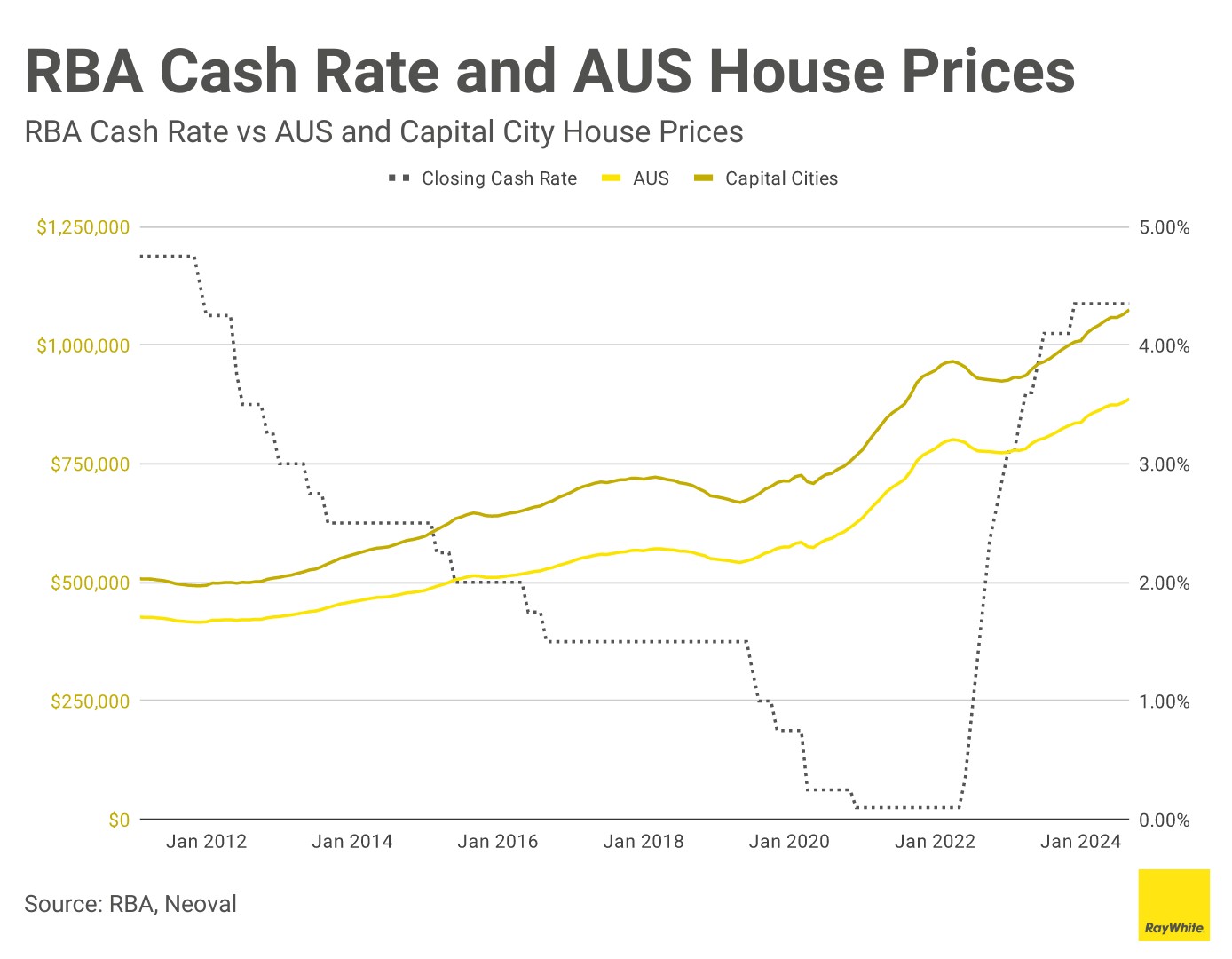

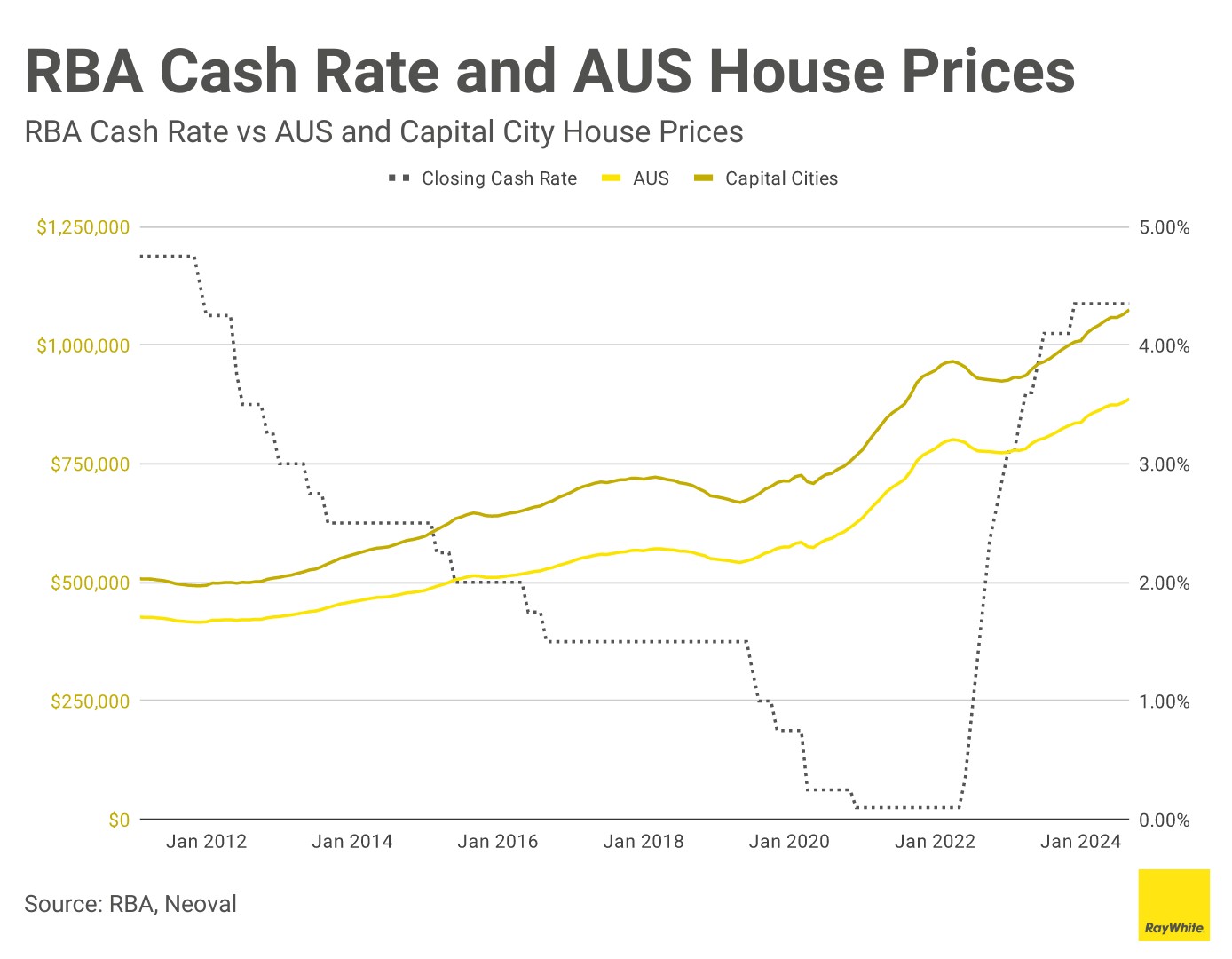

With inflation now edging towards three per cent and markets are now pricing in potentially four rate cuts next year, it is possible that we will see a rate cut before the end of the year. With Australian house prices remaining highly divergent between red hot Perth and Brisbane and slowing Melbourne and Sydney, what would be the impact on pricing of a cut?  There are many ways to calculate the impact and it is difficult to tease out what is the impact of a cut and what is the impact of other factors such as the lending environment, population growth, state based economic growth and construction costs. However, we have looked at it very simply. What has been the impact on pricing the month after a rate cut previously? In particular when there hasn’t been a rate cut for some time.

There are many ways to calculate the impact and it is difficult to tease out what is the impact of a cut and what is the impact of other factors such as the lending environment, population growth, state based economic growth and construction costs. However, we have looked at it very simply. What has been the impact on pricing the month after a rate cut previously? In particular when there hasn’t been a rate cut for some time.

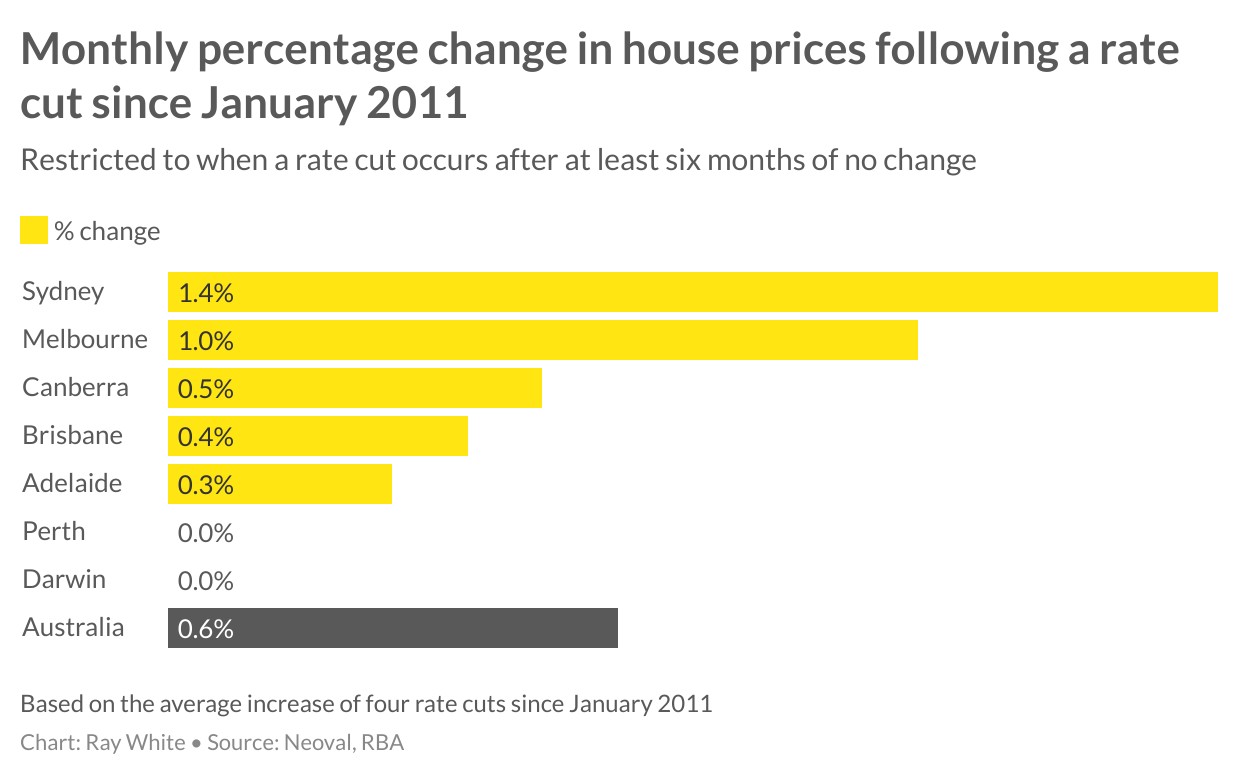

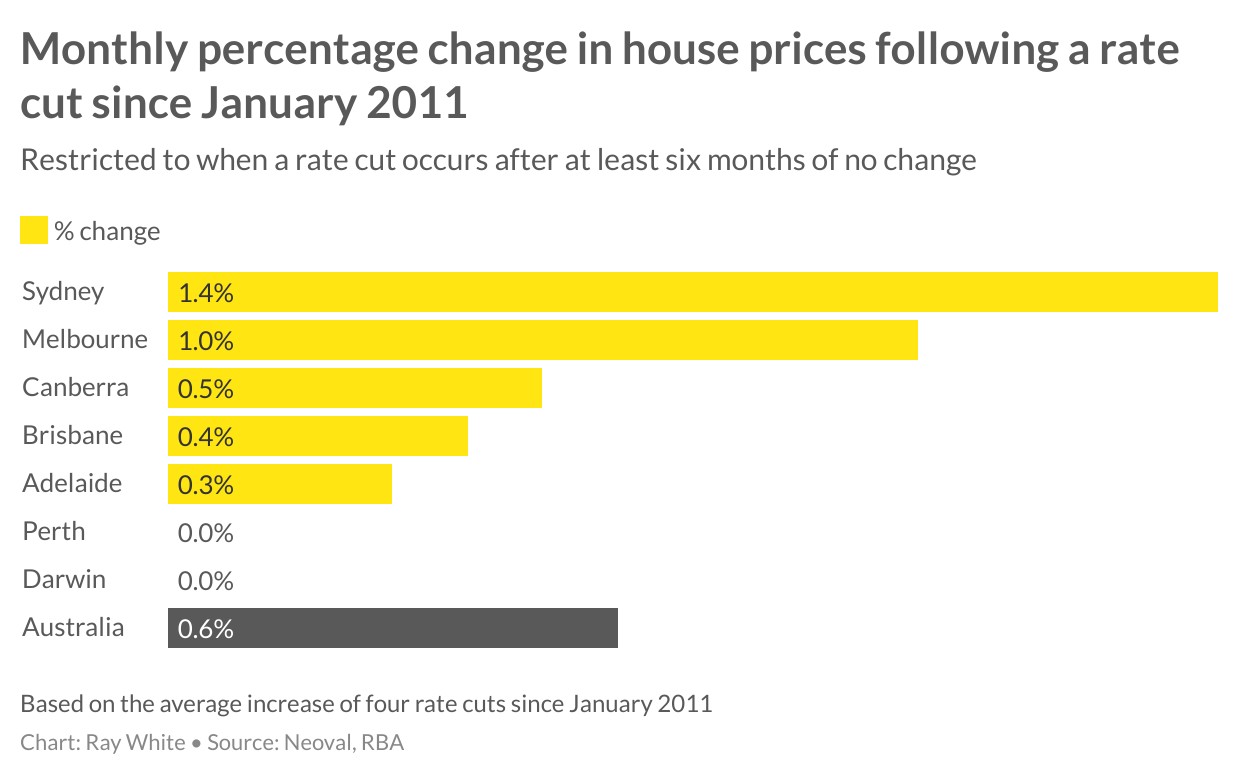

In undertaking this analysis, we have looked at house prices for Australia, and by capital city and looked at what happens to pricing the month after a cut. We have limited it to cuts that occur after at least six months of no movement. There have been four instances since January 2011 that this occurs – November 2011, February 2015, May 2016 and June 2019.

The results are not surprising. Since January 2011, the city that has had the biggest jump following a rate cut has been Sydney, followed by Melbourne then Canberra. All these cities are the most expensive in Australia and therefore it makes sense that they would be more sensitive to the cost of borrowing. Perth and Darwin saw no increase, reflecting relatively stagnant markets during this time but also their lower sensitivity to interest rate changes.

Would a similar occurrence happen this time around? It’s likely to be slightly different, as they are every cycle. Perth, and Brisbane are currently our strongest markets and although less sensitive to interest rates, are likely to get a further boost following a rate cut. Sydney and Melbourne are comparatively weak, having seen falls in pricing in some months this year. It is likely that conditions will turn around somewhat once rates are cut.

There are many ways to calculate the impact and it is difficult to tease out what is the impact of a cut and what is the impact of other factors such as the lending environment, population growth, state based economic growth and construction costs. However, we have looked at it very simply. What has been the impact on pricing the month after a rate cut previously? In particular when there hasn’t been a rate cut for some time.

There are many ways to calculate the impact and it is difficult to tease out what is the impact of a cut and what is the impact of other factors such as the lending environment, population growth, state based economic growth and construction costs. However, we have looked at it very simply. What has been the impact on pricing the month after a rate cut previously? In particular when there hasn’t been a rate cut for some time.